Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

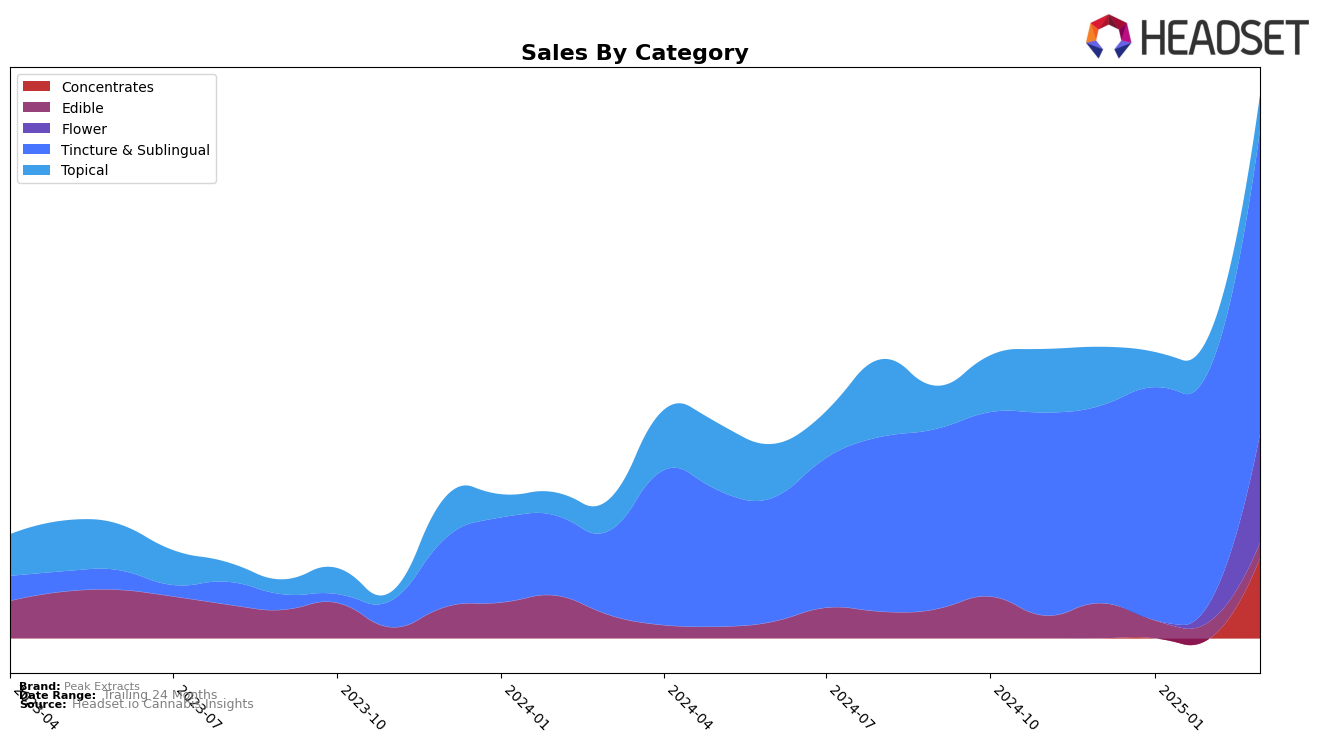

Peak Extracts has demonstrated notable performance in the Oregon market, particularly within the Tincture & Sublingual category. Maintaining a consistent top-five position from December 2024 through March 2025, the brand has shown a steady increase in sales, culminating in a notable rise in March. This stability and growth in Oregon indicate a strong foothold in the state, which could be attributed to consumer loyalty or effective product offerings. Conversely, in the Topical category within Oregon, Peak Extracts was ranked seventh in December 2024 but did not appear in the top 30 in subsequent months, suggesting a potential area for improvement or increased competition in this segment.

In Missouri, Peak Extracts' presence in the Flower category did not make it to the top 30 brands from December 2024 through March 2025. This absence could be interpreted as a challenge in gaining market traction or a highly competitive landscape in Missouri's Flower category. The brand's sales in December 2024 were recorded at $18,635, which may not have been sufficient to break into the top rankings. This contrast in performance between states highlights the varying dynamics and consumer preferences that Peak Extracts must navigate across different markets. Understanding these nuances could be crucial for the brand's strategic planning and future growth initiatives.

Competitive Landscape

In the Oregon Tincture & Sublingual category, Peak Extracts has shown a consistent performance, maintaining a stable rank of 5th place in December 2024, February 2025, and March 2025, with a slight dip to 6th place in January 2025. This stability is noteworthy given the competitive landscape, where brands like High Desert Pure and Siskiyou Sungrown have also shown resilience. Notably, Hapy Kitchen consistently ranks higher at 3rd place, indicating a strong market presence. Despite this, Peak Extracts has experienced a positive trend in sales, particularly in March 2025, where it saw a significant increase, closing the gap with higher-ranked competitors. This suggests that while Peak Extracts may not have the top rank, its sales trajectory indicates a growing consumer base and potential for upward mobility in the rankings.

Notable Products

For March 2025, Modified Grapes Tincture (1000mg THC, 2oz) retained its position as the top-selling product for Peak Extracts, with sales reaching $373. Mini Dark Chocolate Bar (100mg) climbed to the second spot, showing a significant increase from its fifth-place ranking in February. The CBG/CBD/THC 3:2:1 White CBG Tincture slipped to third place from second in February, indicating a slight decline in consumer preference. CBDTHC 1:1 AC/DC Purple Trainwreck Tincture maintained its fourth position from February, showing consistent performance. CBN/CBD/THC 4:2:1 TRUCBN Tincture held onto the fifth spot, showcasing a steady sales trend over the past two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.