Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

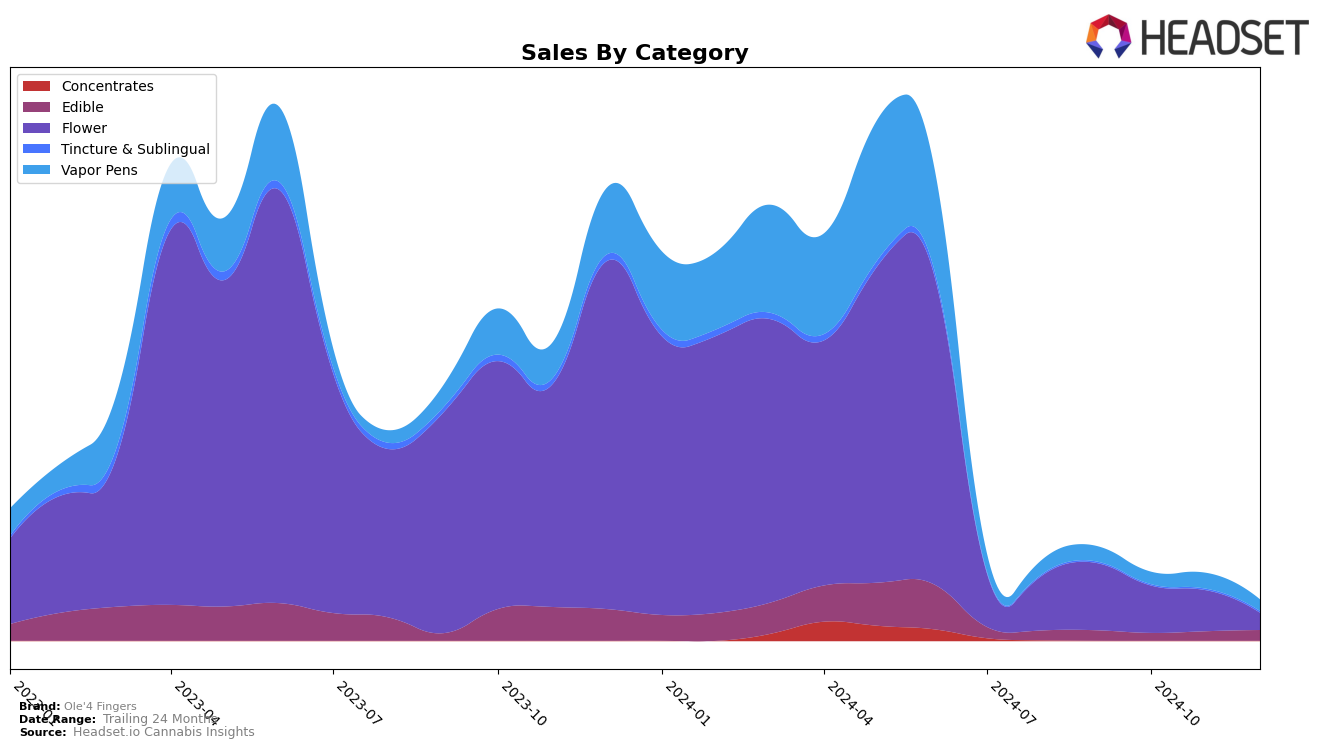

Ole'4 Fingers has demonstrated a notable presence in the California market, particularly within the Edible category. Despite not breaking into the top 30 rankings, the brand has shown a consistent upward trajectory from September to December 2024, improving from the 53rd to the 50th position. This suggests a gradual increase in consumer interest and market penetration. The sales figures reflect this positive trend, with a notable rebound in December, reaching $41,477, indicating a strong finish to the year. This movement could suggest effective marketing strategies or seasonal demand influences, positioning Ole'4 Fingers as a brand to watch in the California Edible category.

In contrast, the Flower category in California presents a more challenging landscape for Ole'4 Fingers. The brand was ranked 92nd in September 2024 and did not appear in the top 30 in subsequent months, highlighting a potential area for growth or re-evaluation. This absence from the top ranks suggests that the brand may need to explore new strategies to boost its visibility and competitiveness within this category. The initial sales figure in September was substantial, indicating a strong start, but the lack of continued ranking suggests that maintaining momentum in this highly competitive category could be a hurdle for Ole'4 Fingers.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Ole'4 Fingers has shown a steady improvement in its ranking over the last few months of 2024, moving from 53rd place in September to 50th in December. This upward trend suggests a positive reception among consumers, despite the brand facing stiff competition. For instance, Garden Society, a prominent competitor, has seen a decline in its ranking from 35th to 44th, indicating potential challenges in maintaining its market position. Meanwhile, Care By Design has improved its rank from 64th to 52nd, showcasing a significant gain in market traction. NFuzed and Lights Out have maintained relatively stable positions, with NFuzed hovering around the mid-40s and Lights Out improving slightly from 56th to 54th. Ole'4 Fingers' ability to climb the ranks amidst these dynamics highlights its growing appeal and potential for increased sales, setting a promising outlook for the brand in the competitive California edible market.

Notable Products

In December 2024, Ole'4 Fingers saw Bubble Bath Smalls (3.5g) maintain its top position in the Flower category, achieving sales of 6,956 units. Blueberry Gummies 10-Pack (100mg) rose to the second rank in the Edible category, marking a significant improvement from its consistent fourth place in the previous months. Strawberry Gummies 10-Pack (100mg) held steady at the third position, showing a strong presence in the Edible category. Banana Jealousy Smalls (3.5g) made a notable entry at the fourth rank in the Flower category, having not been ranked in the preceding months. Diamond Ring Smalls (3.5g) experienced a decline, dropping from second in November to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.