Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

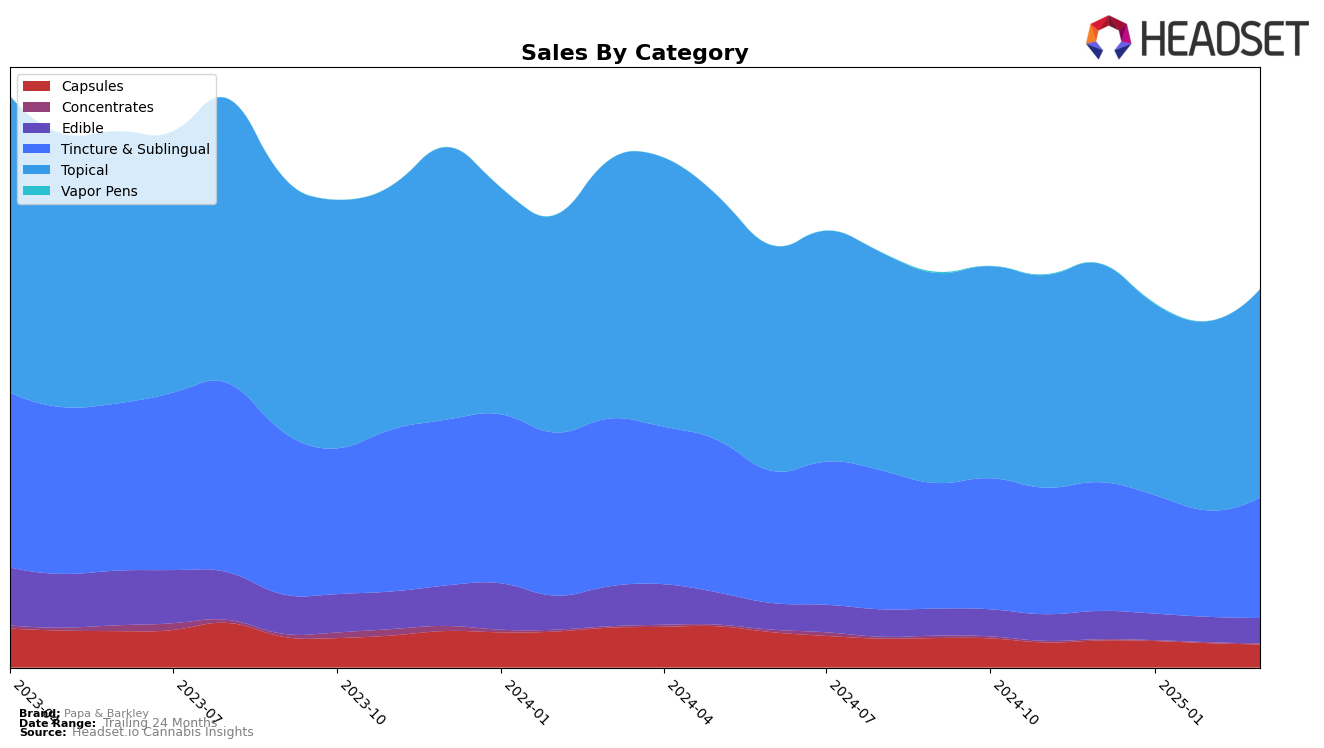

Papa & Barkley has shown a strong presence in the California market, particularly in the Tincture & Sublingual and Topical categories. In the Tincture & Sublingual category, the brand maintained a top-tier position, holding the number one rank in December 2024, January 2025, and March 2025, with a slight dip to second place in February 2025. This consistency indicates a solid consumer base and effective product performance in this category. Similarly, the Topical category saw Papa & Barkley consistently at the top spot throughout the observed months, reinforcing its dominance in this segment. Despite a decrease in sales from December 2024 to March 2025, the brand's leading position in these categories highlights its strong market presence.

However, the performance of Papa & Barkley in the Edible category in California reveals a different trend. The brand did not rank within the top 30, indicating a less competitive stance in this segment. This absence from the top rankings could suggest either a strategic focus on other categories or challenges in gaining traction with edible products. Conversely, in the Capsules category, Papa & Barkley maintained a stable position, ranking 8th by March 2025, despite a gradual decline in sales. This stability in the Capsules category, combined with their leading positions in Tincture & Sublingual and Topical categories, underscores the brand's strength in certain product lines while highlighting areas for potential growth and improvement.

Competitive Landscape

In the competitive landscape of the California Topical cannabis market, Papa & Barkley has consistently maintained its position as the leading brand from December 2024 through March 2025. Despite a slight dip in sales from December to February, Papa & Barkley rebounded in March, showcasing resilience and strong brand loyalty. In contrast, Mary's Medicinals, which holds the second position, experienced a more noticeable decline in sales over the same period, albeit maintaining its rank. This indicates that while Papa & Barkley faces competition, its market dominance remains unchallenged, with sales figures significantly outpacing those of its competitors. Meanwhile, Buddies consistently ranks third, with sales figures that are substantially lower, highlighting the gap between the top two brands and the rest of the market. This data suggests that Papa & Barkley's strategic positioning and product offerings continue to resonate well with consumers, ensuring its leadership in the California Topical category.

Notable Products

In March 2025, Papa & Barkley's top-performing product was the CBD/THC 1:3 THC Rich Releaf Balm (100mg CBD, 300mg THC, 50ml), maintaining its consistent number one ranking from previous months with sales of 4477. The CBD/THC 3:1 CBD Rich Releaf Balm (135mg CBD, 33mg THC, 15ml) climbed to the second position, up from its third-place standing in the previous months. The CBD/THC 3:1 Rich Releaf Balm (450mg CBD, 150mg THC, 50ml) also improved its ranking, moving up to third place. Newly introduced in the rankings, the Sleep Releaf- CBD/CBN/THC 1:1:1 Berry Pomegranate Gummies 20-Pack entered at fourth place. The CBD/THC 1:3 THC Rich Releaf Body Oil (100mg CBD, 300mg THC, 60ml) returned to the rankings at fifth place after being absent in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.