Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

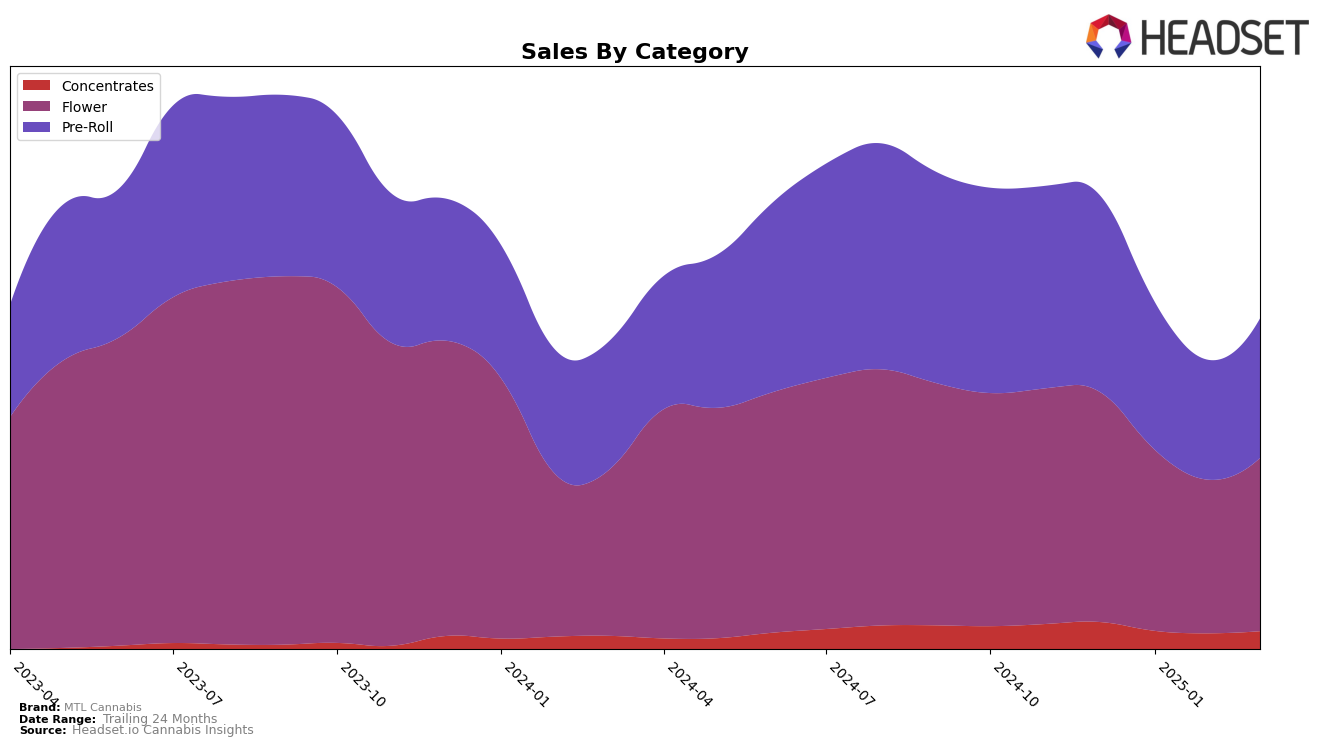

MTL Cannabis has shown a varied performance across different provinces and product categories. In Alberta, the brand's presence in the Flower category has been consistent, albeit outside the top 30, with a slight decline in sales from December 2024 to March 2025. Their Pre-Roll category performance in Alberta has seen a more notable drop, with the brand falling out of the top 30 by March 2025, indicating potential challenges in this segment. In contrast, in British Columbia, MTL Cannabis has maintained a stronger position in the Flower category, with a slight improvement in rank by March 2025, suggesting a recovery in sales after a dip in February. The Pre-Roll category in British Columbia has also seen stable rankings, although the brand's position slightly declined by March 2025.

In Ontario, MTL Cannabis has consistently performed well in the Concentrates category, maintaining a solid rank of 5 throughout the months, which reflects a stable demand for their products in this category. However, in the Flower category, a slight drop in rank is observed by March 2025, indicating increased competition or shifting consumer preferences. Meanwhile, their Pre-Roll products in Ontario have seen a gradual decline in ranking, suggesting that while they remain competitive, there is room for improvement. In Saskatchewan, the Flower category has seen some fluctuations, with the brand experiencing a dip but recovering by March 2025. Their Pre-Roll category also shows a similar trend, with rankings varying over the months, ending with a drop to 10th place by March 2025.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, MTL Cannabis has experienced notable fluctuations in its market positioning, particularly in the first quarter of 2025. While maintaining a steady rank of 13th from December 2024 to February 2025, MTL Cannabis saw a decline to 16th place in March 2025, indicating increased competition and potential challenges in maintaining its market share. This dip in rank coincides with a decrease in sales from December 2024 to February 2025, although there was a slight recovery in March 2025. Competitors such as FIGR and LowKey have shown resilience, with FIGR maintaining a higher rank and sales figures, and LowKey surpassing MTL Cannabis in March 2025. Meanwhile, Tweed and 3Saints have been climbing the ranks, with 3Saints showing a significant improvement from being outside the top 20 in December 2024 to ranking 17th in March 2025. These dynamics suggest that MTL Cannabis may need to reassess its strategies to regain its competitive edge in the Ontario Flower market.

Notable Products

For March 2025, Wes Coast Kush Pre-Roll 3-Pack (1.5g) maintained its position as the top-performing product for MTL Cannabis, with sales figures reaching 13,842 units. Following closely, Strawberry N' Mintz Pre-Roll 3-Pack (1.5g) secured the second spot, showing a slight increase in sales compared to the previous month. Sage N' Sour Pre-Roll 3-Pack (1.5g) held steady at third place, demonstrating consistent performance over the last few months. Jungl' Cake Pre-Roll 3-Pack (1.5g) and West Coast Kush (3.5g) rounded out the top five, with both products maintaining their ranks from February 2025. Overall, the rankings have shown remarkable stability, with no changes in positions from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.