Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

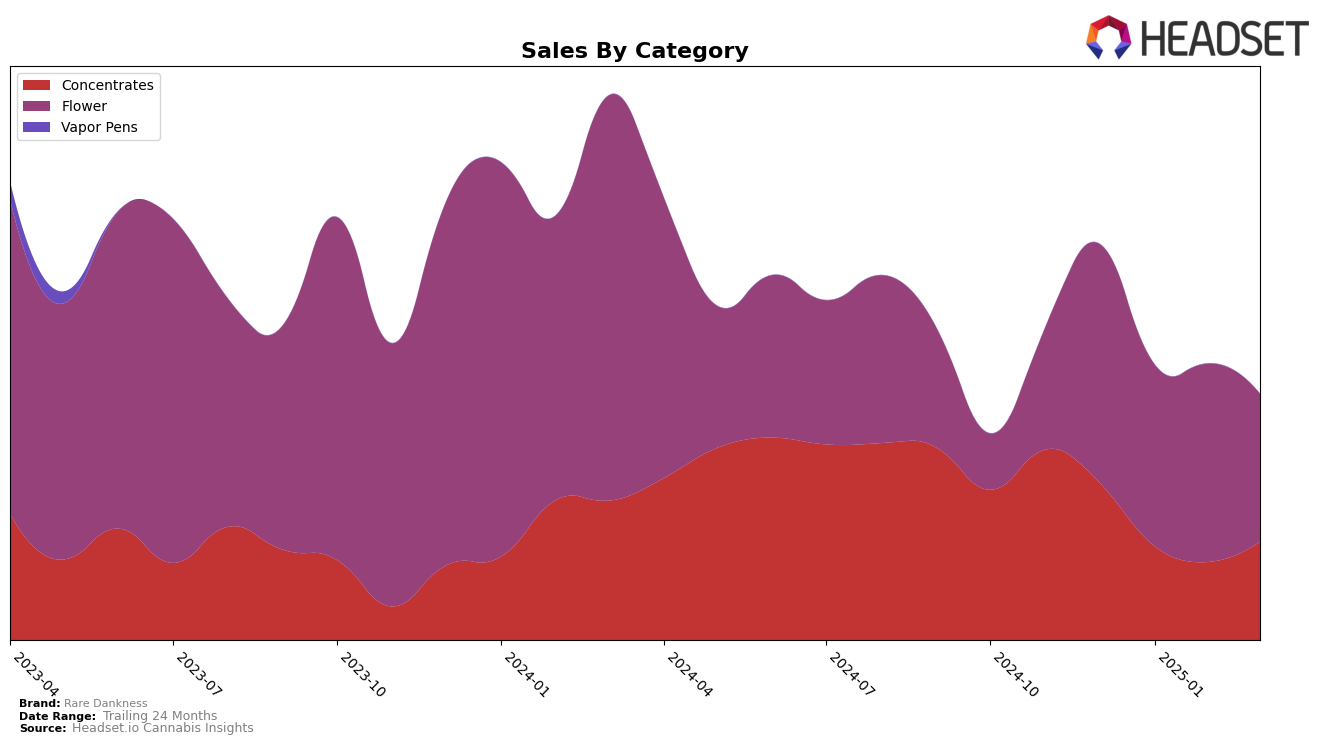

In the Colorado market, Rare Dankness has shown varied performance across different product categories. In the concentrates category, there was a notable fluctuation in rankings, with the brand dropping from 23rd in December 2024 to 34th in both January and February 2025, before recovering slightly to 28th in March 2025. This movement suggests a potential challenge in maintaining a steady presence in the concentrates market, although the rebound in March indicates some regained traction. In contrast, the flower category has been more challenging, with Rare Dankness not breaking into the top 30 rankings at any point during this period, peaking at 47th in December 2024 and dropping to 61st by March 2025. The decline in flower category rankings highlights an area where the brand may need to focus on improving its competitive edge.

Sales figures further illustrate Rare Dankness's performance dynamics in Colorado. For concentrates, there was a significant drop in sales from December 2024 to February 2025, which aligns with the ranking decline, but a slight recovery in March 2025 indicates a positive trend. On the other hand, the flower category experienced a consistent decline in sales from December 2024 through March 2025, reflecting the downward trend in rankings. This pattern suggests that while Rare Dankness might be making strategic adjustments to stabilize its position in concentrates, the flower segment requires more focused efforts to reverse the declining trajectory. The data implies that the brand's strategy may need to be tailored differently for each category to optimize performance and market presence in Colorado.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Rare Dankness has experienced notable fluctuations in its market position from December 2024 to March 2025. Despite starting with a rank of 47 in December, it dropped to 61 by March, indicating a downward trend in its competitive standing. This decline is mirrored in its sales, which decreased from $140,838 in December to $87,283 in March. In contrast, competitors like Old Pal and Summit have shown more resilience, with Old Pal maintaining a relatively stable rank around the mid-40s and Summit only slightly declining from 32 to 56 over the same period. Meanwhile, Sunshine Extracts has also seen a decline in rank but still maintains higher sales figures than Rare Dankness. Additionally, Meraki Gardens has improved its rank from 87 to 71, suggesting a potential rise in consumer preference. These dynamics highlight the competitive pressures Rare Dankness faces, emphasizing the need for strategic adjustments to regain market share and improve sales performance.

Notable Products

In March 2025, Jungle Pie (Bulk) emerged as the top-performing product for Rare Dankness, securing the number one rank with a notable sales figure of 2041 units. Jenny Kush (Bulk) maintained its second position from February, showcasing consistent demand with sales reaching 801 units. Swiss Watch (Bulk) climbed to the third spot, marking its entry into the top ranks for the first time this year. Apricot Scone (Bulk) experienced a slight dip, moving from second in December 2024 to fourth in March 2025, indicating fluctuating popularity. Electro Lime Wax (1g) completed the top five, debuting in March with a sales figure of 482 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.