Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

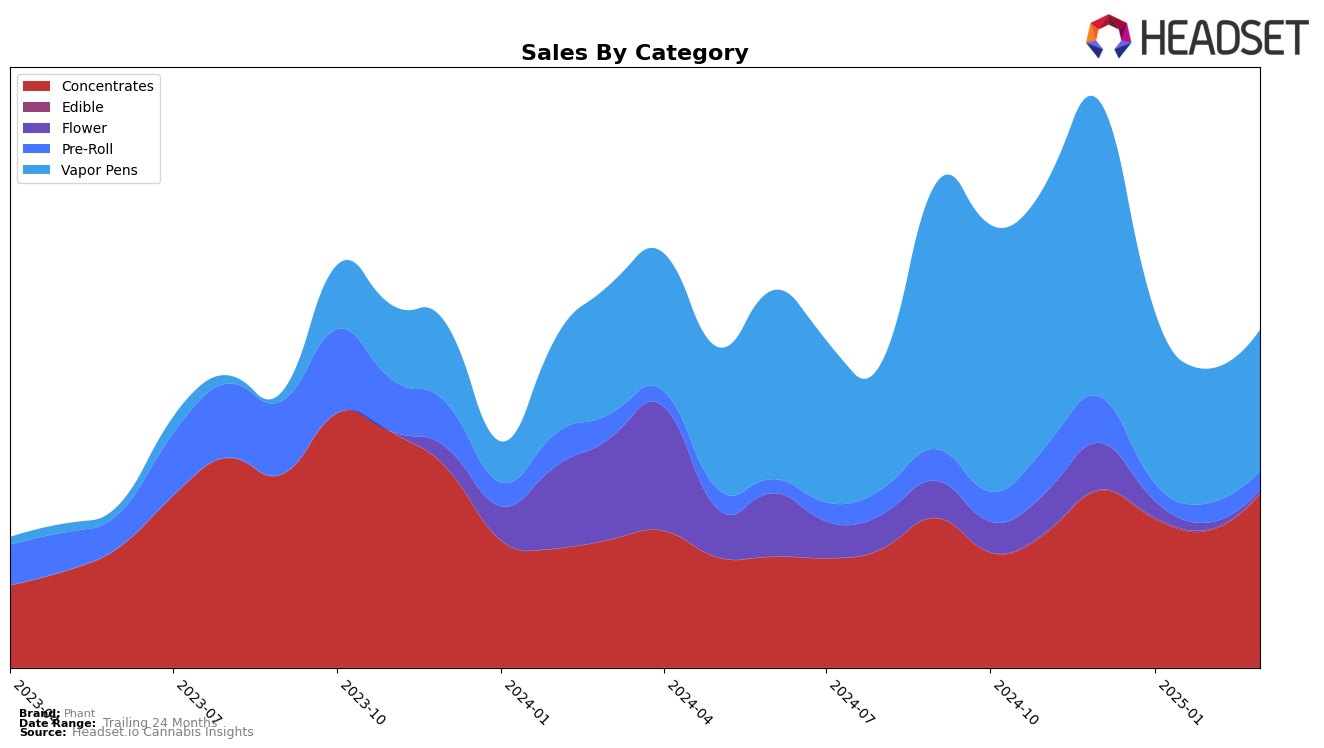

Phant has shown notable performance fluctuations across different categories and provinces. In Alberta, their ranking in the Concentrates category improved significantly from being outside the top 30 in January 2025 to reaching the 19th position by March 2025. This upward trend indicates a strong gain in market presence, likely driven by a significant increase in sales during this period. Conversely, in the Vapor Pens category, Phant's performance in Alberta showed a more modest improvement, moving from 56th to 35th place from January to March 2025. This suggests a steady growth trajectory, albeit at a slower pace compared to their Concentrates category performance.

In British Columbia, Phant's position in the Concentrates category saw a slight downward trend, dropping from 6th in December 2024 to 10th by March 2025. Despite this decline in ranking, the brand maintained a strong presence within the top 10, indicating a resilient market foothold. Meanwhile, in the Vapor Pens category in British Columbia, Phant experienced a more pronounced decline, falling from 29th to 44th place over the same period. This suggests potential challenges in maintaining competitive sales in this category. In Saskatchewan, Phant's ranking in the Concentrates category remained relatively stable, indicating a consistent performance, although the absence from the top 30 in February 2025 could be a point of concern for sustaining momentum.

Competitive Landscape

In the competitive landscape of the concentrates category in British Columbia, Phant has experienced a notable decline in its ranking, moving from 6th place in December 2024 to 10th place by March 2025. This downward trend in rank is accompanied by a decrease in sales over the same period, suggesting potential challenges in maintaining market share. In contrast, Nugz has shown a strong upward trajectory, climbing from 13th to 8th place, with sales consistently increasing each month. Meanwhile, RAD (Really Awesome Dope) made a significant leap from being unranked in January to 9th place by March, indicating a rapid gain in consumer interest and market penetration. Brands like Uncle Bob and Adults Only have maintained more stable positions, with slight fluctuations in rank and sales. For Phant, these dynamics highlight the need for strategic adjustments to regain competitive positioning and counter the rising momentum of its competitors.

Notable Products

In March 2025, the top-performing product from Phant was the Orange Cream THCA Diamonds (1g) in the Concentrates category, maintaining its number one rank for the third consecutive month with a notable sales figure of 3422. The Orange Cream Liquid Live Diamond Disposable (1g) in the Vapor Pens category held steady at the second position, despite a decrease in sales compared to previous months. The Orange Cream Liquid Live Diamond Cartridge (1g) improved to third place after a dip in February, showing a recovery in sales figures. The Orange Cream Diamond Infused Pre-Roll (1g) ranked fourth, experiencing a slight decline in sales. A new entry, Tropical Breeze Diamonds (1g) in the Concentrates category, debuted at the fifth position, indicating a promising start.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.