Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

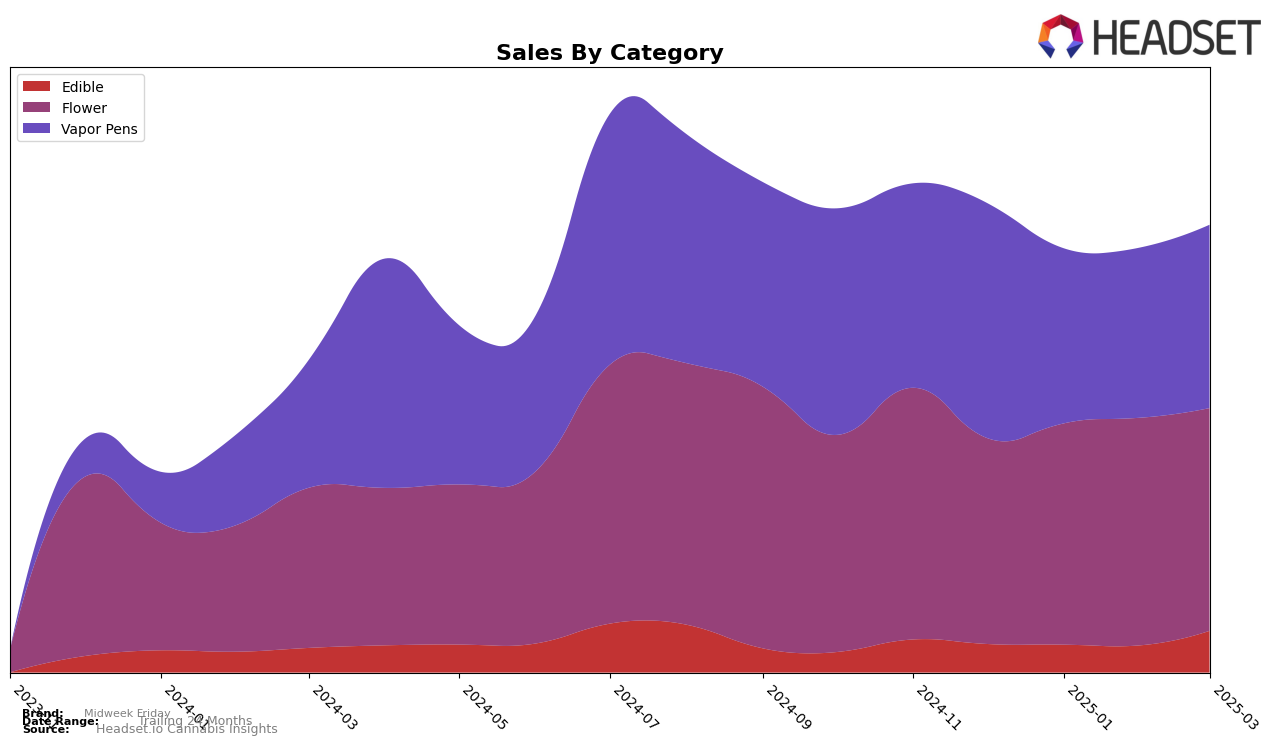

In Illinois, Midweek Friday's performance in the Edible category has shown a promising upward trajectory. Starting from a rank of 26 in December 2024, the brand climbed to 21 by March 2025. This improvement is noteworthy, especially considering the sales jump from $185,701 in February to $285,017 in March. Such a significant increase indicates a growing consumer interest in their edible products. However, it's important to note that while they maintained a presence in the top 30, their initial lower ranking suggests there is still room for growth in this category.

Conversely, in the Flower category, Midweek Friday experienced some fluctuations in rankings. They improved from a rank of 15 in December 2024 to 9 in February 2025, before slightly dropping to 11 in March 2025. This movement suggests a strong competitive environment, although the brand managed to maintain a solid position within the top 15. Meanwhile, their Vapor Pens category remained stable with a consistent rank of 10 throughout the months, despite a dip in sales from December to February. This consistency might reflect a loyal customer base or a steady demand for their vapor pen offerings in the Illinois market.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Midweek Friday has shown a dynamic performance from December 2024 to March 2025. Starting at rank 15 in December, Midweek Friday improved to rank 9 by February, before slightly dropping to rank 11 in March. This fluctuation in rank is indicative of a competitive market environment. Notably, Grassroots demonstrated a strong upward trend, moving from rank 14 in December to a commendable rank 10 by March, which could have influenced Midweek Friday's rank changes. Meanwhile, &Shine experienced significant volatility, peaking at rank 8 in January but dropping to rank 18 in February, before recovering to rank 9 in March, suggesting a highly competitive period that likely impacted Midweek Friday's market position. Despite these challenges, Midweek Friday's sales remained relatively stable, with a peak in February, indicating resilience and a solid consumer base amidst fluctuating ranks.

Notable Products

In March 2025, the Tangerine Energize Gummies 10-Pack (100mg) maintained its top position as the leading product for Midweek Friday, with a notable sales figure of 10,125 units. The Lemon Vibe Pectin Gummies 10-Pack (100mg) rose to the second position, showcasing a strong performance with sales increasing from previous months. Meanwhile, the Strawberry Doze Gummies 20-Pack (100mg) slipped to third place after holding the second spot in January and February 2025. Among vapor pens, the Peach Rings Distillate Cartridge (1g) improved its rank to fourth place, while the Pink Lemonade Distillate Cartridge (1g) re-entered the rankings at fifth. Overall, the Edible category dominated the top three positions, illustrating a consistent preference for gummies among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.