Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

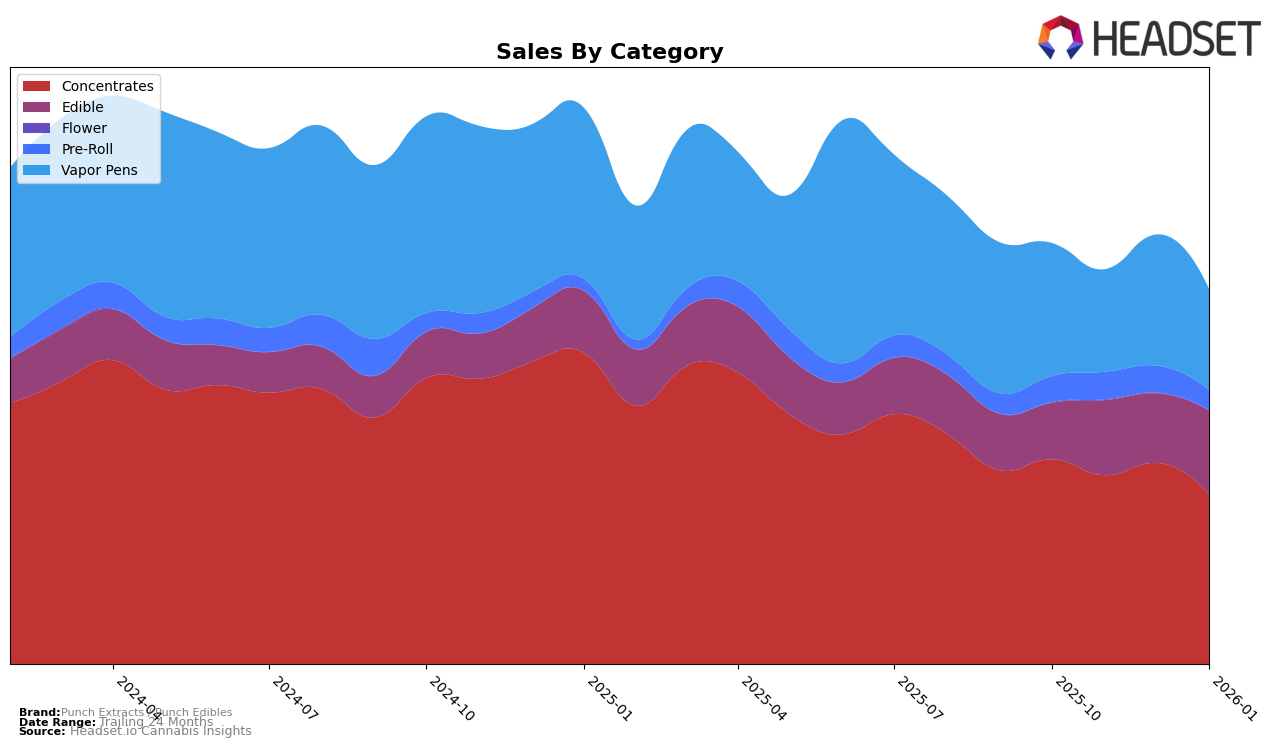

Punch Extracts / Punch Edibles has shown a consistent performance in the California market, particularly in the Concentrates category where it maintained a steady 4th place ranking from October 2025 through January 2026. Despite a decrease in sales from $1,023,747 in October to $844,662 in January, the brand held its ground in the top tier of this category. However, in the Edibles category, the brand experienced a decline, moving from 21st place in October to 27th by January, indicating potential challenges in maintaining its competitive edge. The Vapor Pens category also saw fluctuations, with rankings ranging from 31st to 35th over the same period, suggesting a volatile performance that could be attributed to competitive pressures or shifting consumer preferences.

In New York, Punch Extracts / Punch Edibles had a notable presence in the Edibles category, entering the rankings at 26th place in November 2025 and improving to 20th by January 2026. This upward trend in New York's edible market contrasts with the brand's performance in California, hinting at regional differences in consumer taste or market dynamics. The absence of a ranking in October suggests that the brand was not initially in the top 30, making its subsequent rise noteworthy. This progression in New York could signal a strategic focus or successful marketing efforts that have resonated with local consumers, although more granular data would be needed to draw definitive conclusions about the brand's overall market strategy.

Competitive Landscape

In the competitive landscape of the California concentrates market, Punch Extracts / Punch Edibles consistently held the 4th rank from October 2025 to January 2026. Despite maintaining this position, the brand experienced a noticeable decline in sales over the same period. This trend is particularly significant when compared to competitors like 710 Labs, which maintained a steady 3rd rank with higher sales figures, and STIIIZY, which consistently held the 2nd rank with significantly higher sales. Meanwhile, CannaBiotix (CBX) improved its rank from 6th to 5th, showing a positive sales trend that could pose a future threat to Punch Extracts / Punch Edibles' position. The data suggests that while Punch Extracts / Punch Edibles remains a strong contender in the market, it faces increasing pressure from both established and emerging brands, highlighting the need for strategic initiatives to bolster sales and maintain its competitive edge.

Notable Products

In January 2026, the top-performing product from Punch Extracts / Punch Edibles was the Cookies n Cream Chocolate Bar 10-Pack (100mg), which climbed to the number one rank with notable sales of 4,588 units. The Original Sea Salt Dark Chocolate Bar 10-Pack (100mg) maintained a strong performance, holding the second rank with consistent sales figures. The Raspberry Dark Chocolate Solventless Hash Rosin Bar 10-Pack (100mg) improved its position to third place, showing a recovery after not being ranked in December. The Milk Chocolate Bar 10-Pack (100mg) also saw a rise, moving up to fourth place from not being ranked in December. Lastly, the Dulce Fresca Distillate Cartridge (1g) held onto the fifth spot, indicating steady demand in the vapor pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.