Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

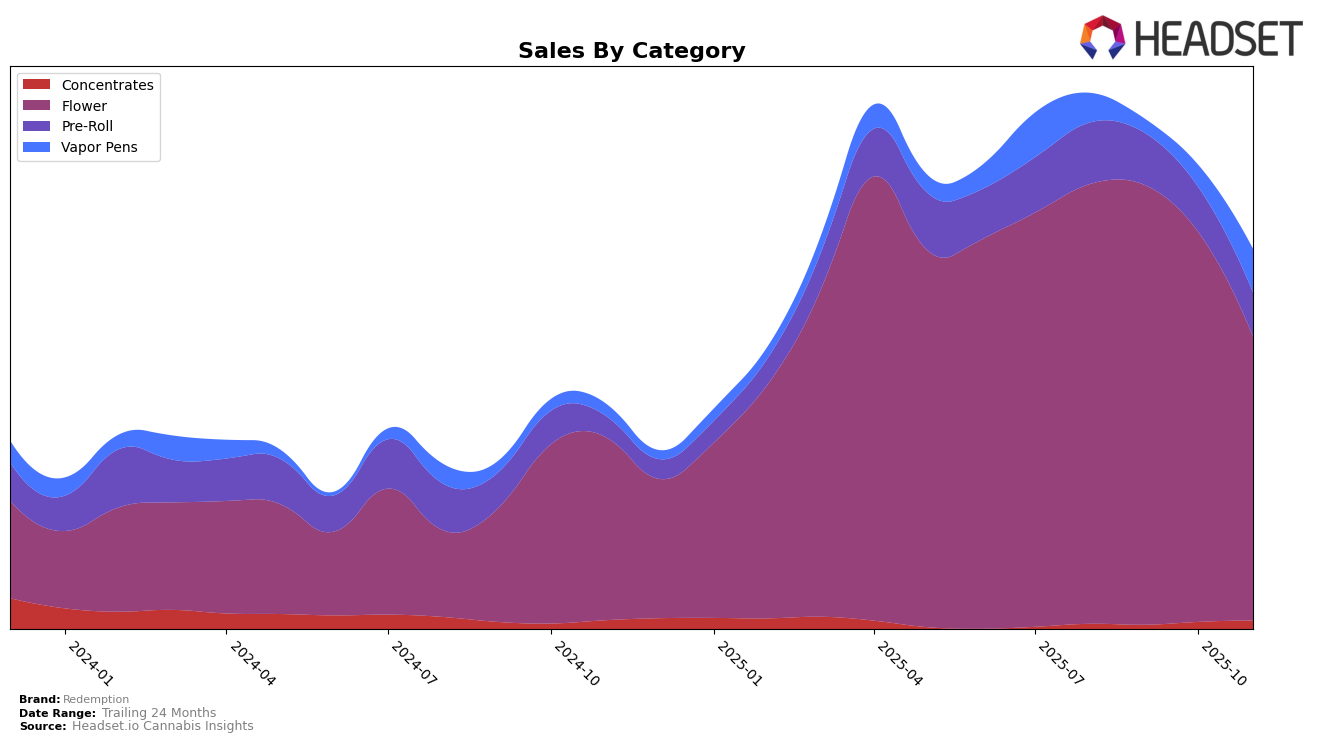

Redemption has demonstrated varied performance across different states and product categories, reflecting both opportunities and challenges. In Illinois, Redemption's presence in the Flower category has been inconsistent, with the brand failing to make the top 30 in October 2025. This could indicate a potential area for improvement or increased competition in this market. Meanwhile, in Maryland, Redemption has maintained a steady position in the Flower category, holding ranks between 23rd and 24th from August to November 2025, which suggests a solid and stable performance. However, the brand's absence from the top 30 in the Pre-Roll category after August might indicate a decline in market share or shifting consumer preferences.

In Michigan, Redemption's performance across categories shows both growth and decline. The brand's ranking in the Concentrates category improved from 35th in August to 26th by November 2025, highlighting a positive trend. Conversely, in the Flower category, Redemption experienced a decline from 6th place in August to 11th by November, which could be attributed to a significant drop in sales. Interestingly, the Vapor Pens category saw a remarkable recovery, with Redemption climbing from 48th place in September to 27th in November. This suggests a resurgence in consumer interest or successful strategic adjustments in this product line. Overall, Redemption's varied performance across these states and categories underscores the dynamic nature of the cannabis market.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Redemption has experienced notable fluctuations in its ranking, which could impact its market positioning and sales strategy. Over the period from August to November 2025, Redemption's rank shifted from 6th to 11th, indicating a decline in its competitive standing. During the same timeframe, Grown Rogue improved its position significantly, moving from 18th to 12th, suggesting a potential threat to Redemption's market share. Meanwhile, Common Citizen maintained a relatively stable presence, fluctuating slightly but ultimately ranking higher than Redemption in November. Additionally, Local Grove showed a remarkable rise from outside the top 20 to 13th place, further intensifying competition. Despite these shifts, Redemption's sales remained robust, although they experienced a decrease in November, aligning with its drop in rank. This dynamic environment underscores the importance for Redemption to adapt its strategies to maintain its competitive edge in Michigan's flower market.

Notable Products

In November 2025, Stanky Leg (3.5g) maintained its position as the top-selling product for Redemption, despite a slight decrease in sales to 13,231 units. Lemon Cherry Diesel (3.5g) rose to the second spot, improving from its third-place ranking in October, with consistent sales figures. Mafia Funeral (1g) made a notable entry into the rankings at third place, indicating strong demand. Sweet N' Gassy (7g) followed closely in fourth place, marking its debut in the rankings. Boss Lady (3.5g) remained steady in fifth place, despite a decline in sales from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.