Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

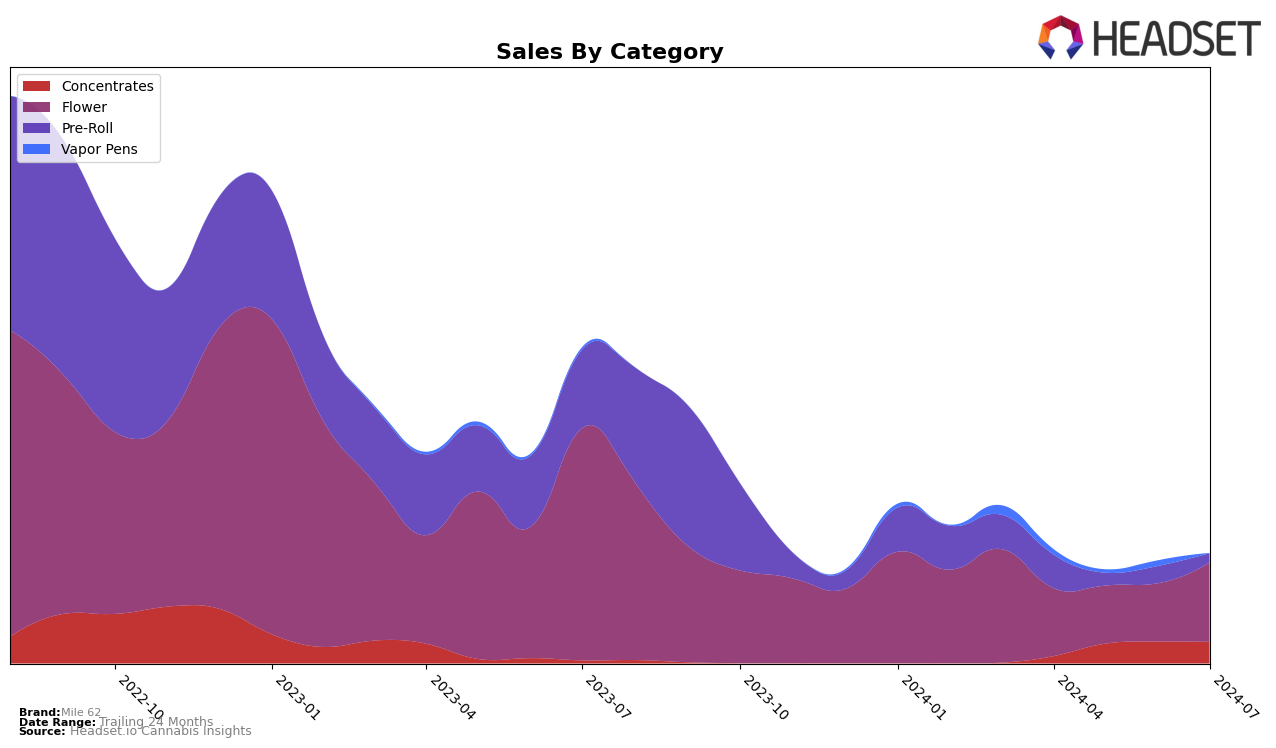

Mile 62 has demonstrated significant improvements in the Massachusetts market, particularly in the Concentrates category. Starting from a rank of 59 in April 2024, the brand climbed to 27 by July 2024, indicating a consistent upward trend. This movement is a positive sign, reflecting the brand's growing popularity and market penetration within this category. The increase in sales from $11,197 in April to $33,661 in July further substantiates this growth. However, in the Flower category, Mile 62's performance has been less consistent. While the brand improved its ranking from 78 in April to 71 in July, it did experience a dip in May and June, indicating potential volatility or competition in this space.

In terms of Pre-Rolls, Mile 62's performance in Massachusetts has been less impressive. The brand was ranked 87 in April 2024 but did not make it to the top 30 in the subsequent months. This absence from the rankings suggests that Mile 62 might be struggling to gain a foothold in this particular category. The lack of data for May, June, and July could be indicative of either a strategic shift away from Pre-Rolls or increased competition making it difficult for the brand to maintain a top position. Overall, while Mile 62 shows promise in Concentrates, it faces challenges in other categories that need to be addressed for a more balanced performance across the board.

Competitive Landscape

In the Massachusetts Flower category, Mile 62 has shown a notable fluctuation in its rankings and sales over recent months. Starting at rank 78 in April 2024, Mile 62 experienced a dip to 89 in May before climbing back up to 71 by July. This indicates a recovery and positive trend in its market position. In comparison, LivWell has not been in the top 20 for the past four months, suggesting a weaker competitive stance. Curaleaf also showed improvement, moving from 95 in April to 77 in July, but its sales growth was less consistent. Good Green demonstrated a strong upward trajectory, advancing from rank 93 in April to 68 in July, which could pose a significant competitive threat to Mile 62. Green Meadows, maintaining a relatively stable and higher rank, consistently outperformed Mile 62, indicating a strong market presence. These dynamics suggest that while Mile 62 is recovering, it faces stiff competition, particularly from brands like Good Green and Green Meadows, which are showing robust performance and growth.

Notable Products

For July 2024, the top-performing product from Mile 62 is Citronella (3.5g) in the Flower category, maintaining its position at rank 1 with notable sales of 1621 units. Sour Lemons (3.5g), also in the Flower category, has climbed to rank 2 from its previous position at rank 3 in June 2024. The Sour Lemons Pre-Roll (1g) in the Pre-Roll category has dropped to rank 3 from its previous rank of 2 in June. The Sour Lemons Pre-Roll (0.5g) re-entered the rankings at position 4 after being unranked in the previous months. Lakc (3.5g) made its debut in the rankings at position 5, indicating a new entry with 407 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.