Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

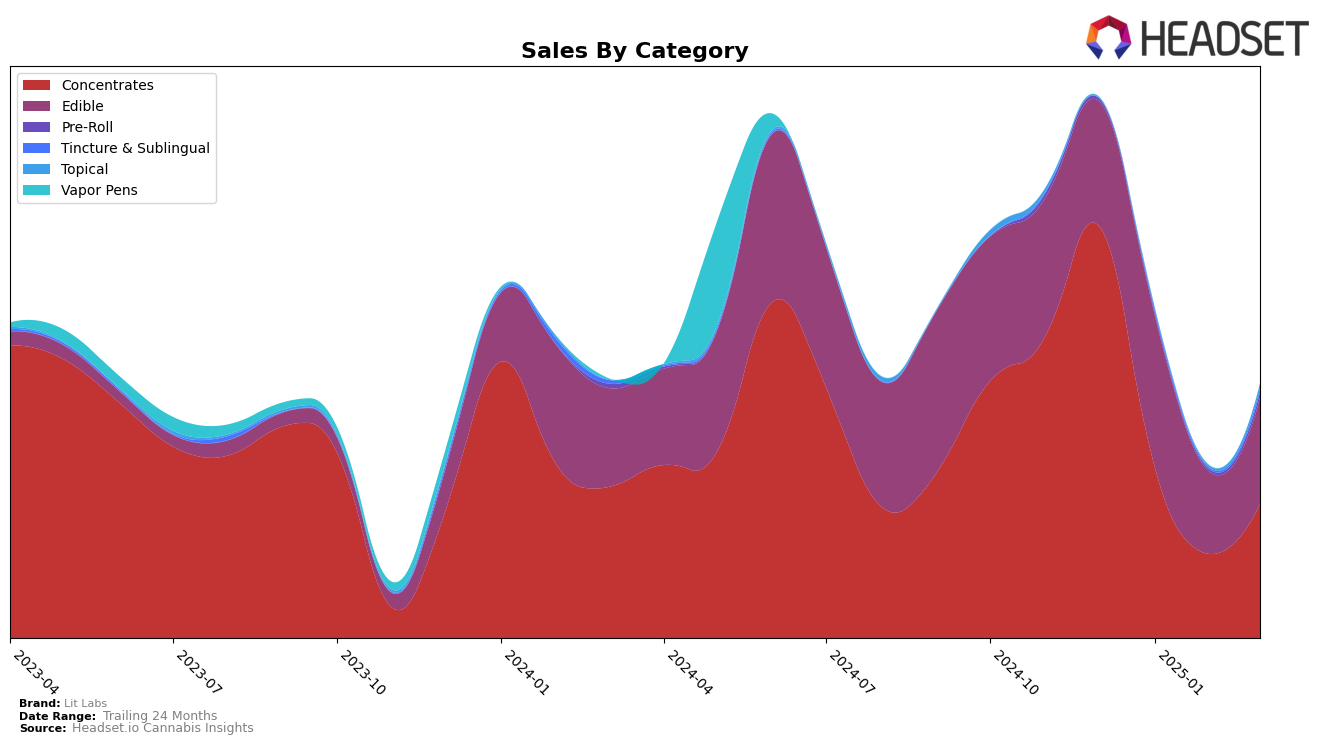

In the Michigan market, Lit Labs has experienced notable shifts in its performance across different categories. For concentrates, the brand was ranked 16th in December 2024 but saw a decline, falling out of the top 30 in January 2025 and March 2025, with a slight improvement to 54th in March. This fluctuation indicates potential challenges in maintaining a strong foothold in the concentrates category, despite a rebound in sales from February to March. This downward trend in ranking highlights the competitive nature of the market and suggests that Lit Labs may need to reassess its strategies to regain its earlier position.

In the edibles category, Lit Labs has demonstrated a more stable performance in Michigan, although it has not broken into the top 30. Starting at 58th in December 2024, the brand improved slightly to 53rd in January 2025 but slipped back to 64th by February. By March, Lit Labs had moved up one spot to 63rd. While the brand has not yet achieved a top-tier ranking in edibles, the slight fluctuations suggest a consistent presence in the market. This consistency, albeit outside the top 30, could be a foundation for future growth if the brand can capitalize on emerging trends or consumer preferences in the edibles category.

Competitive Landscape

In the Michigan concentrates market, Lit Labs has experienced notable fluctuations in its ranking and sales over the past few months, which could impact its competitive positioning. Starting from a strong position in December 2024 with a rank of 16, Lit Labs saw a significant drop to the 41st position by January 2025, and further down to 62nd in February, before slightly recovering to 54th in March. This decline in rank is mirrored by a substantial decrease in sales from December to February, with a slight uptick in March. In contrast, competitors like True North Collective have shown a more stable and improving trend, moving from 59th in December to 43rd in February, indicating a potential shift in consumer preference. Meanwhile, Redbud Roots and Made By A Farmer have maintained relatively consistent sales and rankings, suggesting a steady market presence. These dynamics highlight the competitive pressures Lit Labs faces and underscore the importance of strategic adjustments to regain its market share and improve sales performance.

Notable Products

In March 2025, the top-performing product from Lit Labs was the Blue Razz Full Spectrum Vegan Gummies 10-Pack (200mg), reclaiming its number one spot after briefly dropping to second place in February. The Strawberry Rosin Gummies 20-Pack (200mg) held steady in the second position, indicating consistent popularity. The Watermelon Full Spectrum Rosin Vegan Gummies 10-Pack (200mg) slipped from first in February to third in March, showing a slight decline in sales momentum. The Mango Rosin + Resin Full Spectrum Vegan Gummies 10-Pack (200mg) maintained its fourth place ranking from the previous month. Notably, the Watermelon Rosin Gummies 20-Pack (200mg) entered the rankings for the first time in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.