Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

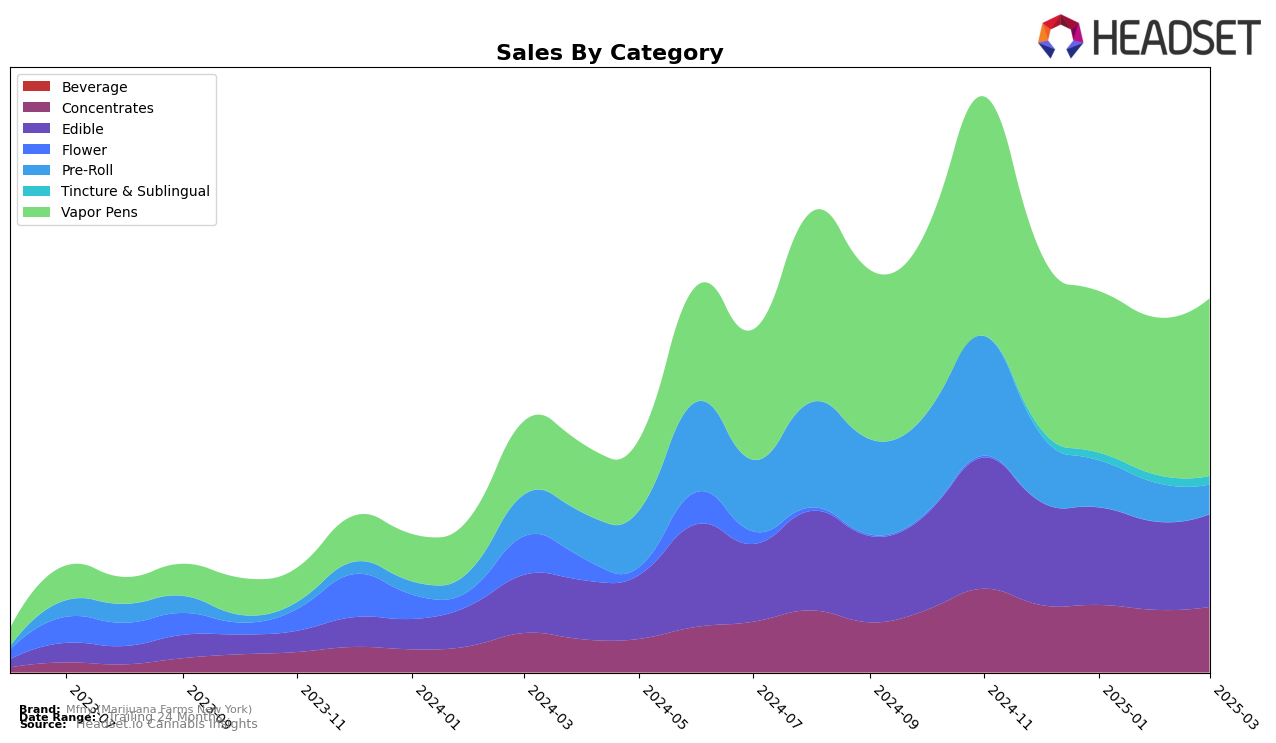

Mfny (Marijuana Farms New York) has shown a strong and consistent performance in the New York cannabis market, particularly in the Concentrates category, where it maintained the top ranking from December 2024 through March 2025. This indicates a robust brand presence and consumer loyalty in this segment. However, the Pre-Roll category tells a different story, with a noticeable decline from 7th place in December 2024 to 16th place by March 2025. This drop might suggest increased competition or shifting consumer preferences, which could be areas for the brand to investigate further. The Vapor Pens category remains a stronghold for Mfny, consistently ranking 4th over the first quarter of 2025, demonstrating stable demand and possibly effective marketing strategies in this product line.

In the Edible category, Mfny's position fluctuated slightly, moving from 6th place in December 2024 to 5th in January 2025, before settling back at 6th in March 2025. This suggests a competitive landscape with potential for growth if strategic adjustments are made. Interestingly, the Tincture & Sublingual category saw Mfny enter the top rankings only in February 2025, debuting at 5th place and improving to 4th by March. This upward trajectory could indicate a successful product launch or growing consumer interest in these products. The absence of rankings for earlier months in this category highlights the brand's recent entry and potential for further expansion. Overall, Mfny's performance across categories shows both strengths and areas for potential growth, with the Concentrates and Vapor Pens categories being particularly noteworthy for their consistent high rankings.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Mfny (Marijuana Farms New York) has shown a consistent performance, maintaining its rank at 4th place from January to March 2025. This stability in rank is notable, especially when compared to competitors like Fernway, which has consistently held the 5th position, and Mfused, which has remained at 6th place during the same period. Despite fluctuations in sales figures, with a noticeable dip in February 2025, Mfny's ability to retain its rank suggests a strong brand presence and customer loyalty. However, the brand faces stiff competition from Rove and Ayrloom, which have consistently occupied the top three positions, indicating a significant gap in market share that Mfny could aim to close with strategic marketing and product differentiation efforts.

Notable Products

In March 2025, Mfny (Marijuana Farms New York) saw the Honey Banana Live Resin Cartridge (0.5g) rise to the top, achieving the number one rank in Vapor Pens with notable sales of 3488 units. The Cherry x Poddy Mouth Live Resin Gummies 10-Pack (100mg) maintained a strong position, holding steady at the second rank in the Edible category. The Hash Burger Live Rosin Cartridge (0.5g) experienced a slight drop, moving from first in January to third in March for Vapor Pens. Meanwhile, the Pink Lemonade x Lemon Cane Live Resin Gummies 10-Pack (100mg) debuted at fourth in the Edible category. Lastly, the Strawberry Mango x Honey Banana Live Rosin Gummies 10-Pack (100mg) rounded out the top five, showing a slight decline from its third-place ranking in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.