Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

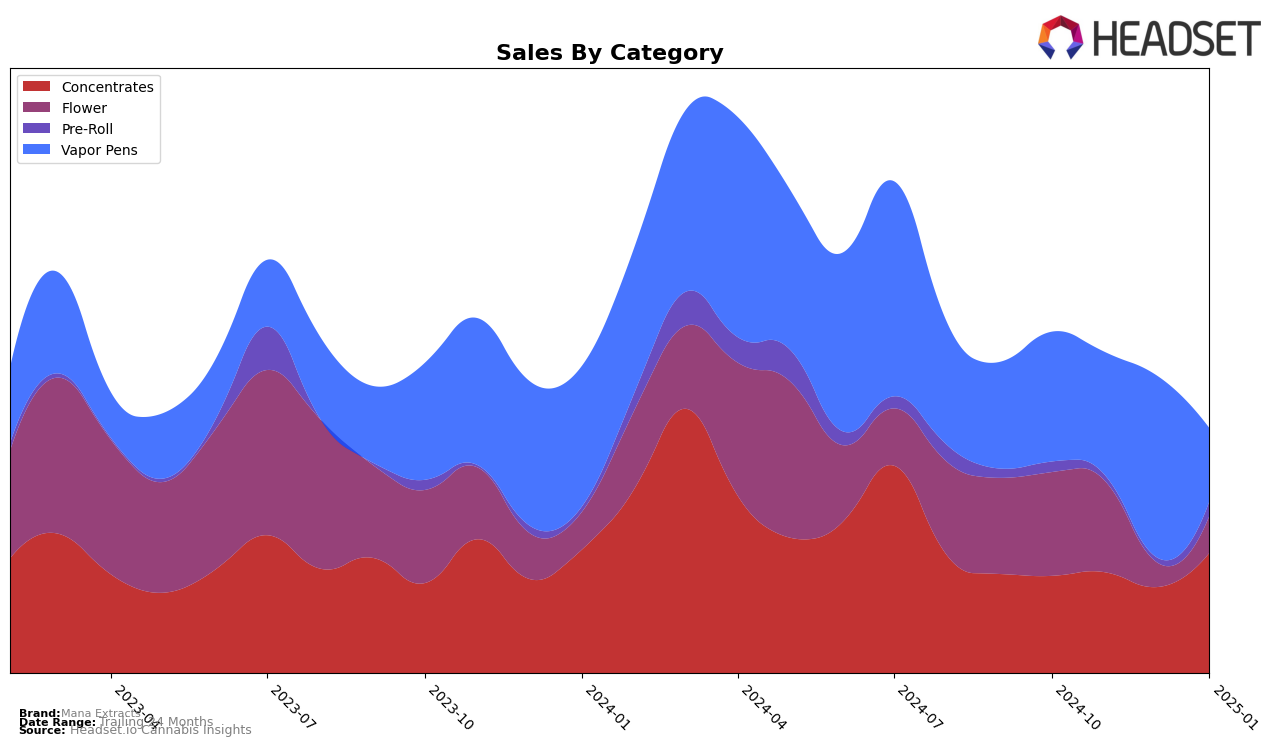

Mana Extracts has demonstrated varied performance across different categories in the Oregon cannabis market. In the concentrates category, Mana Extracts has shown a positive trend, climbing from a 27th rank in October 2024 to a 21st rank by January 2025. This upward movement is particularly notable given the competitive nature of the concentrates market. On the other hand, the brand's presence in the flower category has been less prominent, with rankings outside the top 30 in recent months, indicating potential areas for growth or reevaluation of strategies in this segment. The pre-roll category saw Mana Extracts entering the top 100 at the 86th position in January 2025, a promising entry that could be a precursor to further advancements if the brand continues to capitalize on this momentum.

When it comes to vapor pens, Mana Extracts experienced fluctuations in their rankings, starting at 43rd in October 2024, briefly improving to 34th in December 2024, before dropping to 51st in January 2025. This volatility suggests that while there is potential, there might be challenges that need addressing to maintain a stable position in this category. Despite these challenges, the brand's sales figures reveal significant movements, especially in the concentrates category, where there was a noticeable increase in January 2025. This indicates that while rankings provide one perspective, sales performance offers another layer of insight into the brand's market dynamics. Overall, Mana Extracts appears to have a foothold in the Oregon market, with opportunities for further growth and stabilization across its product categories.

Competitive Landscape

In the competitive landscape of Oregon's concentrates category, Mana Extracts has demonstrated a notable upward trajectory in its market position. From October 2024 to January 2025, Mana Extracts improved its rank from 27th to 21st, showcasing a positive trend in its market presence. This upward movement is particularly significant when compared to competitors such as Beehive Extracts, which dropped to 20th place in January 2025, and Echo Electuary, which saw a significant decline from 9th to 19th place over the same period. Meanwhile, Willamette Valley Alchemy and Elysium Fields have fluctuated in rankings, with Willamette Valley Alchemy not making it into the top 20 until January 2025. Mana Extracts' sales figures reflect this positive trend, with a notable increase in January 2025, positioning them as a rising contender in the market. This consistent improvement in rank and sales suggests that Mana Extracts is effectively capturing market share and enhancing its brand visibility among Oregon consumers.

Notable Products

In January 2025, Linda's Diamonds Infused Pre-Roll (1g) emerged as the top-performing product for Mana Extracts, achieving the highest rank among all offerings. Jack Herer (Bulk) slipped to the second position, despite leading in November and December 2024, with sales recorded at 1,211 units. Cereal Milk Sugar Wax (1g) secured the third spot, marking its first appearance in the top rankings. Taste Budz - Blackberry Jam Flavored Sugar Wax (1g) followed closely in fourth place, while Sherb Haze Cured Resin (1g) rounded out the top five. This shift in rankings indicates a growing consumer preference for Pre-Rolls and Concentrates at the start of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.