Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

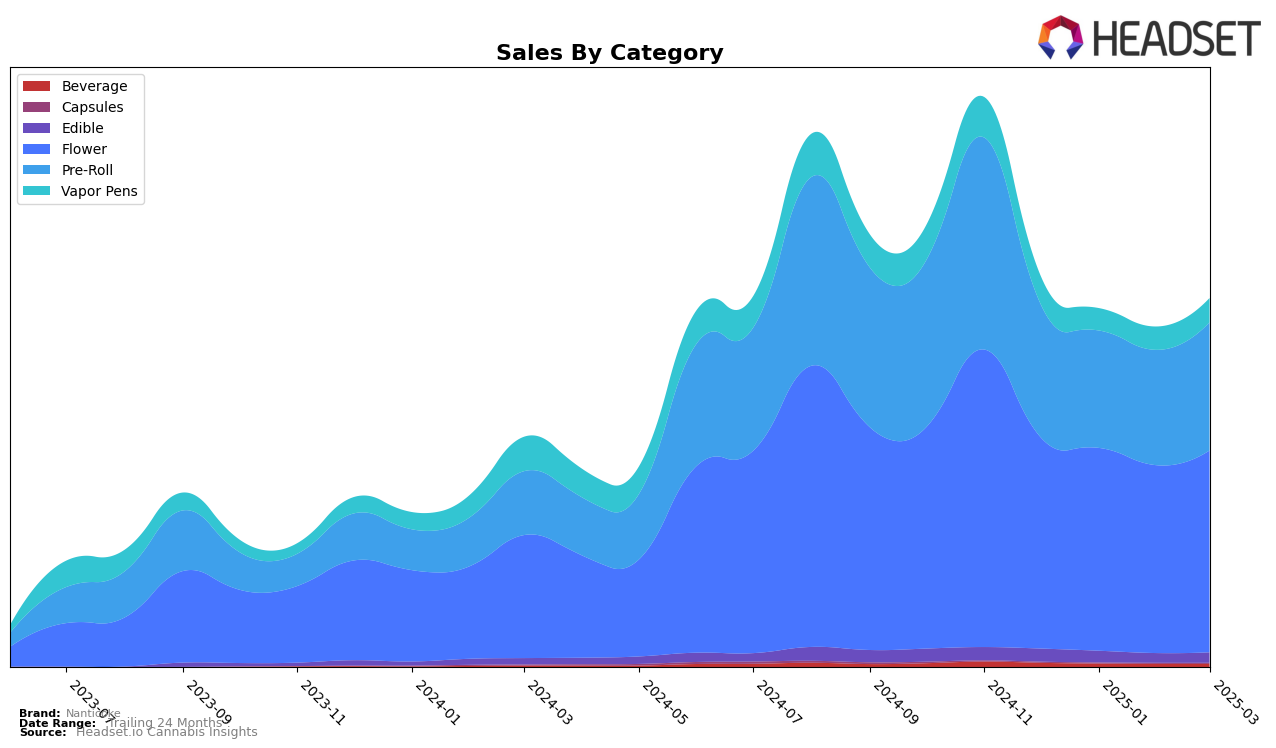

Nanticoke's performance in the state of New York has shown notable variation across different product categories. In the Edible category, Nanticoke has seen a slight decline, slipping from the 28th position in December 2024 to 31st by March 2025, indicating some challenges in maintaining its presence among the top brands. Interestingly, the Flower category has been more stable, with Nanticoke maintaining a consistent rank of 8th in December and January, before dropping slightly to 10th in February and March. This suggests that while there is some volatility, Nanticoke's Flower products have a relatively strong foothold in the New York market.

In contrast, the Pre-Roll category has been a bright spot for Nanticoke, where it has consistently held a top 10 position, even improving from 6th place in December and January to 5th in February, before returning to 6th in March 2025. However, the Vapor Pens category tells a different story, with Nanticoke not breaking into the top 30, as indicated by its ranking of 38th in December and 40th in March. This suggests that while Nanticoke has a strong presence in some categories, there are others where it faces significant competition and market challenges. Such insights highlight the brand's diverse performance across categories and the varying competitive landscapes it navigates in New York.

Competitive Landscape

In the competitive landscape of the New York flower category, Nanticoke has experienced some fluctuations in its market position, which could be pivotal for strategic planning. As of December 2024, Nanticoke held the 8th rank, but by March 2025, it had slipped to the 10th position. This decline in rank is mirrored by a decrease in sales from December to February, although there was a slight recovery in March. In contrast, Revert Cannabis New York maintained a stronger position, consistently ranking higher than Nanticoke and even improving its rank from 6th to 8th over the same period. Meanwhile, Rythm also saw a decline in rank from 7th to 9th, but their sales in March 2025 were notably higher than Nanticoke's, indicating a more robust recovery. Leal and Back Home Cannabis Co. remained stable in their rankings, with Leal consistently outperforming Nanticoke in sales by March 2025. These insights suggest that while Nanticoke is facing competitive pressures, there is potential for strategic adjustments to regain market share in the New York flower category.

Notable Products

In March 2025, the top-performing product for Nanticoke was Blue Dream Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one rank consistently since December 2024, with sales reaching 6,554 units. Blue Dream (3.5g) in the Flower category also held its ground at the second position, showing remarkable stability over the months. Lemon Grab Pre-Roll (0.5g) made a notable leap to third place from fifth in January, displaying an upward trend in sales. Mac Nilla Pre-Roll (0.5g) experienced a slight decline, moving from second in January to fourth in March. Additionally, Blue Dream Pre-Roll 5-Pack (2.5g) entered the rankings in March at the fifth position, indicating a growing interest in multi-pack options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.