Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

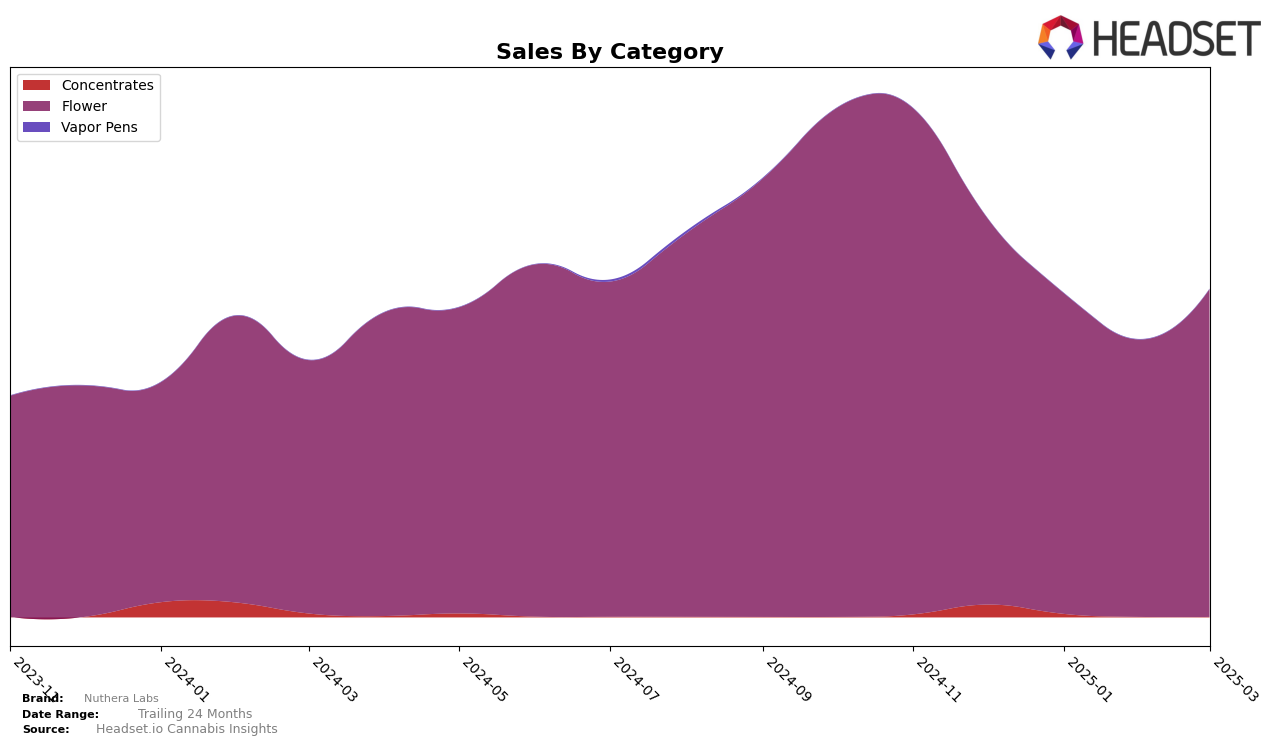

In the state of Missouri, Nuthera Labs has demonstrated a notable presence in the Flower category. Starting at rank 16 in December 2024, the brand experienced a slight drop to rank 18 in January 2025, followed by a further decline to rank 22 in February. However, by March 2025, Nuthera Labs showed resilience by climbing back to rank 20. This fluctuation in rankings could be indicative of competitive market dynamics or strategic shifts within the brand. Interestingly, Nuthera Labs did not make it into the top 30 for the Concentrates category, which might suggest a potential area for growth or a need for strategic reevaluation in that segment.

Despite not being in the top 30 for Concentrates in Missouri, Nuthera Labs' performance in the Flower category reflects a significant level of market penetration, even amidst fluctuating sales figures. The sales trend from December to March shows a dip in January and February but a rebound in March, which could be attributed to seasonal factors or successful promotional efforts. The absence from the Concentrates ranking could be viewed as a challenge or an opportunity for Nuthera Labs to diversify and strengthen its portfolio in Missouri. Understanding the underlying factors driving these movements could provide valuable insights for stakeholders looking to capitalize on market opportunities or mitigate risks.

Competitive Landscape

In the Missouri flower category, Nuthera Labs has experienced fluctuating rankings over the past few months, with a notable dip from 16th place in December 2024 to 22nd in February 2025, before recovering slightly to 20th in March 2025. This volatility in rank is mirrored in their sales, which saw a decline from December to February, followed by a rebound in March. In comparison, Proper Cannabis maintained a stronger position, consistently ranking higher than Nuthera Labs, although they too experienced a downward trend from 14th in December to 18th in March. Meanwhile, TwentyTwenty (IL) and The Standard have shown more stable rankings, with The Standard even surpassing Nuthera Labs in March. The competitive landscape indicates that while Nuthera Labs is facing challenges in maintaining its rank, there is potential for recovery as evidenced by the recent uptick in sales, suggesting a need for strategic adjustments to regain a stronger foothold in the market.

Notable Products

In March 2025, Grape Cream Cake (3.5g) maintained its position as the top-performing product for Nuthera Labs, despite a slight decrease in sales to 2472 units. Buttermilk Biscuits #8 (3.5g) emerged as a strong contender, ranking second, marking its debut in the rankings. New York Mayhem (3.5g) saw a drop to third place from its previous top position in January 2025, with sales figures showing a decrease to 1845 units. Sour GMO Cookies Popcorn (14g) entered the rankings in fourth place, highlighting its growing popularity. Smackin (3.5g) reappeared in the rankings at fifth place, despite not being ranked in January and February, indicating a resurgence in interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.