Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

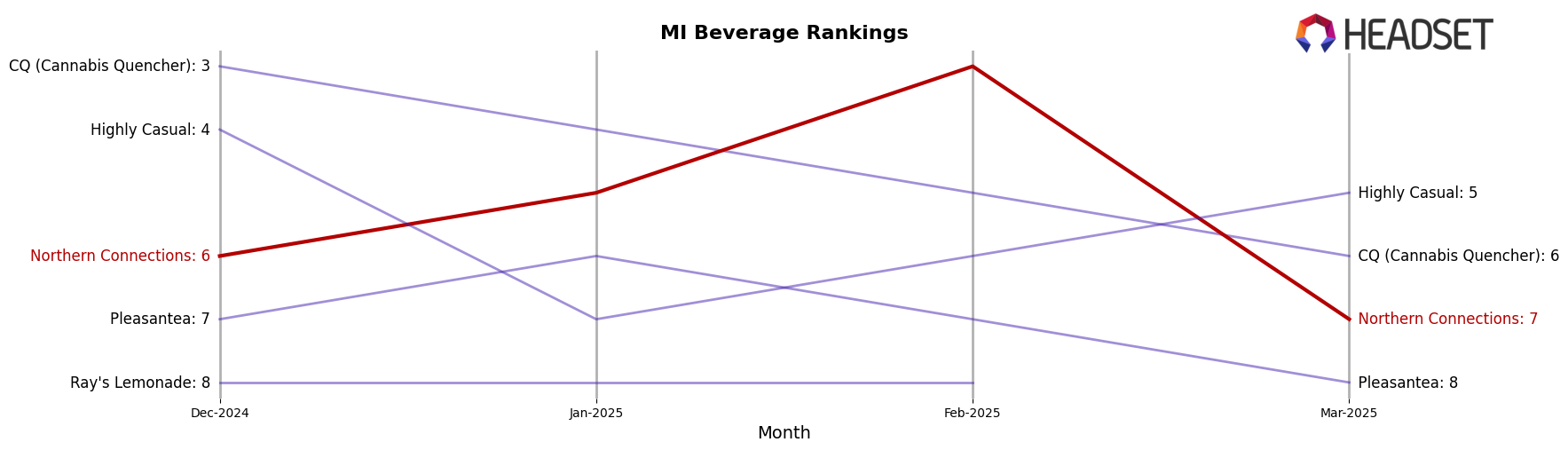

In the state of Michigan, Northern Connections has shown notable fluctuations in the Beverage category. Starting in December 2024, the brand held the 6th position, improving to 5th in January 2025, and then climbing to an impressive 3rd in February. However, by March, they slipped back to the 7th position. This movement indicates a competitive landscape where Northern Connections is actively maintaining a strong presence. The sales trend reveals that while there was a peak in February, March saw a decline, suggesting potential challenges or increased competition. In the Edible category, Northern Connections was not ranked in the top 30 for December and January, but they made an entry at 92nd in February, which could signal a strategic expansion or new product introduction.

In the Topical category, Northern Connections has had a mixed performance. They began December 2024 ranked 9th, but there is no data for January, indicating they did not make it to the top 30 during that month. By February, they rebounded to 6th place, although March data is missing, which could mean they fell out of the top 30 again. This inconsistent ranking underscores the volatility in the Topical market and the challenges Northern Connections faces in maintaining a steady position. The absence of rankings in certain months for both Edibles and Topicals suggests areas where the brand could focus on strengthening its market presence or reassessing its strategy to ensure more consistent performance.

Competitive Landscape

In the competitive landscape of the Michigan cannabis beverage market, Northern Connections has experienced notable fluctuations in its rank and sales performance over the past few months. Starting from December 2024, Northern Connections was ranked 6th, but it climbed to 3rd place by February 2025, showcasing a positive trend in consumer preference and market penetration. However, by March 2025, it dropped to 7th place, indicating a potential challenge in maintaining its upward momentum. This fluctuation is particularly significant when compared to competitors like CQ (Cannabis Quencher), which consistently held a top position, albeit with a gradual decline from 3rd to 6th place over the same period. Meanwhile, Highly Casual showed resilience by improving its rank from 7th in January to 5th in March. The competitive dynamics suggest that while Northern Connections has the potential to capture significant market share, it faces stiff competition from established brands like Pleasantea and Ray's Lemonade, which have maintained relatively stable positions. For Northern Connections, the challenge lies in sustaining its growth trajectory amidst these market shifts.

Notable Products

In March 2025, the top-performing product from Northern Connections was Blue Razz Liquid Loud Syrup (200mg), maintaining its position as the number one ranked product for the third consecutive month, with sales reaching 823 units. Soaring Strawberry Liquid Loud Syrup (200mg) held steady at the second position, although its sales saw a decline compared to February. Cherry Limeade Liquid Loud Syrup (200mg) climbed to the third position, showing an improvement from its fifth-place ranking in February. Grape Liquid Loud Syrup (200mg) entered the rankings for the first time, securing the fourth spot. Black Cherry Liquid Loud Syrup (200mg) also made its debut in March, rounding out the top five products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.