Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

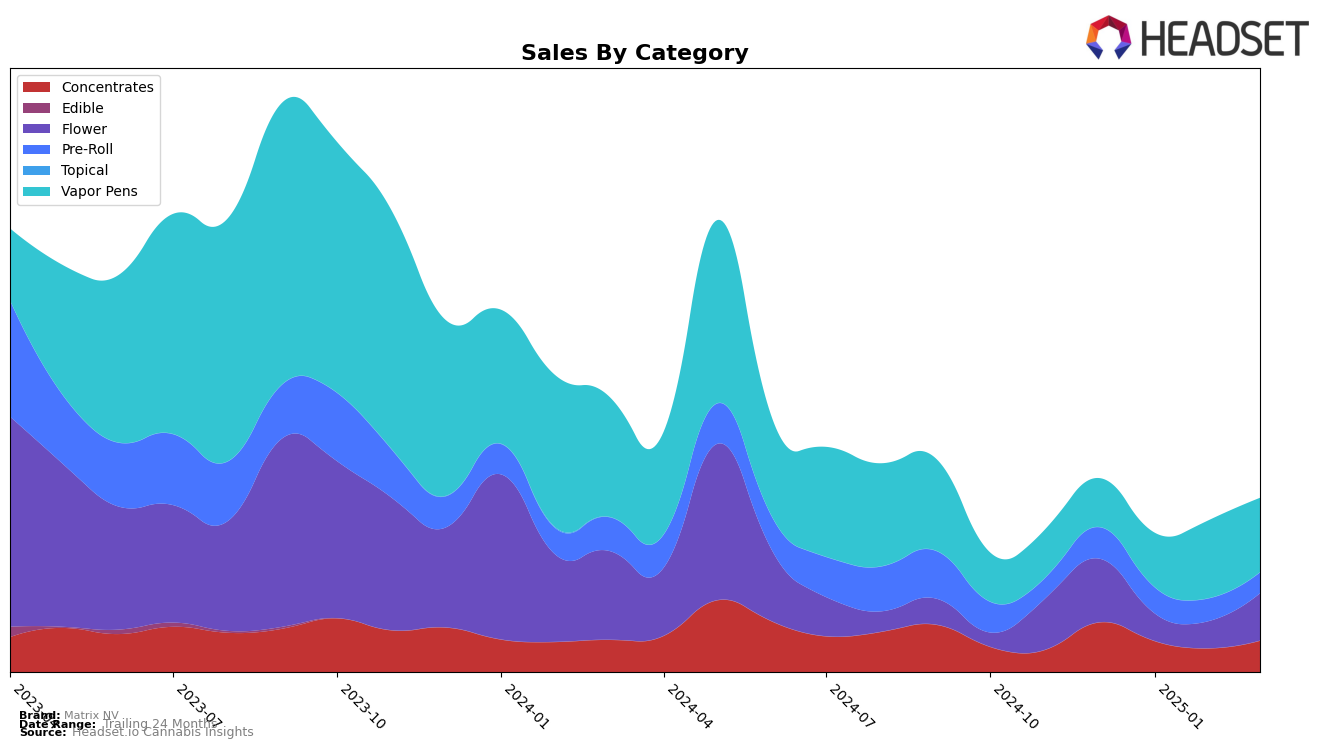

Matrix NV has demonstrated a varied performance across different product categories in Nevada. In the Concentrates category, the brand started strong with a rank of 12 in December 2024 but experienced a downward trend, reaching 18 in February 2025 before slightly improving to 15 in March 2025. This fluctuation indicates potential challenges in maintaining a consistent market position. On the other hand, the Vapor Pens category showed a positive trajectory, with Matrix NV climbing from a rank of 33 in December 2024 to 25 by February 2025, before settling at 27 in March. This improvement in ranking suggests a growing consumer preference or effective marketing strategies in this category.

In contrast, the Flower and Pre-Roll categories have not seen similar upward trends. Matrix NV's Flower products did not make it into the top 30 brands in Nevada throughout the observed months, indicating a weaker competitive stance in this segment. The Pre-Roll category also reflected a downward trend, with the brand's ranking deteriorating from 36 in December 2024 to 45 in March 2025. Such movements highlight areas where Matrix NV might need to reassess its strategies to enhance its market presence and consumer appeal in these categories.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Matrix NV has shown a notable upward trajectory in its rankings from December 2024 to March 2025, moving from 33rd to 27th place. This improvement in rank is indicative of a positive trend in sales, as Matrix NV's sales figures have consistently increased over this period, culminating in a significant boost in February 2025. In contrast, Khalifa Kush experienced fluctuating ranks, dropping to 33rd in February before recovering to 26th in March, while Bonanza Cannabis Company maintained a steadier position, hovering around the mid-20s. Notably, Beboe showed a similar pattern to Matrix NV, peaking in February but slipping back to 28th in March. These dynamics suggest that while Matrix NV is gaining momentum, it faces stiff competition from brands like Bonanza Cannabis Company, which consistently outperformed it in sales, and Beboe, which closely mirrors its trajectory. The data highlights the importance for Matrix NV to continue its upward sales trend to secure a stronger foothold in the Nevada vapor pen market.

Notable Products

In March 2025, the top-performing product for Matrix NV was Grape Fog Pre-Roll 1g, securing the first position in the sales rankings for the month with a notable sales figure of 485 units. GP x AB Pre-Roll 1g maintained its consistent performance, holding the second rank for the third consecutive month, although its sales dipped slightly to 423 units. Grape Fog 3.5g emerged as a strong contender, debuting in the rankings at third place. Gary P x Apples & Bananas 3.5g followed closely in fourth place, while Jokerz Candy Pre-Roll 1g rounded out the top five. This month saw new entries in the rankings, indicating a shift in consumer preferences towards different product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.