Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

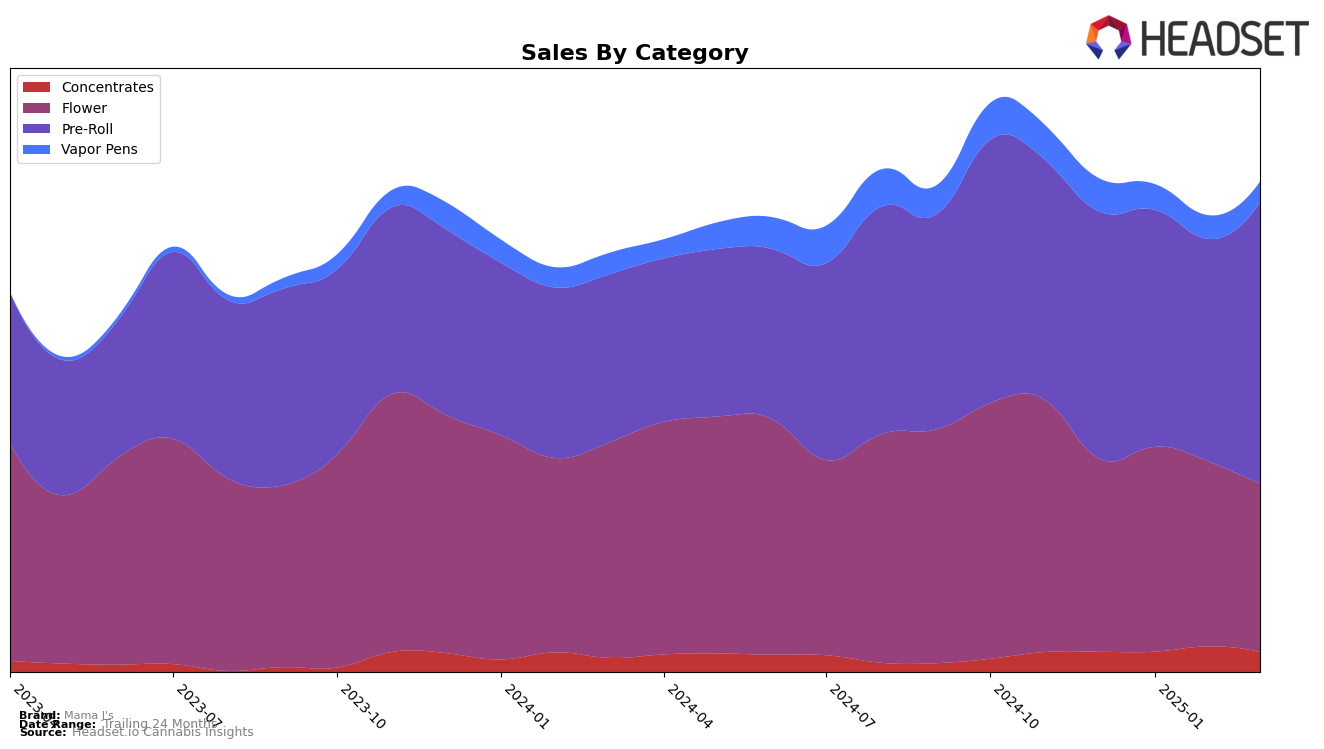

In the state of Washington, Mama J's has shown varied performance across different product categories. Concentrates saw a promising upward trend from December 2024 to February 2025, improving from 29th to 23rd before slightly dropping to 27th in March 2025. This indicates a potential for growth in this category if the brand can maintain momentum. On the other hand, the Flower category exhibited a fluctuating pattern, with the brand peaking at 13th in February 2025 before descending to 18th in March. This suggests a need for strategic initiatives to stabilize and improve their position in this competitive category.

Pre-Rolls have been a consistent stronghold for Mama J's, maintaining a top 4 position from December 2024 through February 2025, and even climbing to 3rd in March 2025. This consistency underscores the brand's strength and popularity in this category. In contrast, Vapor Pens have not been as successful, consistently ranking outside the top 30, with a slight drop from 60th to 62nd by March 2025. This highlights a significant challenge for Mama J's in capturing market share within the Vapor Pens category, suggesting a potential area for strategic focus and improvement. Overall, while Mama J's has strongholds, particularly in Pre-Rolls, there are clear opportunities and challenges in other categories that need addressing to enhance their market presence.

Competitive Landscape

In Washington's pre-roll category, Mama J's has shown a promising upward trajectory in recent months. Starting from a consistent 4th place ranking from December 2024 to February 2025, Mama J's climbed to 3rd place in March 2025, overtaking 2727 Marijuana, which slipped from 3rd to 4th place. This shift indicates a positive momentum for Mama J's, as it managed to increase its sales from February to March, contrasting with the declining sales trend of Phat Panda and Lifted Cannabis Co. Despite the dominance of Phat Panda and Ooowee in the top two positions, Mama J's ability to improve its rank and sales suggests a strengthening brand presence and potential for further growth in the competitive Washington market.

Notable Products

In March 2025, the top-performing product for Mama J's was the Lemon Cherry Gelato Pre-Roll 2-Pack (2g), which climbed to the number one spot with notable sales of 4646 units. Following closely was the Bubblegum Gelato Pre-Roll 2-Pack (2g), which secured the second position, showing a consistent performance after being ranked first in February. The Hidden Pastry Pre-Roll 2-Pack (2g) made a strong debut in March, entering the rankings directly at third place. The Super Boof Pre-Roll 2-Pack (2g) maintained a steady presence, finishing fourth after not being ranked in February. Alien Rock Candy Pre-Roll 2-Pack (2g) rounded out the top five, experiencing a slight drop from its previous rank in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.