Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

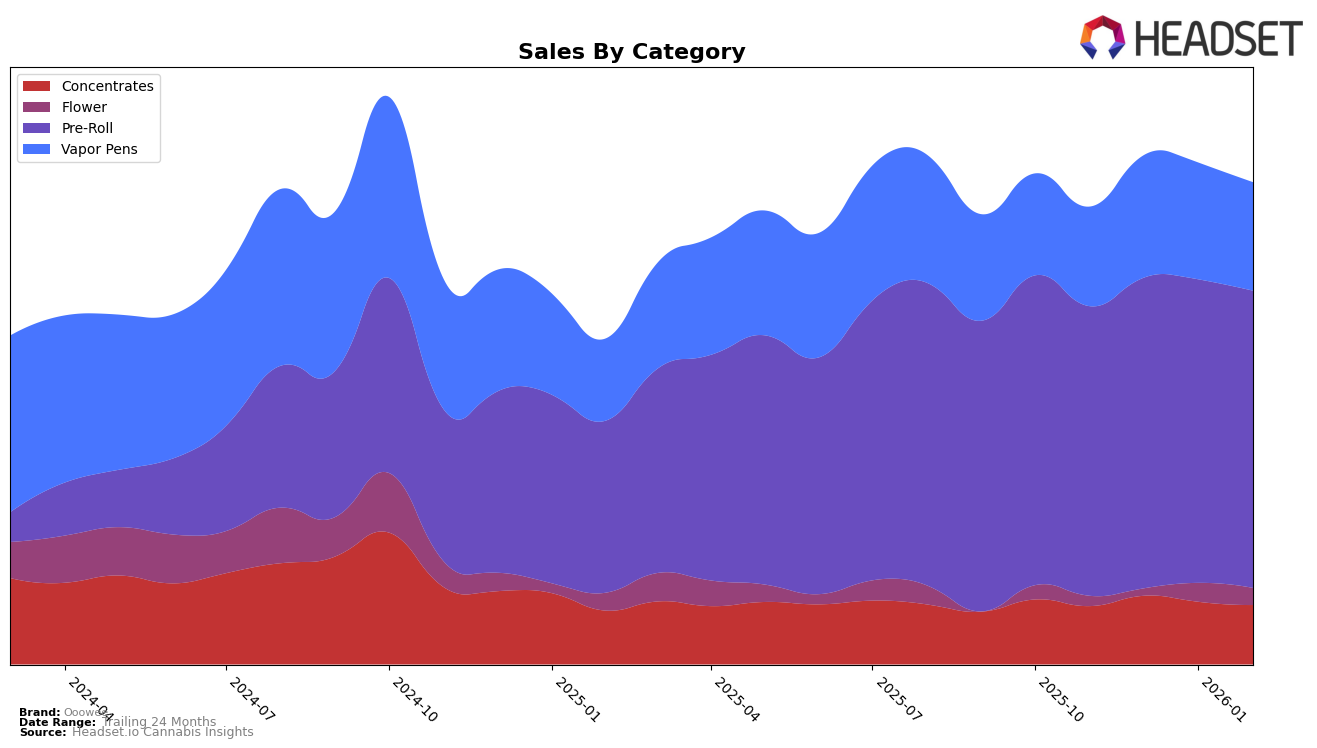

Ooowee has demonstrated a strong performance in the Washington cannabis market, particularly in the Concentrates and Pre-Roll categories, where it has consistently held the top position from November 2025 through February 2026. This suggests a dominant presence and a strong consumer preference for Ooowee products in these segments. In the Vapor Pens category, Ooowee has shown upward momentum, improving its ranking from 12th in November 2025 to consistently holding the 10th position by January and February 2026. This indicates a positive reception of their vapor pen products, potentially reflecting successful marketing strategies or product innovation.

In contrast, the Flower category presents a more dynamic landscape for Ooowee in Washington. While the brand was ranked 27th in November 2025, it has made significant strides, improving its position to 19th by February 2026. This upward trend in the Flower category may indicate an increasing acceptance and popularity of Ooowee's flower products among consumers. However, it's worth noting that outside of these categories, if Ooowee is not mentioned in other state or provincial rankings, it implies that the brand did not make it into the top 30, highlighting potential areas for growth or market entry in those regions.

Competitive Landscape

In the Washington pre-roll market, Ooowee has consistently maintained its top position from November 2025 through February 2026, showcasing its strong market presence and consumer preference. Despite facing competition from brands like Phat Panda and Mama J's, which have held steady ranks at second and third respectively during the same period, Ooowee's sales figures have consistently outperformed these competitors. Notably, while Phat Panda has seen a slight decline in sales from January to February 2026, Ooowee's sales have remained robust, indicating a resilient demand for its products. This consistent performance not only highlights Ooowee's strong brand loyalty but also suggests potential for further growth and dominance in the pre-roll category within the state.

Notable Products

In February 2026, the top-performing product from Ooowee was the FaceLock Pre-Roll 5-Pack (5g), which climbed to the number one rank with sales figures of 5190. The Seattle Strawberry Cough Sugar Wax (1g) saw a significant rise, moving from unranked in January to second place. The Seattle Strawberry Cough Pre-Roll 5-Pack (5g), previously holding the top spot, dropped to third position. Ooowee Marker Pre-Roll 5-Pack (5g) improved its rank from fifth to fourth, while Pink Zaza Pre-Roll 5-Pack (5g) entered the top five for the first time. This shift indicates a dynamic change in consumer preferences within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.