Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

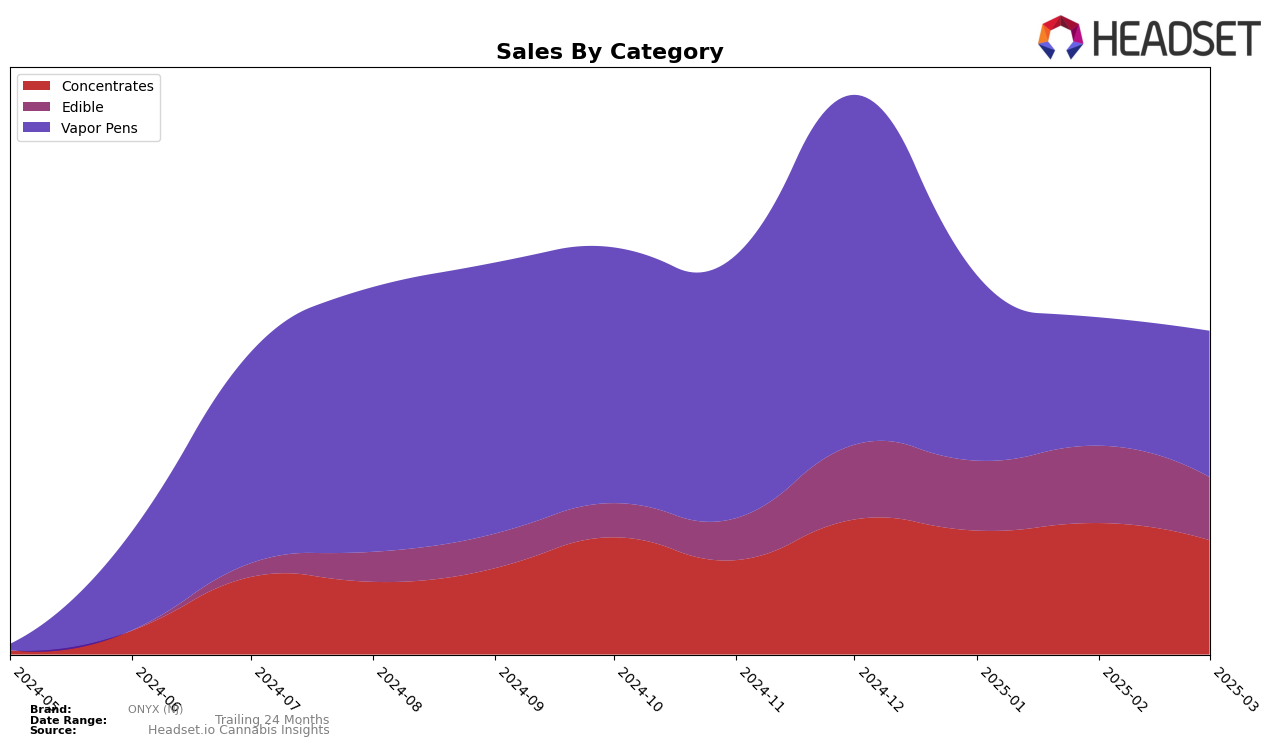

ONYX (NJ) has demonstrated a consistent performance in the New Jersey concentrates category, maintaining a solid presence within the top 10 rankings over the past four months. Although there was a slight dip from 8th to 9th place in March 2025, the brand has shown resilience in this competitive market. This stability indicates a strong consumer base and effective product offerings in the concentrates segment. However, there was a noticeable decline in sales from December 2024 to March 2025, which might be an area for the brand to investigate further to sustain its market position.

In contrast, ONYX (NJ) faced challenges in the vapor pens category, where it slipped from 17th place in December 2024 to 27th place by March 2025. This downward trend highlights potential issues in maintaining product appeal or market share in this rapidly evolving category. Meanwhile, the edible category saw fluctuating rankings, with the brand peaking at 23rd place in January 2025 but dropping back to 26th by March. The volatility in these categories suggests that ONYX (NJ) might need to reassess its strategy to regain momentum and improve its standing in the New Jersey market.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, ONYX (NJ) faces significant challenges as it navigates a fluctuating market. Over the months from December 2024 to March 2025, ONYX (NJ) experienced a decline in rank from 17th to 27th, reflecting a downward trend in sales. This is contrasted by brands like Cookies, which, despite a drop from 12th to 26th, still managed to maintain higher sales figures than ONYX (NJ). Meanwhile, The Botanist showed resilience, consistently ranking in the 21st to 25th range, with sales figures that suggest a more stable market presence compared to ONYX (NJ). New entrant Cheetah appeared in March 2025 at 29th, indicating potential new competition. Additionally, The Growfather demonstrated an upward trajectory, climbing from 41st in January to 28th by March, suggesting a growing market share that could further impact ONYX (NJ)'s positioning. These dynamics highlight the need for ONYX (NJ) to strategize effectively to regain its competitive edge in the New Jersey vapor pen market.

Notable Products

In March 2025, the top-performing product for ONYX (NJ) was London Pound Cake Live Resin Sugar (1g) in the Concentrates category, securing the number one rank. Strawberry Fields Gummies 10-Pack (100mg) rose to the second position in the Edible category, showing a notable increase from its third place in January 2025, with sales reaching 491 units. Tropical Gush Full Spectrum Gummies 10-Pack (100mg) maintained a strong presence, ranking third after a slight drop from second in February. Sour Diesel Live Rosin Cartridge (0.5g) emerged as a new entrant in the top ranks, securing fourth place in the Vapor Pens category. Blueberry Muffin Live Resin Full Spectrum Gummies 10-Pack (100mg) saw a decline to fifth position, despite being the top-ranked product in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.