Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

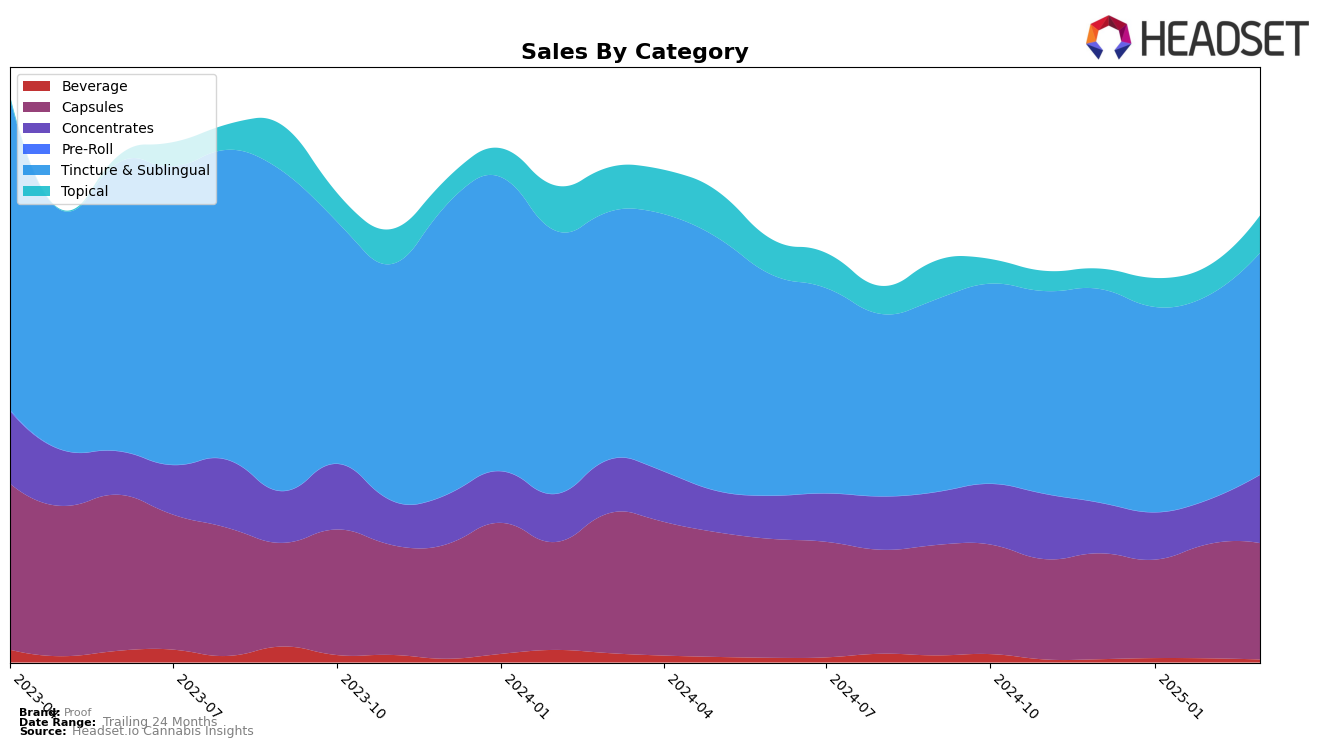

Proof has demonstrated notable performance in the California market, particularly in the Capsules category. Over the past few months, Proof's ranking has improved from 11th in December 2024 to 9th by March 2025. This upward movement indicates a strengthening position within this category, supported by a steady increase in sales. In contrast, the Tincture & Sublingual category saw a slight fluctuation, with Proof maintaining a strong position, albeit with a minor dip in February before bouncing back to 9th place in March. This suggests a resilient hold in this segment despite the competitive landscape.

The Concentrates category in California presents a different story for Proof, with a dramatic rise from 82nd in December 2024 to 60th by March 2025. This significant leap highlights a growing presence, though it remains outside the top 30, indicating room for improvement and potential for further growth. Meanwhile, in the Topical category, Proof has shown consistent progress, moving from 13th to 10th position within the same period. This upward trajectory suggests an increasing consumer preference for Proof's topical products, reflecting positively on their market strategy and product appeal. Overall, Proof's performance across these categories demonstrates both strengths and opportunities for further growth in the California market.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Proof has shown a steady performance, maintaining a rank of 9th in December 2024, January 2025, and March 2025, with a slight improvement to 8th position in February 2025. This consistent ranking places Proof in a competitive spot against brands like ABX / AbsoluteXtracts, which consistently holds the 7th rank, indicating a strong foothold in the market. Meanwhile, Jade Nectar fluctuated between 8th and 9th positions, suggesting a close competition with Proof. Despite a dip in sales in January and February 2025, Proof's sales rebounded in March 2025, indicating potential for growth. In contrast, Super Wow and Moods Spray trailed behind, with Super Wow dropping out of the top 10 in March 2025, highlighting Proof's stronger market presence. This analysis suggests that while Proof is holding its ground, there is room for strategic initiatives to climb higher in the rankings.

Notable Products

In March 2025, the CBD/THC 1:1 Bazillion Tincture Drops (1000mg CBD, 1000mg THC, 15ml) emerged as the top-performing product for Proof, climbing from second place in February to first, with notable sales of 768 units. The Indica Full Spectrum Oil Syringe (1g) maintained a strong position, ranking second, up from fourth place in February, with a significant increase in sales. The CBD/THC 1:1 Balance Tincture (300mg CBD, 300mg THC, 15ml), which had consistently held the top spot from December 2024 through February 2025, dropped to third in March. The CBD Extra Strength Tincture (1000mg CBD, 15ml) re-entered the rankings at fourth place, showcasing a recovery in sales figures. The CBD/THC 20:1 Tincture (300mg CBD, 15mg THC, 15ml) made its debut in the rankings at the fifth position, indicating a growing interest in this product category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.