Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

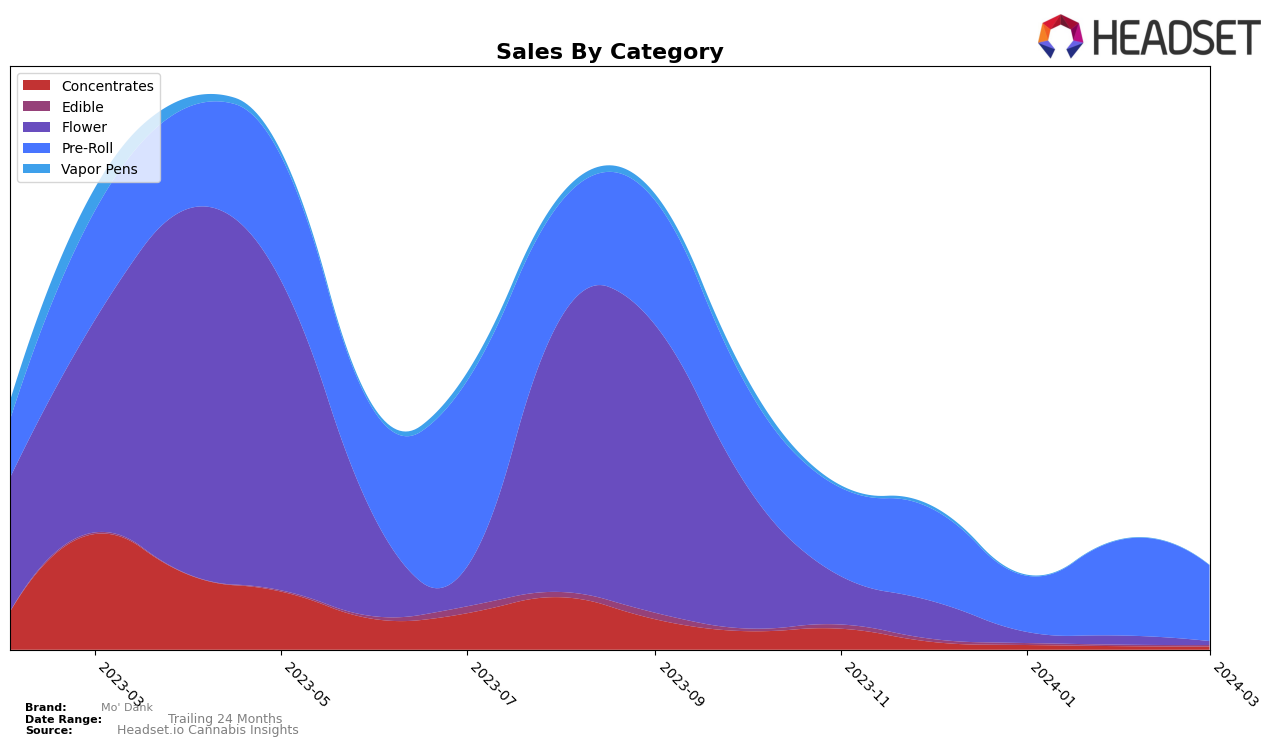

In the competitive cannabis market of Missouri, Mo' Dank has shown a varied performance across different product categories. Notably, their Pre-Roll category has maintained a strong presence within the top 20 ranks from December 2023 to March 2024, peaking at rank 12 in February 2024. This indicates a robust demand and consistent market share in this category, highlighted by a significant sales figure of 262988 in December 2023. Conversely, their Vapor Pens category has struggled significantly, with rankings sliding from 75th in December 2023 to 92nd by March 2024. This downward trend is mirrored in their sales numbers, which plummeted from 7467 in December 2023 to a mere 182 in March 2024, suggesting a sharp decline in consumer interest or possible distribution challenges within this segment.

Looking at Mo' Dank's performance in other categories within the Missouri market, it's clear that there are areas of concern and opportunity. The Flower category has seen a gradual decline in rankings from 43rd in December 2023 to 54th by March 2024, accompanied by a substantial drop in sales from 106933 in December to 10278 in March. This could indicate a loss of market share to competitors or perhaps shifts in consumer preferences. On the brighter side, the Concentrates and Edible categories, despite not breaking into the top 30, have shown relatively stable rankings, suggesting a steady, if not dominant, position within their respective niches. These insights could help Mo' Dank in strategizing their product development and marketing efforts to capitalize on strengths and address weaknesses.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Missouri, Mo' Dank has experienced fluctuations in its ranking and sales over the recent months, indicating a dynamic market presence. Starting from December 2023, Mo' Dank held the 13th position but saw a slight dip in January 2024 to 15th, before improving to 12th in February and then slightly dropping again to 17th in March 2024. This rollercoaster movement contrasts with its competitors, such as FUBAR (MO), which experienced a more significant decline from 6th to 19th position, and Vertical (MO), which showed an impressive climb from 26th to 15th position, indicating a stronger performance in the latter months. Meanwhile, Sundro Cannabis and Vibe Cannabis (MO) also showed varying degrees of improvement and decline. These movements suggest that while Mo' Dank has maintained a relatively stable presence in the market, the competitive dynamics, including significant gains by competitors like Vertical (MO), pose challenges that could impact Mo' Dank's rank and sales trajectory in the longer term.

Notable Products

In Mar-2024, Mo' Dank's top-performing product was Mo'Lite - Peach Crescendo Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one rank from February with impressive sales of 15,574 units. Following closely, Mo' Lite - Missouri Belle Pre-Roll (0.5g) secured the second spot, showing a significant rise in its ranking from fourth in February. The third position was held by High Fructose Corn Syrup Pre-Roll (0.5g), which dropped from second place in February, indicating a shift in consumer preference. New entries to the top five include Mo'Lite - Blue Goo Infused Pre-Roll (0.5g) and Mo'Lite - Blue Gloo Diamond Infused Pre-Roll (1g), ranking fourth and fifth respectively, demonstrating Mo' Dank's ability to innovate and capture market interest. These rankings highlight dynamic consumer trends and Mo' Dank's dominance in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.