Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

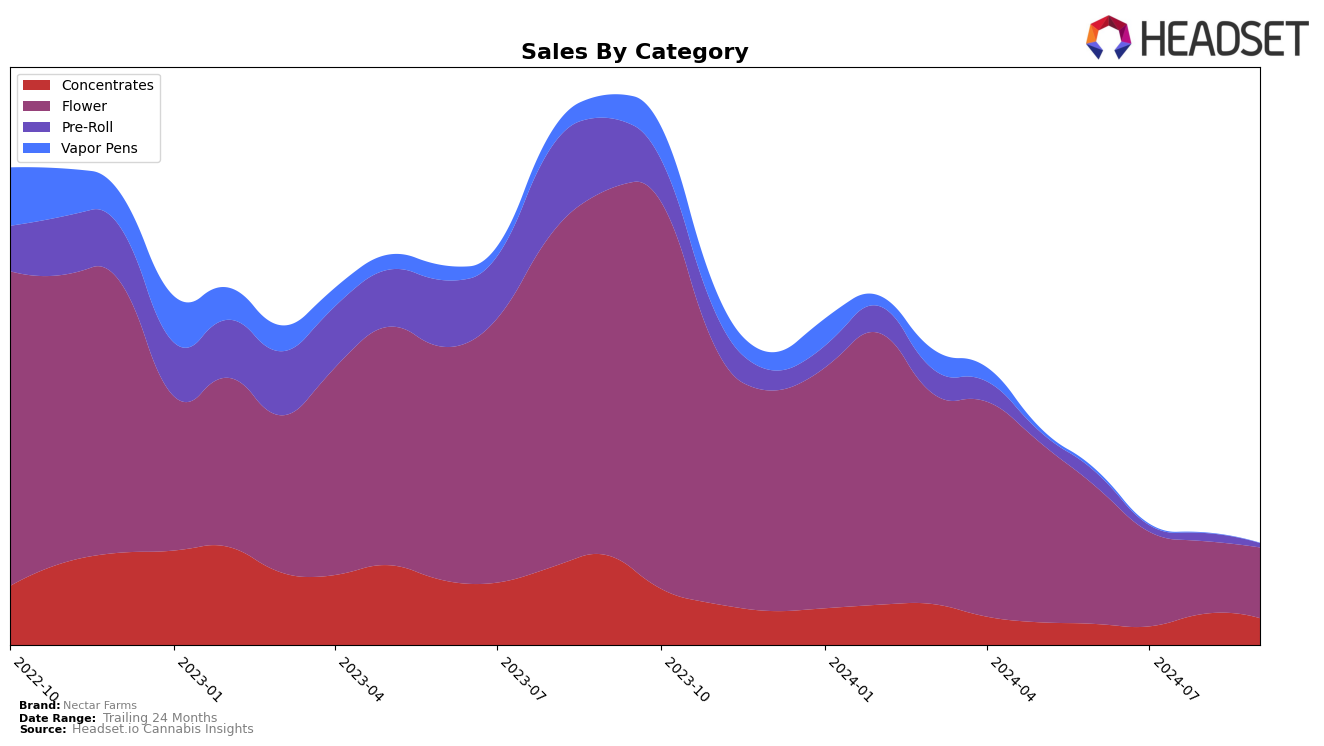

In the state of Arizona, Nectar Farms demonstrated notable movement in the Concentrates category. The brand improved its ranking from 30th in June 2024 to 26th by September 2024, indicating a positive trend despite a dip to 36th in July. This upward trajectory was mirrored in sales, which saw a significant increase from $28,289 in July to $40,260 by September. In contrast, the Flower category showed a decline in performance, with Nectar Farms ranking 37th in September, a drop from 34th in June. This decline was accompanied by a steady decrease in sales from June to September. The Pre-Roll category did not see Nectar Farms breaking into the top 30 by September, which might suggest challenges in this segment.

Focusing on the Pre-Roll category in Arizona, Nectar Farms faced hurdles, as indicated by its absence from the top 30 brands in September 2024. This could be a point of concern given the competitive nature of the market. Despite this, there was a slight improvement in ranking between July and August, moving from 66th to 63rd, which might suggest potential for growth if strategic adjustments are made. The absence from the top 30 in September highlights the intense competition and perhaps a need for Nectar Farms to reassess its market strategy in this category. The overall performance across categories suggests that while there are areas of growth, particularly in Concentrates, there are also significant challenges that need addressing, especially in the Pre-Roll segment.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Nectar Farms has experienced fluctuating rankings over the past few months, indicating a challenging market environment. From June to September 2024, Nectar Farms' rank shifted from 34th to 37th, showing a slight decline in market position. This trend is contrasted by brands like TRYKE, which improved its rank significantly from 63rd to 41st, and House Exotics, which saw a notable jump in August before falling back in September. Meanwhile, Old Pal and Grow Sciences experienced a decline in sales, with Old Pal dropping from 26th to 33rd and Grow Sciences from 29th to 34th, both reflecting a downward trend. Nectar Farms' sales have also decreased over this period, which may be attributed to increased competition and shifting consumer preferences. These dynamics suggest that Nectar Farms needs to strategize effectively to regain its competitive edge and improve its market position.

Notable Products

In September 2024, the top-performing product for Nectar Farms was the THC RSO Full Spectrum Syringe (1g) in the Concentrates category, maintaining its number one rank for four consecutive months with a notable sales figure of 1237 units. The Indica Blend RSO Full Spectrum Syringe (1g), also in Concentrates, held steady at the second position from August to September. Cap Junkie (3.5g) emerged in the Flower category, ranking third in September, marking its first appearance in the top ranks. Oishii Oni (3.5g) re-entered the rankings at third place in September after previously holding fourth position in June. The Handyman (3.5g) maintained its fourth-place ranking from August to September, showing consistent performance in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.