Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

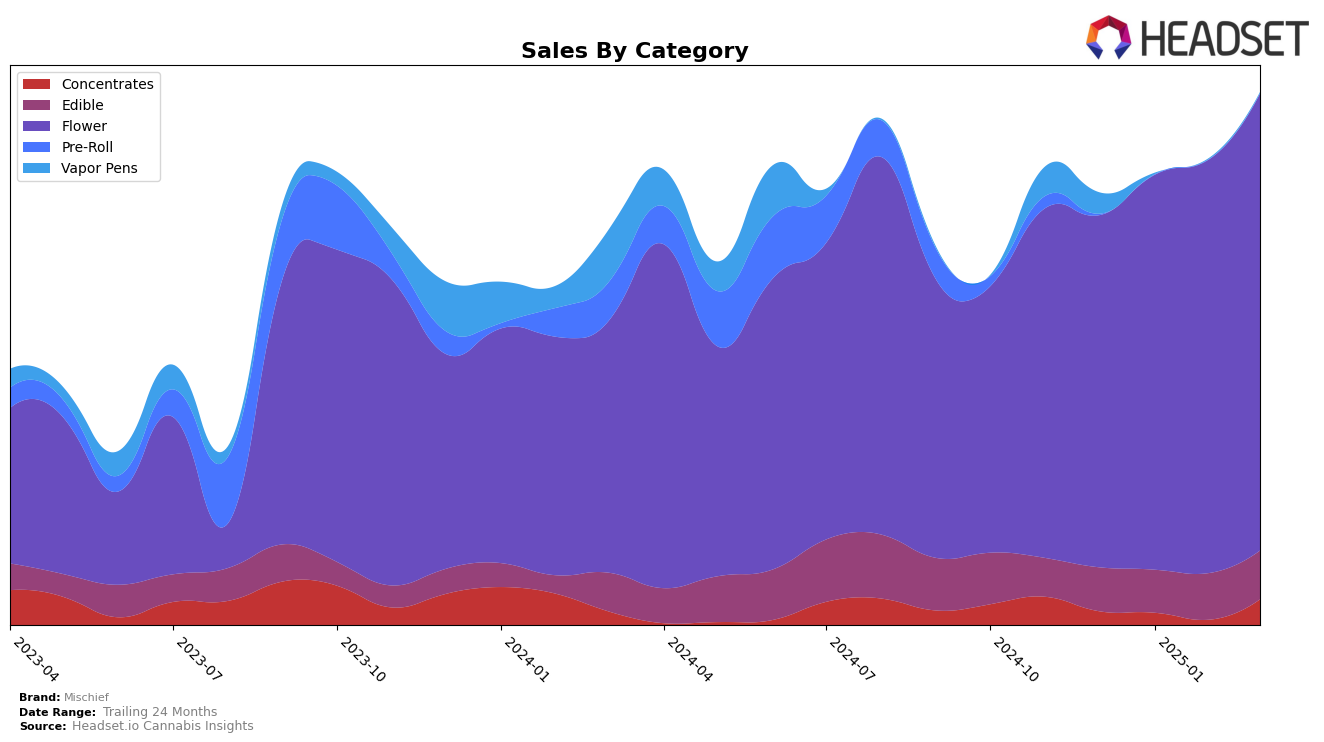

Mischief has experienced a dynamic performance across various categories in the state of Michigan. In the concentrates category, Mischief was not in the top 30 rankings for February 2025, but interestingly made a significant leap to 26th position by March 2025, indicating a potential resurgence in consumer interest or strategic market moves. Conversely, their presence in the vapor pens category remains absent from the top 30 since January 2025, which might suggest a need for strategic adjustments or increased competition in that segment. This fluctuation in rankings across categories highlights the brand's varying strengths and potential areas for growth within the Michigan market.

In the edibles and flower categories, Mischief has shown consistent performance and upward momentum in Michigan. The brand improved its ranking in the edibles category, moving from 26th in December 2024 to 19th by March 2025, reflecting a steady increase in sales and consumer preference. Similarly, Mischief's flower category maintained strong positions, consistently ranking within the top 6 across the months, although it saw a slight dip from 4th to 5th position in March 2025. This consistent performance in flower sales, with sales figures reaching over $3 million in March 2025, underscores Mischief's robust market presence and consumer loyalty in this category. These movements suggest that while Mischief is solidifying its position in certain categories, there are opportunities to enhance its footprint in others.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Mischief has maintained a relatively stable position, ranking between 4th and 6th place from December 2024 to March 2025. This consistency in rank is indicative of a steady performance in sales, with a noticeable upward trend over the months. However, Mischief faces stiff competition from brands like Pro Gro, which has consistently held a top-three position, even reaching the number one spot in February 2025. Play Cannabis also poses a significant challenge, having recovered from an 11th place dip in January 2025 to secure the 4th position by March 2025, reflecting a strong sales rebound. Meanwhile, Ozone and Goodlyfe Farms have shown fluctuations in their rankings, with Ozone improving from 15th to 6th place and Goodlyfe Farms maintaining a stable presence in the top 10. For Mischief, the key to climbing higher in the ranks may lie in differentiating its offerings and capitalizing on the upward sales momentum observed in the first quarter of 2025.

Notable Products

In March 2025, the top-performing product for Mischief was Magic Gum Drops (3.5g) in the Flower category, securing the number one rank with sales of 12,554 units. Bubblegum Gummies 10-Pack (200mg) followed closely in second place, showing a slight drop from its first-place position in February. Peach Rings (3.5g) entered the top ranks at third, marking its debut on the leaderboard. Strawberry Gummies 10-Pack (200mg) retained a solid fourth position, consistent with its previous ranking. Sour Razz Gummies 10-Pack (200mg) saw a drop to fifth place, down from a peak first-place ranking in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.