Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

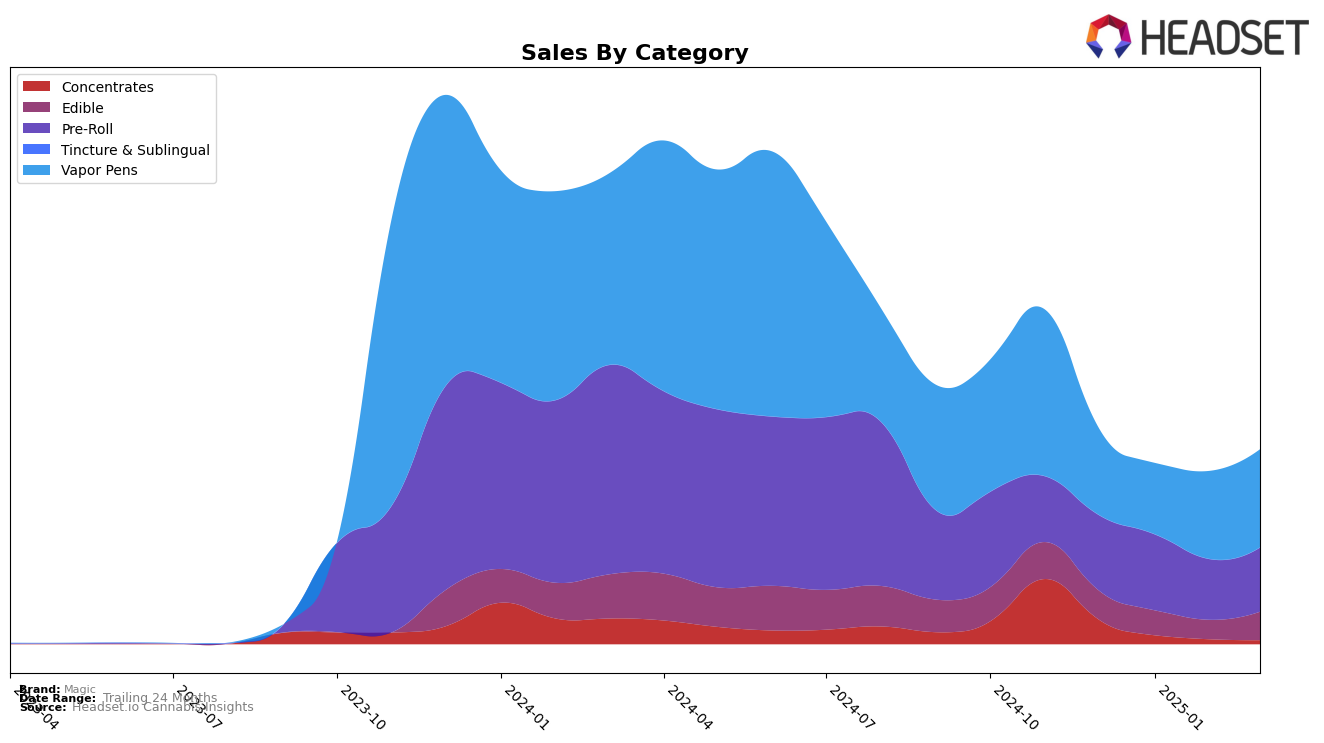

Magic's performance in the Michigan market has shown varied results across different categories. In the Concentrates category, Magic did not make it into the top 30 rankings from December 2024 through March 2025, which may indicate challenges in this segment. However, in the Edible category, Magic demonstrated a relatively stable position, ranking between 49th and 55th over the same period, suggesting a consistent presence but room for growth. The Pre-Roll category saw Magic start strong in December 2024 at 29th, but there was a slight decline to 34th by March 2025, indicating some volatility in consumer preferences or competitive pressures.

In contrast, Magic's performance in the Vapor Pens category in Michigan has been more promising. The brand improved its rank from 32nd in January 2025 to 24th by March 2025, highlighting a positive trajectory and potential strengthening of its market position. This upward movement in Vapor Pens could be attributed to successful product innovations or marketing strategies that resonated well with consumers. While there are challenges in some categories, the brand's growth in Vapor Pens suggests avenues for potential expansion and increased market share if leveraged effectively.

Competitive Landscape

In the competitive landscape of Vapor Pens in Michigan, Magic has shown a notable improvement in its rank from December 2024 to March 2025, climbing from 29th to 24th position. This upward trajectory in rank is indicative of Magic's increasing market presence and sales performance, particularly when juxtaposed with competitors like Bloom and Giggles, which have maintained relatively stable rankings. Notably, ErrlKing Concentrates experienced a significant leap from 41st to 23rd, suggesting a robust competitive pressure. Despite this, Magic's sales surged from February to March 2025, surpassing the sales of Bloom and Giggles, indicating a successful strategy in capturing consumer interest. However, Magic still trails behind Amnesia, which consistently ranks higher, although its sales have shown a downward trend. This dynamic suggests that while Magic is gaining ground, there remains a competitive gap to close with the top-tier brands in the Michigan Vapor Pens market.

Notable Products

In March 2025, the top-performing product for Magic was Blueberry Kush Infused Pre-Roll (1.2g) in the Pre-Roll category, maintaining its first-place ranking from February with sales reaching 19,285. Blueberry Gummies 4-Pack (200mg) in the Edible category consistently held its second-place position from December 2024 through March 2025. Sour Tropicana Infused Pre-Roll (1.2g) improved its ranking to third place in March, up from fifth in the previous two months. Bomb Pop OG Infused Pre-Roll (1.2g) made its debut in the rankings at fourth place, indicating a strong entrance into the market. Apples & Bananas Infused Pre-Roll (1.2g) saw a slight decline, dropping to fifth place in March from third in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.