Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

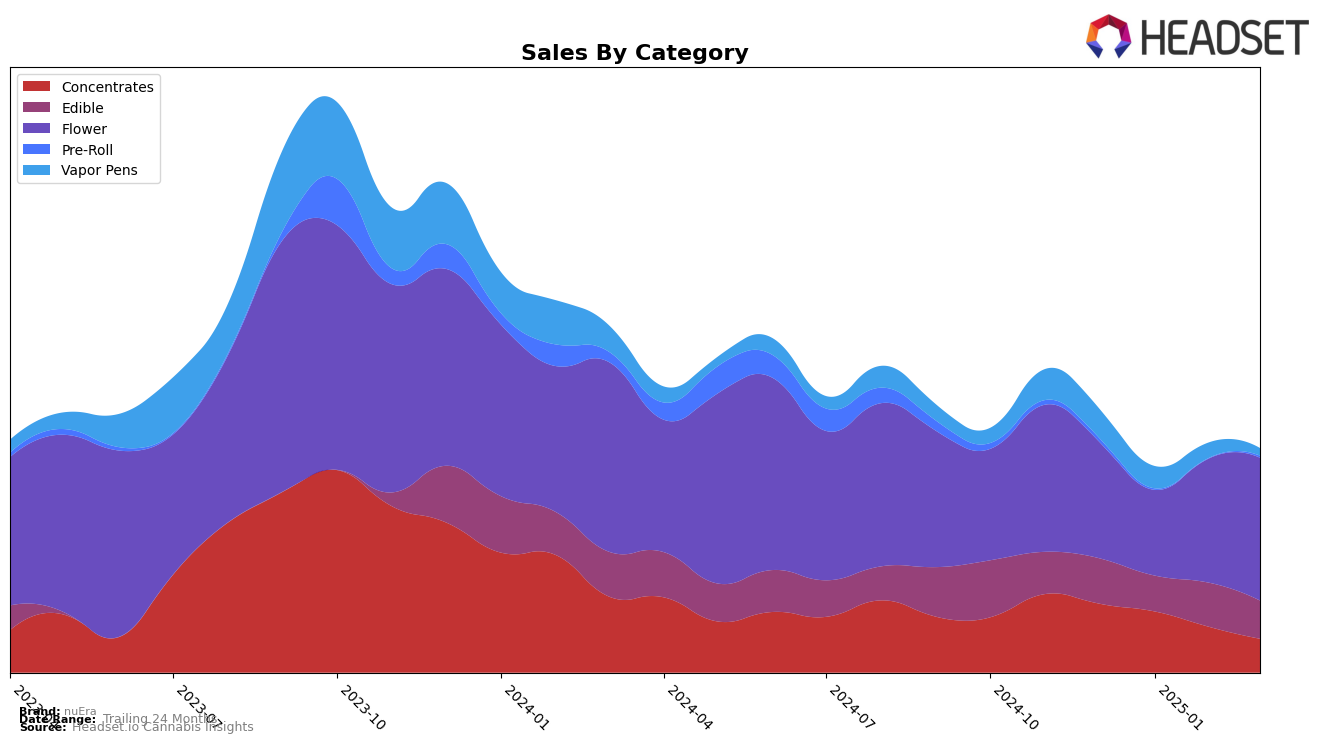

nuEra's performance across different product categories in Illinois reveals a mix of stability and challenges. In the Concentrates category, nuEra maintained a steady presence within the top 20, although its rank slipped from 13th in December 2024 to 19th by March 2025. This decline in ranking corresponds with a noticeable drop in sales, suggesting increased competition or shifting consumer preferences within this category. Meanwhile, the Edible category saw nuEra oscillating around the 30th position, with a brief entry into the top 30 in February 2025, only to fall back to 35th by March. This fluctuation indicates a struggle to consistently capture consumer interest in edibles, highlighting an area for potential strategic focus.

The Flower category presented a more promising trend for nuEra, as it climbed from 42nd in January 2025 to 36th by March, reflecting a positive trajectory and growing consumer demand for their flower products. This upward movement is particularly notable given the overall increase in sales within this category. Conversely, the Vapor Pens category showed a concerning decline, with nuEra not ranking within the top 50 by March 2025. This significant drop suggests a potential need for reevaluation of product offerings or marketing strategies in this segment. The mixed performance across categories in Illinois underscores the importance of targeted strategies to capitalize on strengths while addressing areas of weakness.

Competitive Landscape

In the Illinois flower category, nuEra experienced a notable fluctuation in its competitive standing from December 2024 to March 2025. Starting at rank 35 in December, nuEra saw a slight dip to 42 in January, before recovering to 37 in February and improving further to 36 in March. This recovery trajectory suggests a positive trend in sales momentum, potentially driven by strategic marketing or product adjustments. In contrast, In House saw a decline from rank 20 in December to 34 by March, indicating a significant drop in sales performance. Meanwhile, TwentyTwenty (IL) maintained a relatively stable position, hovering around the low 30s, and Blaze Craft Cannabis Flower (IL) showed consistent performance close to nuEra's rank. The most dramatic improvement was seen by Mini Budz, which climbed from rank 66 in December to 37 by March, suggesting a rapid increase in market presence. These dynamics highlight nuEra's resilience and potential for growth amidst a competitive landscape, emphasizing the importance of continuous market analysis to capitalize on emerging opportunities.

Notable Products

In March 2025, the top-performing product for nuEra was Black Cherry Gelato (3.5g) in the Flower category, securing the first rank with notable sales of 1987 units. Black Inferno (3.5g) followed closely in the second position, maintaining a strong presence since December 2024. Indica Blueberry Live Resin Gummies 10-Pack (100mg) ranked third, showing a slight decline from its previous consistent top-two positions. Sour Diesel (3.5g) emerged in the fourth spot, while Sativa Lemon Live Resin Gummies 10-Pack (100mg) held the fifth position, a slight drop from its earlier rankings. This shift in rankings indicates a dynamic change in consumer preferences for nuEra's products over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.