Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

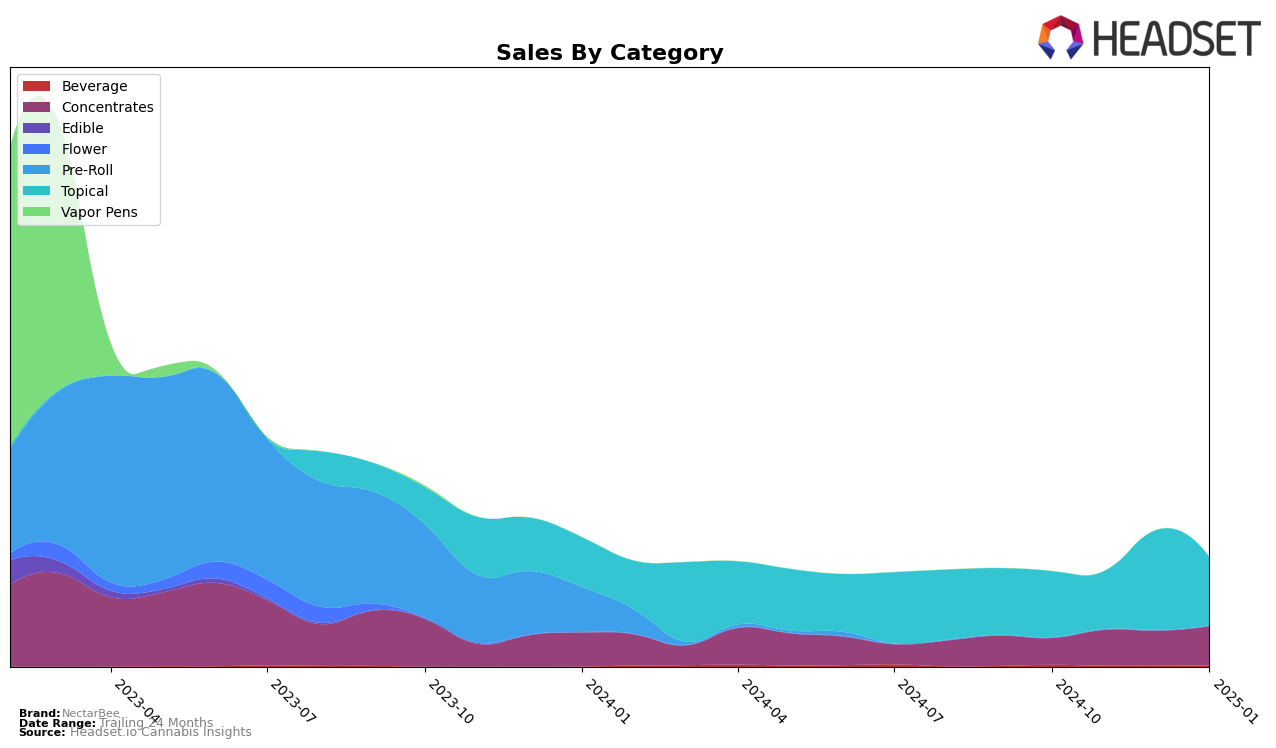

NectarBee's performance in the Colorado market reveals some intriguing dynamics across different product categories. In the Concentrates category, NectarBee was not ranked in the top 30 brands in October and December 2024, indicating a weaker presence during those months. However, the brand showed improvement in January 2025, climbing to the 54th position, which suggests a positive trend in their market penetration or sales strategy. This movement could be indicative of seasonal demand or effective marketing campaigns during that period. The absence from the top 30 in multiple months highlights potential challenges in maintaining consistent performance in this competitive category.

In contrast, NectarBee's performance in the Topical category in Colorado was more stable, consistently ranking within the top 10 brands from October 2024 to January 2025. The brand maintained a strong foothold, ranking 7th in both October and December 2024, slipping slightly to 9th in November, and then to 8th in January 2025. Despite the minor fluctuations, the steady presence in the top 10 suggests a solid consumer base and possibly a well-received product line in the Topical segment. This consistent ranking, coupled with the sales figures, indicates a reliable demand, although there is room for growth to reclaim or surpass the 7th position consistently.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Colorado, NectarBee has experienced notable fluctuations in its ranking and sales performance from October 2024 to January 2025. NectarBee's rank saw a dip from 7th to 9th place in November 2024, before recovering to 7th in December and settling at 8th in January 2025. This volatility contrasts with the consistent performance of My Brother's Flower, which maintained a steady 6th place throughout the same period, indicating a stronger market presence. Meanwhile, Highly Edible showed an upward trend, improving from 8th to 7th place by January 2025, suggesting increasing consumer preference. ioVia also demonstrated a competitive edge, ranking 8th in both November and December 2024, though it did not appear in the top 20 in January 2025. The fluctuating sales figures for NectarBee, with a peak in December 2024, suggest a need for strategic adjustments to sustain growth and improve market positioning amidst strong competition.

Notable Products

In January 2025, NectarBee's top-performing product was Pure Caviar (1g) from the Concentrates category, maintaining its leading position from November 2024 with impressive sales of 657 units. The CBD/THC 1:5 Heal Line Nerve Salve (50mg CBD, 250mg THC, 1.78oz) ranked second, experiencing a slight drop from its December 2024 top rank, yet still achieving notable sales figures. The CBD/THC 1:1 Heal Line Muscle Balm (100mg CBD, 100mg THC) held the third position, consistent with its November ranking, despite a decrease in sales. Ginger Ale (10mg, 355ml) remained steady in fourth place, showing minimal fluctuation in its ranking over the previous months. This analysis highlights Pure Caviar's consistent dominance in the market and the competitive dynamics among NectarBee's topicals.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.