Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Revolution Cannabis has shown varied performance across different product categories in Illinois. In the concentrates category, the brand has maintained a strong presence, consistently ranking within the top five over the past months. Despite a slight dip from fourth to fifth place in November, their sales have shown resilience. Conversely, in the edible category, Revolution Cannabis has struggled to secure a top 30 position, with rankings fluctuating between 31st and 40th. This indicates a challenge in gaining a foothold in a competitive segment, potentially pointing to an area for improvement or strategic reevaluation.

In the flower category, Revolution Cannabis has maintained a steady presence in the top 20, with a notable improvement from 19th to 18th place in November. This suggests a positive trend, possibly driven by consumer preference or effective marketing strategies. However, their performance in the pre-roll and vapor pen categories has seen more volatility. With pre-rolls, the brand has consistently ranked around the 19th position, while their vapor pen rankings have dropped from 22nd to 32nd by November, indicating a potential decline in consumer interest or increased competition. These insights highlight Revolution Cannabis's strengths and challenges within Illinois's dynamic cannabis market.

Competitive Landscape

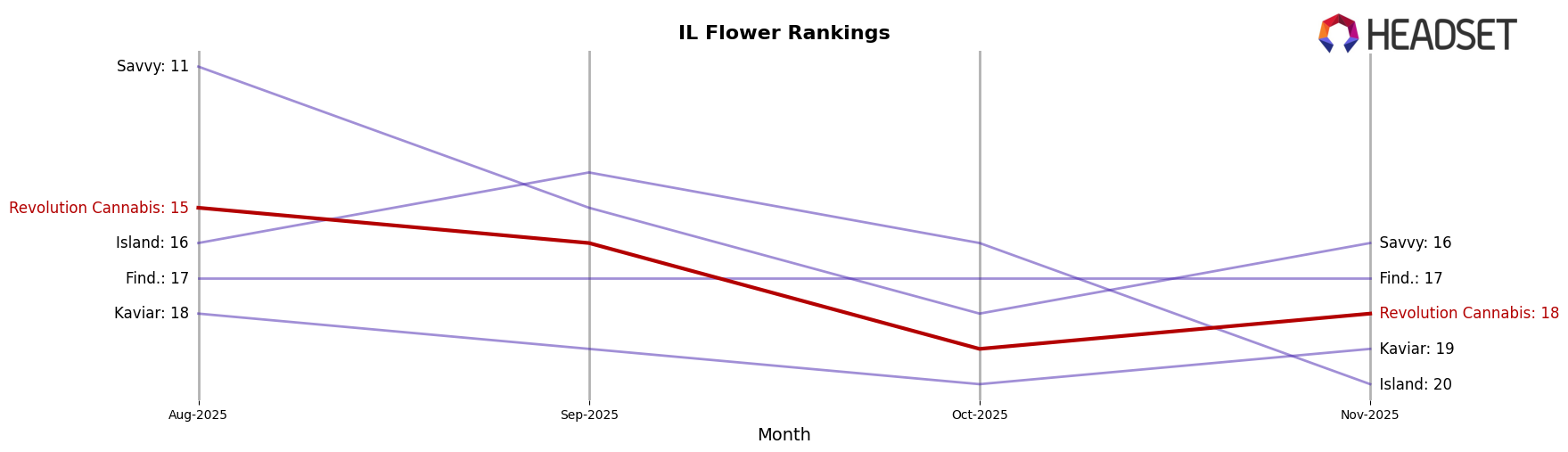

In the competitive landscape of Illinois' flower category, Revolution Cannabis has experienced notable fluctuations in its rank from August to November 2025. Starting at 15th place in August, Revolution Cannabis saw a decline to 19th by October, before slightly recovering to 18th in November. This trajectory suggests a challenging period for the brand, as competitors like Savvy and Island also experienced rank changes but managed to maintain or improve their positions more effectively. For instance, Savvy, despite a dip in September, rebounded to 16th place by November, indicating a potential recovery in sales momentum. Meanwhile, Island, although dropping to 20th in November, consistently stayed within the top 20, showcasing resilience. Revolution Cannabis' sales trends, combined with these rank shifts, highlight the competitive pressure and the need for strategic adjustments to regain a stronger foothold in the market.

Notable Products

In November 2025, Indiana Bubblegum (3.5g) emerged as the top-performing product for Revolution Cannabis, climbing to the number one rank with sales of 1590 units, a significant increase from its fourth position in October. Baker's Dream (3.5g) secured the second spot, marking its debut in the rankings. Closet Gremlin Smalls (14g) followed closely in third place, while its variant, Closet Gremlin (3.5g), took the fourth position. Purple Milk (3.5g) completed the top five, maintaining its presence in the rankings for the first time. The notable shift in Indiana Bubblegum's rank highlights its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.