Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

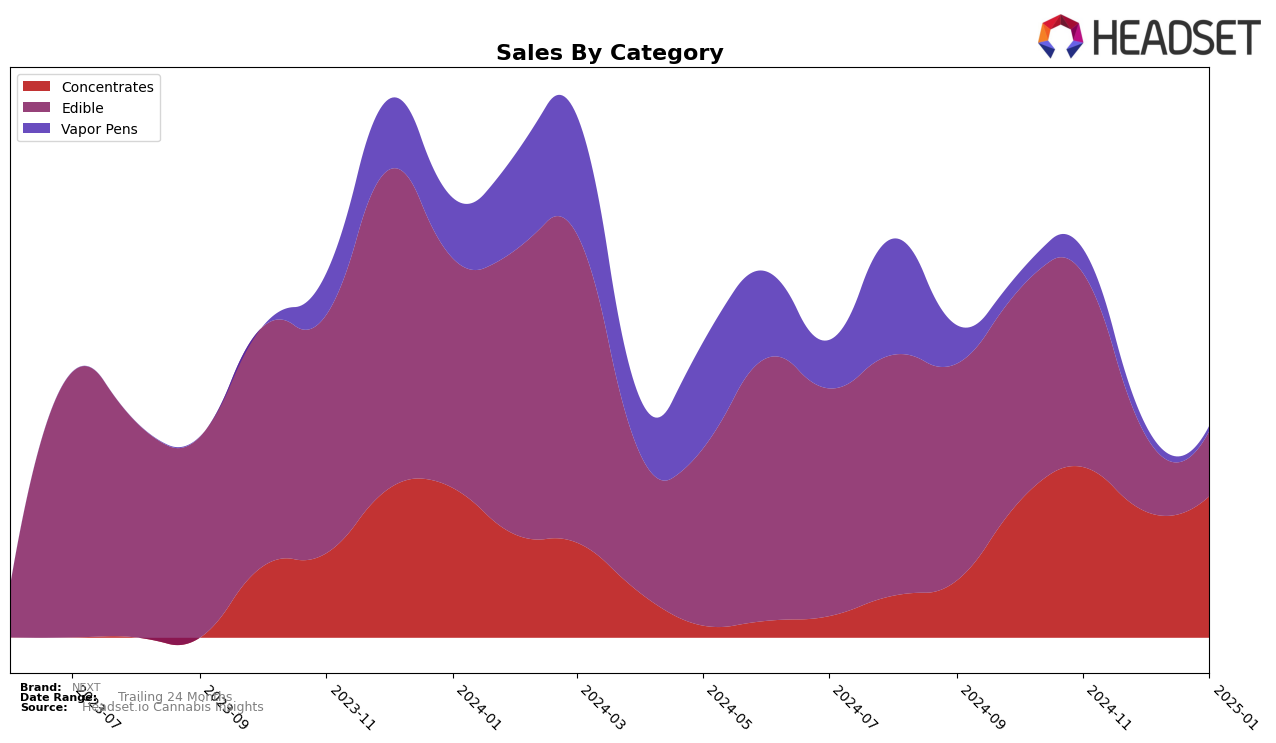

In the rapidly evolving cannabis market, NEXT has shown varied performance across different categories and states. In the Concentrates category in New York, NEXT made a notable entrance into the top 30 brands in November 2024, securing the 26th position. This indicates a positive trajectory for the brand in this category, as it wasn't ranked in October 2024, suggesting a significant improvement in market presence. However, in the Edibles category in New York, NEXT has not yet broken into the top 30, with rankings of 51st in October and slipping to 59th in November. This drop could indicate challenges in gaining traction or increased competition in the edibles segment.

Sales figures also reflect these trends, with November 2024 showing a substantial sales figure for Concentrates, suggesting that the brand's efforts are resonating with consumers. The absence of rankings in December 2024 and January 2025 for both categories in New York might indicate a dip in performance or intensified market competition. This fluctuation highlights the importance of sustained marketing and product innovation to maintain and improve brand positioning. Observing these movements can provide insights into strategic adjustments that NEXT might need to make to enhance its market share and stability across different product categories.

Competitive Landscape

In the competitive landscape of the New York concentrates market, NEXT has been facing challenges in maintaining a top 20 rank. While NEXT was not ranked in October 2024, it reappeared in November 2024 at 26th place, indicating a struggle to gain traction against competitors. Notably, Hashtag Honey showed a significant upward trend, moving from 25th in November to 17th in December, before settling at 22nd in January 2025. This suggests a competitive edge over NEXT, potentially drawing customers away. Meanwhile, Luci experienced a decline, dropping out of the top 20 by January 2025, which could present an opportunity for NEXT to capture some of Luci's market share if they can leverage strategic marketing efforts. Overall, the fluctuating ranks and sales figures highlight the dynamic nature of the market, emphasizing the need for NEXT to innovate and adapt to regain a stronger position.

Notable Products

In January 2025, the top-performing product from NEXT is Jelly Rancher Live Resin (1g) in the Concentrates category, maintaining its first-place ranking from December 2024 with sales of 135 units. Grape Nectar Bites Gummies 10-Pack (100mg) from the Edible category climbed to the second position, a notable improvement from its fourth position in December. Mango Nectar Bites Gummies 10-Pack (100mg) consistently held the second rank for the past three months, indicating stable sales performance. Blue Razz Nectar Gummies 10-Pack (100mg) experienced a slight decline, moving from third to fourth place. Meanwhile, Platinum GMO Live Resin Badder (1g) saw an improvement, rising to fourth place from fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.