Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

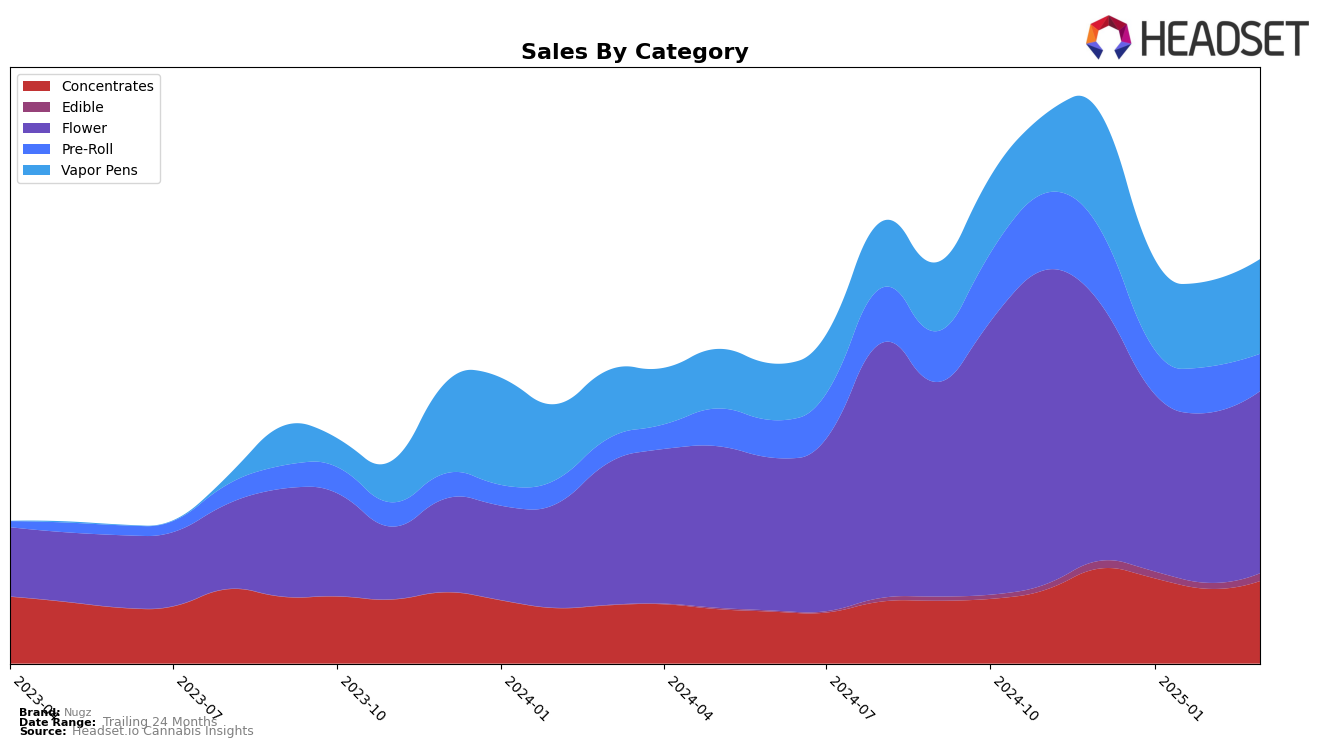

In Alberta, Nugz has demonstrated a strong performance in the Concentrates category, showing a notable climb from 6th place in December 2024 to 3rd place by March 2025. This upward movement is complemented by a significant increase in sales, suggesting a strengthening market presence. On the other hand, their performance in the Pre-Roll category has seen a decline, with a drop from a rank of 28th in January 2025 to 46th by March 2025. This decline might indicate a need for strategic adjustments in their product offerings or marketing efforts in this category. Meanwhile, in the Vapor Pens category, Nugz has maintained a stable position, consistently ranking 15th over the last two months, which might be a positive sign of steady demand for their products in this segment.

In Ontario, Nugz has held a consistent 3rd place in the Concentrates category, indicating a strong foothold in this market. Their Flower category has seen a positive trend, moving from 31st place in December 2024 to 20th by March 2025, reflecting an increasing consumer preference for their products. However, the Pre-Roll category presents a challenge, as Nugz has not ranked within the top 30, with a further decline to 85th place by March 2025. This suggests a potential area for improvement or innovation to capture more market share. In Missouri, while the Flower category has seen a decline from 13th to 25th place over the same period, the sales figures suggest a relatively stable performance, hinting at the possibility of market saturation or increased competition in this category.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Nugz has made notable strides, improving its rank from 31st in December 2024 to 20th by March 2025. This upward trajectory is indicative of a positive trend in sales performance, as Nugz has consistently increased its sales figures over this period. In contrast, 1964 Supply Co and Tweed have experienced fluctuations in their rankings, with both brands hovering around the lower end of the top 20, suggesting a more volatile sales performance. Meanwhile, Tribal has seen a decline, dropping out of the top 20 by March 2025, which could indicate challenges in maintaining market share. Holy Mountain has maintained a relatively stable position, but without significant upward movement. Nugz's consistent improvement in rank and sales highlights its growing presence and competitive edge in the Ontario Flower market.

Notable Products

In March 2025, Nugz's top-performing product was Guava Jam Rosinaut Gummy (10mg) in the Edible category, maintaining its first-place ranking from the previous two months with sales reaching 9,234 units. Kingpin Wrap Sativa Infused Pre-Roll (1g) climbed to second place in the Pre-Roll category, despite a slight decrease in sales to 5,955 units. Lemon Linx Live Resin Disposable (1g) debuted in third place among Vapor Pens, showcasing strong initial sales. Lemon Linx Full Spectrum Live Resin Cartridge (1g) dropped to fourth place within the same category, continuing its downward trend from a second-place position in January and February. Guava Jam (7g) retained its fifth-place ranking in the Flower category, showing a slight increase in sales compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.