Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

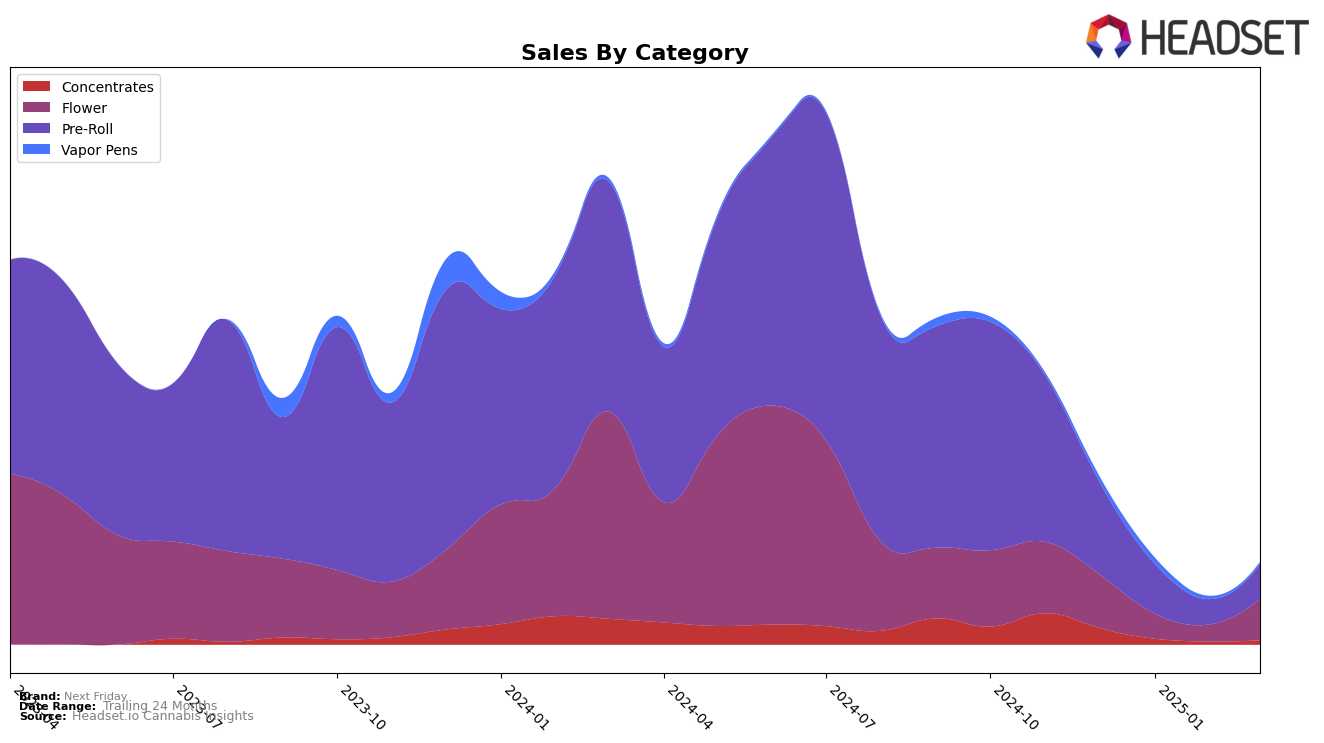

In the province of Alberta, Next Friday's performance across the cannabis categories has shown some notable fluctuations. For instance, in the Pre-Roll category, the brand's rank has seen a decline from 50th in December 2024 to 86th by March 2025, with sales dropping from 135,701 to 45,694 units. However, the Flower category presents a different narrative, where the brand improved its rank from 78th to 74th over the same period, indicating a positive reception among consumers. Interestingly, Next Friday did not make it into the top 30 in the Concentrates category, suggesting potential challenges or competition in this segment within Alberta.

Meanwhile, in Saskatchewan, Next Friday's presence in the Concentrates category was stronger, achieving a rank of 20th as of December 2024. The Flower category also saw some dynamic changes, with the brand moving from 46th to 45th from December 2024 to March 2025, reflecting a slight improvement in market position. However, it's worth noting that Next Friday did not maintain a top 30 ranking in the Pre-Roll category, suggesting either a strategic shift or increased competition in this space. The absence of rankings in some months indicates potential volatility or strategic realignment by the brand in these provinces.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Next Friday has shown a notable fluctuation in its market presence. After being ranked 78th in December 2024, Next Friday was absent from the top 20 rankings in January and February 2025, indicating a potential dip in visibility or sales performance during those months. However, the brand made a comeback in March 2025, securing the 74th position. This rebound suggests a positive shift in strategy or consumer preference. In contrast, competitors like Highly Dutch experienced a significant drop from 34th in February to 71st in March, while Jonny Chronic and Pistol and Paris also saw declining ranks, indicating potential opportunities for Next Friday to capitalize on shifting market dynamics. Additionally, Truro Cannabis Co. re-entered the rankings in January at 67th but dropped to 77th by March, further highlighting the volatile nature of this market segment.

Notable Products

In March 2025, the top-performing product from Next Friday was the Burner Phone Special Pre-Roll (0.5g) in the Pre-Roll category, maintaining its position as the top seller for four consecutive months with sales of 1615 units. The Next Friday Pre-Roll (0.5g) held steady at the second spot, showing a consistent improvement from its fifth-place ranking in December 2024. The Chameleon Connoisseurs Pre-Roll 5-Pack (2.5g) ranked third, moving up from fifth place in January 2025. A notable entry in March 2025 is the Mixtape Milled Flower (7g), debuting at fourth rank. The Mutant Tire Fire Pre-Roll (0.5g) re-entered the rankings at fifth place after being absent in January and February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.