Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

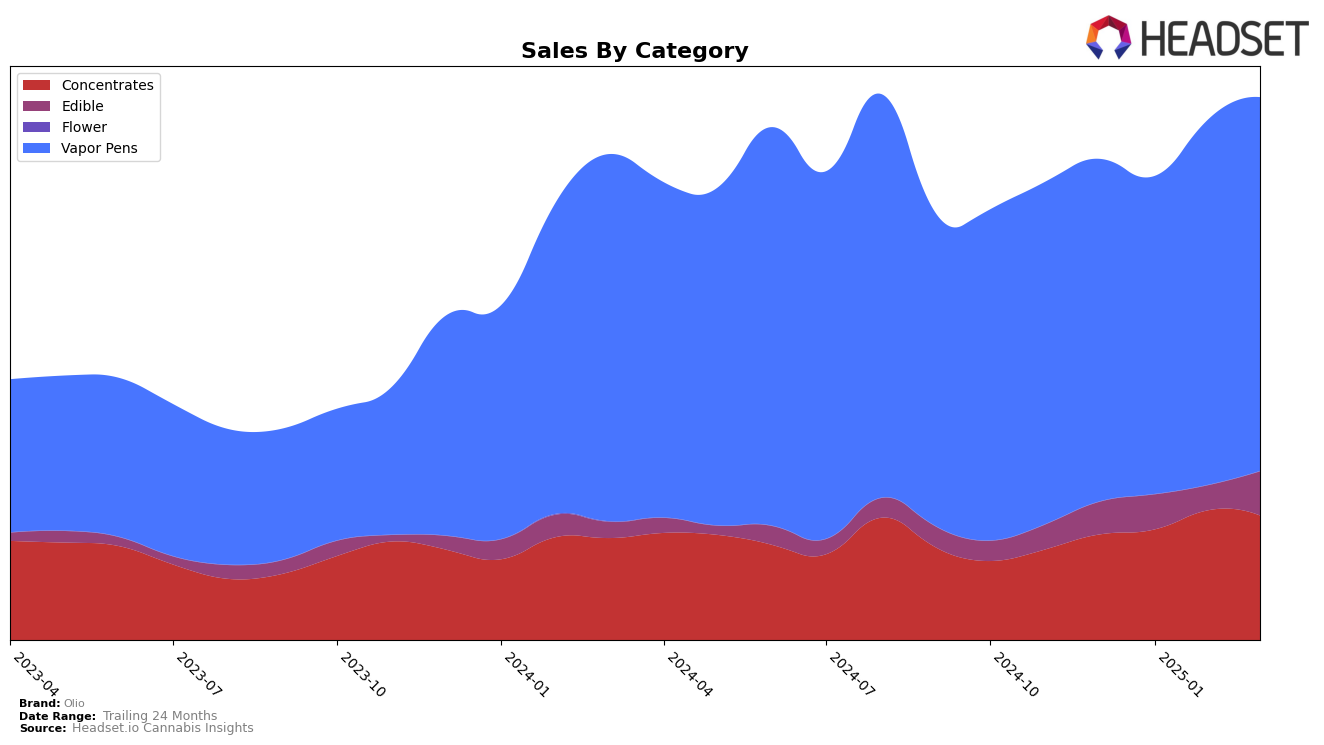

Olio's performance across various categories in Colorado shows some interesting trends. In the Concentrates category, Olio maintained a stable ranking, moving from 17th in December 2024 to 23rd in January and February 2025, before returning to 17th in March 2025. This fluctuation suggests a competitive market environment. In the Vapor Pens category, Olio's ranking saw minor movement, starting at 11th in December and ending at 14th in March, indicating a slight decline. Notably, Olio was consistently ranked within the top 30 in the Edible category, although it experienced a drop to 26th in February before recovering slightly to 24th in March. These movements highlight Olio's resilience and competitiveness in the Colorado market, particularly in Concentrates and Vapor Pens.

In New York, Olio demonstrated a strong presence in the Concentrates category, where it improved its ranking from 11th in December 2024 to 6th in February 2025, before slightly decreasing to 7th in March. This upward trend underscores Olio's growing popularity in the New York market. However, in the Vapor Pens category, Olio only managed to break into the top 30 by March 2025, indicating a more challenging market landscape. Meanwhile, in Michigan, Olio's presence was less pronounced, as it only appeared in the top 100 for Concentrates in January and February, and in the top 100 for Vapor Pens in February, reflecting a need for strategic focus to enhance its market standing in Michigan. Such insights into Olio's performance across states and categories reveal the brand's varying levels of success and areas for potential growth.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Olio experienced a slight decline in rank from December 2024 to March 2025, moving from 11th to 14th position. Despite this, Olio maintained a relatively stable sales performance, with sales figures showing only a minor decrease over the months. This trend suggests that while Olio's market position faced pressure, their sales resilience indicates a loyal customer base. Notably, The Clear improved its rank significantly, moving from 18th to 13th, with a corresponding increase in sales, which could indicate a growing preference among consumers. Meanwhile, Spectra managed to regain its 12th position by March 2025 after a dip in February, showing volatility in its ranking but a strong recovery in sales. Seed and Smith (LBW Consulting) remained consistently close to Olio, suggesting a competitive rivalry, while Natty Rems made a notable jump from outside the top 20 to 16th place by March, indicating a potential emerging competitor. These dynamics highlight the competitive pressure Olio faces in maintaining its market share in the Colorado vapor pen category.

Notable Products

In March 2025, the top-performing product from Olio was the Traditional Rosin Gummies 10-Pack (100mg) in the Edible category, maintaining its consistent first-place rank from previous months with sales of 1830 units. The Sour Raspberry Rosin Gummies 10-Pack (100mg) climbed to the second position, showing a significant increase in sales compared to February. Passion Fruit Rosin Gummies 10-Pack (100mg) held steady in third place, while Fresh Squeeze Live Resin Cartridge (1g) remained fourth since its introduction in February. Pomegranate Limeade Rosin Gummies 10-Pack (100mg) returned to the rankings in fifth place after being unranked in February. These shifts highlight a dynamic market for Olio's edible products, with notable growth in the Sour Raspberry variant.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.