Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

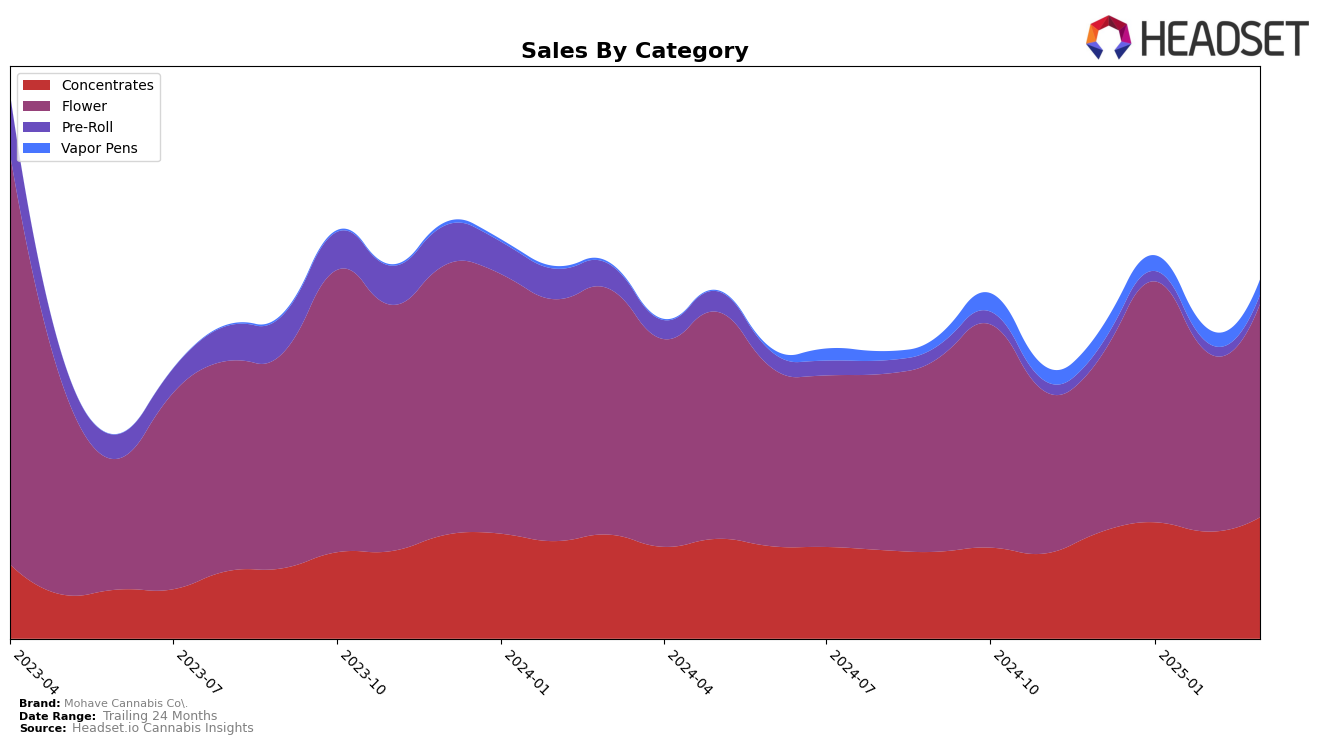

Mohave Cannabis Co. has shown a strong performance in the Arizona market, particularly in the Concentrates category, where it has maintained a consistent number one ranking from December 2024 through March 2025. This stability indicates a solid consumer base and effective market strategies within this category. In the Flower category, Mohave Cannabis Co. has also performed well, consistently holding the second spot during the same period, which suggests a robust presence and competitive edge. However, the brand's performance in Pre-Rolls and Vapor Pens has been less dominant, with rankings fluctuating between 20th and 24th positions. This variation could signal potential challenges or opportunities for growth in these segments.

While Mohave Cannabis Co. continues to excel in certain categories, its lower rankings in Pre-Rolls and Vapor Pens in Arizona might indicate areas where the brand could focus on product innovation or marketing efforts to improve its positioning. Despite these lower rankings, the brand's ability to stay within the top 30 in these categories suggests a foothold that could be strengthened with targeted strategies. The consistent high performance in Concentrates and Flower categories highlights the brand's expertise and consumer loyalty in these areas, setting a strong foundation for potential expansion or enhancement of their product lines. Overall, Mohave Cannabis Co.'s performance across categories reflects both its strengths and areas for potential growth in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Mohave Cannabis Co. consistently held the second rank from December 2024 through March 2025. This stability in rank reflects a strong market presence, although it trails behind Find., which maintained the top position throughout the same period. Despite not surpassing Find., Mohave Cannabis Co.'s sales figures indicate robust performance, with a notable increase from December 2024 to January 2025, followed by a slight decline but still maintaining a healthy lead over other competitors. Shango and High Grade fluctuated in the ranks, with High Grade even dropping out of the top 20 in February 2025, highlighting Mohave Cannabis Co.'s relative stability and resilience in the market. This competitive positioning suggests that while Mohave Cannabis Co. is a formidable player, there is room for growth to challenge the dominance of Find. in the Arizona flower market.

Notable Products

In March 2025, the top-performing product from Mohave Cannabis Co. was Mixed Strain RSO (1g) in the Concentrates category, maintaining its number one rank from February, with a notable sales figure of 11,965. Gold Apple Fritter Budder (1g) also performed well, debuting in second place among Concentrates. Hawaiian Nights (3.5g) in the Flower category climbed back to third place after not being ranked in February. Gold - Bubba Star Dog Budder (1g) emerged in fourth place in Concentrates, showing a strong introduction to the rankings. Reserve - Cadillac Rainbow (3.5g) in the Flower category dropped to fifth place, down from its second-place position in February.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.