Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

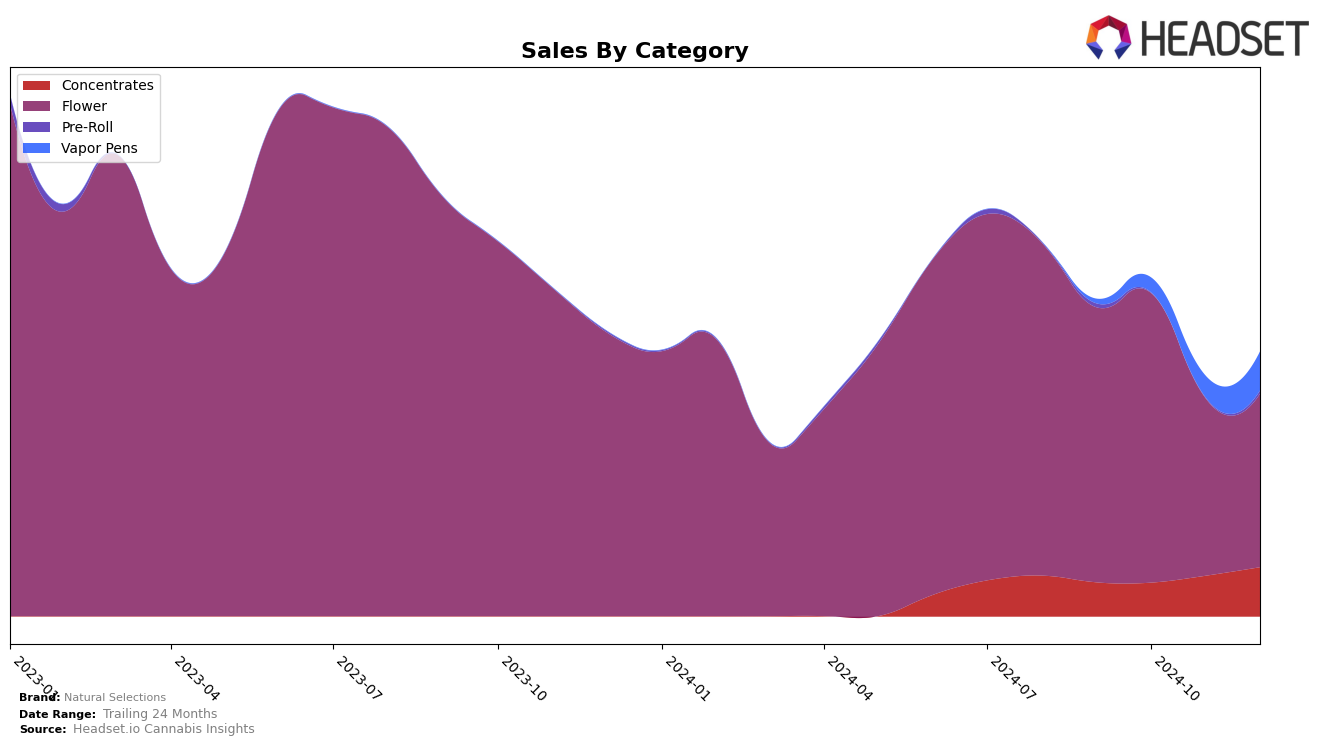

Natural Selections has shown noteworthy progress in the Massachusetts market, particularly in the Concentrates category. The brand moved up from not being in the top 30 in September 2024 to securing the 26th position by December 2024. This upward trajectory is underscored by a steady increase in sales, culminating in a significant rise from $26,281 in September to $38,113 in December. In contrast, their performance in the Flower category has been less stable, with rankings fluctuating and ultimately dropping from 49th in October to 65th by December. Such variability suggests potential challenges in maintaining consistent market share in this category.

In the Vapor Pens category, Natural Selections made an impressive entry into the rankings in November 2024, debuting at the 98th position and quickly climbing to the 76th position by December. This swift advancement indicates a growing acceptance and demand for their products in this category within Massachusetts. However, the brand's absence from the top 30 in both September and October highlights the competitive nature of this segment and the hurdles they faced before gaining traction. Overall, while Natural Selections has demonstrated potential for growth and adaptability in certain categories, the mixed results across different segments suggest areas that may require strategic focus to achieve sustained success.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Natural Selections has experienced notable fluctuations in its market rank, which directly impacts its sales performance. Over the last four months of 2024, Natural Selections has seen a slight improvement in its rank from 51st in September to 49th in October, followed by a drop to 68th in November, and a slight recovery to 65th in December. This volatility contrasts with competitors like INSA, which maintained a relatively stable position, hovering around the low 60s, and Impressed, which showed a consistent upward trend, climbing from 83rd in September to 62nd in December. Despite these challenges, Natural Selections' sales figures have shown resilience, with only a minor decrease from October to December, suggesting potential for recovery if strategic adjustments are made. Meanwhile, brands like Green Gold Group and Bailey's Buds have struggled to maintain consistent rankings, indicating a competitive but volatile market environment where Natural Selections could capitalize on its strengths to regain higher market positions.

Notable Products

In December 2024, D.O. Double OG (3.5g) emerged as the top-performing product for Natural Selections, climbing from third place in November to first place, with impressive sales of 1948 units. Gary Payton (3.5g) also saw a significant rise, moving from fourth place in November to second place in December. Galactic Grape (3.5g) made its debut in the rankings at third place, while Grease Bucket (3.5g) followed closely behind in fourth. Gasonade (3.5g) completed the top five, maintaining its position from the previous month. Overall, December saw a reshuffling in rankings, with D.O. Double OG leading the charge with a substantial increase in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.