Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

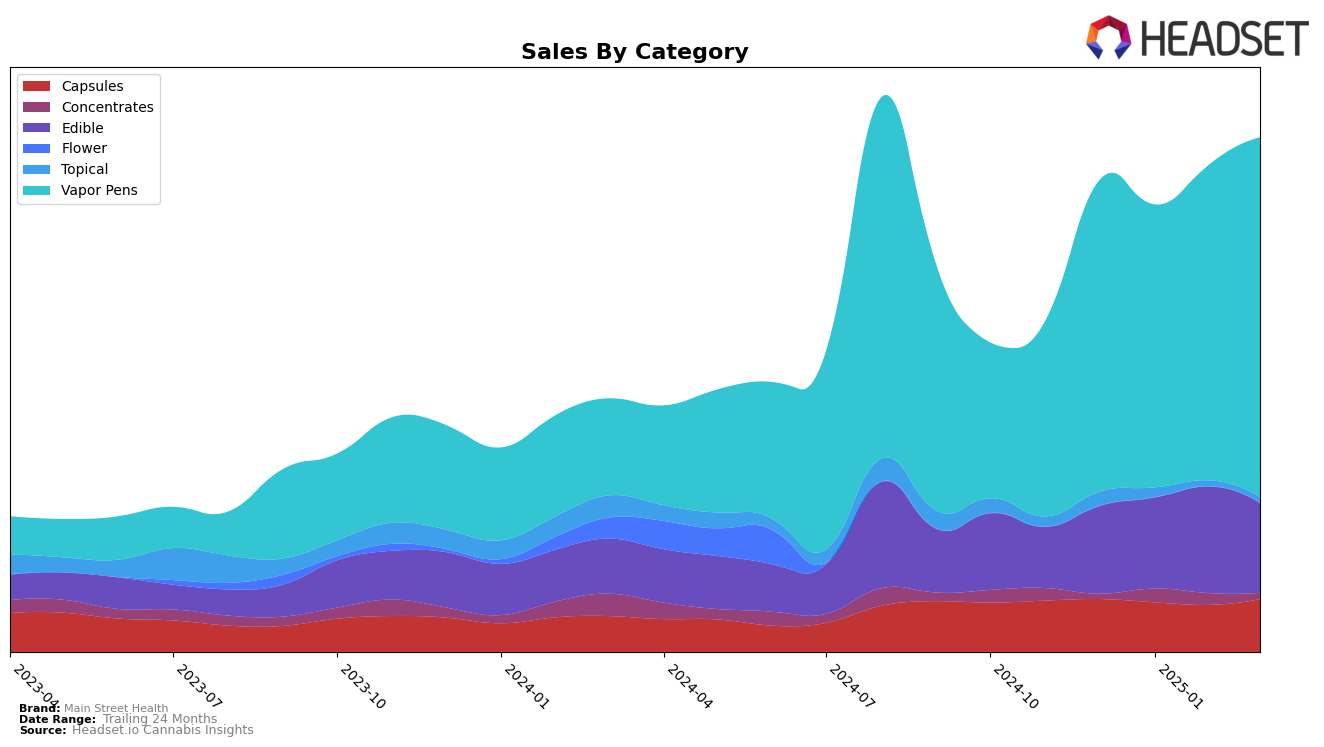

Main Street Health has demonstrated a consistent performance in the Ohio market, particularly in the Capsules category, where it maintained a steady third-place ranking from December 2024 through March 2025. This stability indicates a strong foothold in the market, although sales figures showed some fluctuations, with a notable dip in January 2025 before recovering in March. In contrast, their presence in the Concentrates category was less prominent, as they only appeared in the rankings starting January 2025, peaking at 19th place and then dropping to 24th by February, before disappearing from the top 30 in March. This suggests potential challenges in sustaining a competitive edge in this segment.

In the Edible category, Main Street Health experienced a slight decline in ranking from December 2024 to March 2025, moving from 16th to 18th place. However, it is worth noting that their sales in this category saw a peak in February 2025, suggesting potential for growth despite the ranking slip. The Vapor Pens category showed a positive trajectory, with the brand climbing from 15th place in January 2025 to a solid 10th place by March. This upward movement is indicative of a strengthening position in this high-demand segment. Meanwhile, in the Topical category, Main Street Health was ranked 6th in December 2024 but did not appear in the top 30 in subsequent months, highlighting a significant drop in visibility and potentially signaling a need for strategic adjustments.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, Main Street Health has demonstrated a resilient performance from December 2024 to March 2025. Despite a slight dip in January, where it fell to 15th place, Main Street Health rebounded to secure the 10th position by February and maintained this rank through March. This recovery is indicative of effective strategic adjustments that have positively impacted their sales trajectory, culminating in a notable increase by March. In contrast, Sauce Essentials consistently hovered around the 13th position, only slightly improving to 12th in March, which suggests a stable yet less dynamic market presence. Meanwhile, Neighborgoods made a significant leap from being outside the top 20 in December to ranking 11th by March, highlighting a rapid growth phase that could pose a future challenge to Main Street Health. Additionally, Savvy and Butterfly Effect - Grow Ohio maintained stronger positions, with Savvy stabilizing around the 7th and 8th spots, and Butterfly Effect - Grow Ohio climbing to 7th in March, suggesting robust competition at the higher ranks. These dynamics underscore the competitive pressures Main Street Health faces as it strives to climb higher in the rankings and capture greater market share in Ohio's vapor pen category.

Notable Products

In March 2025, the top-performing product for Main Street Health was Artifact - Sour Diesel Distillate Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 4856. Artifact - Blueberry Distillate Cartridge (1g) climbed to the second position, showing significant improvement from previous months where it was unranked. Artifact - Acapulco Gold Distillate Cartridge (1g) secured the third spot, moving up from fourth in February 2025. Artifact - Maui Wowie Distillate Cartridge (1g) re-entered the rankings at fourth place after being unranked in February. Artifact - Grape Stomper Distillate Cartridge (1g) maintained a consistent presence, holding steady at fifth place for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.