Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

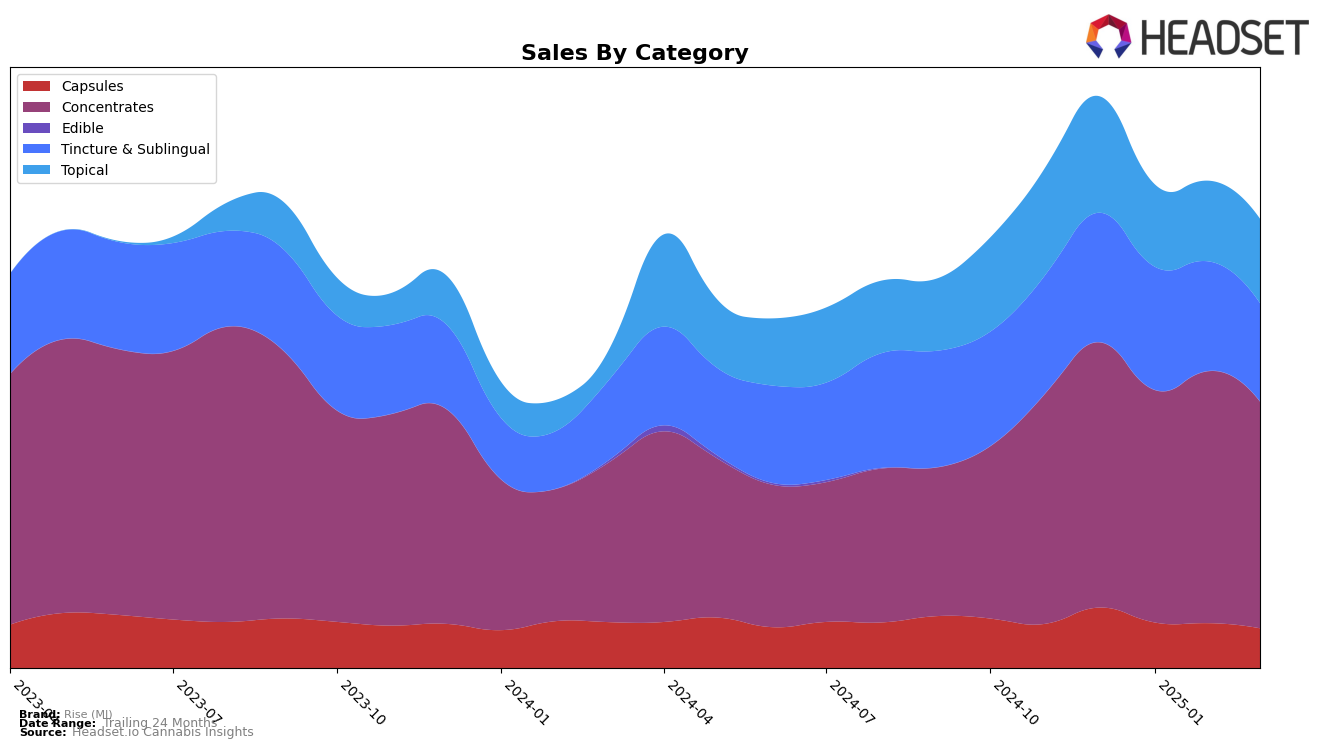

Rise (MI) has maintained a strong presence in the Michigan cannabis market, particularly in the Tincture & Sublingual category, where it consistently held the top position from December 2024 to February 2025, before slightly slipping to the second position in March 2025. This category showcases Rise (MI)'s strength in a niche market, indicating a solid consumer base and effective product offerings. In the Capsules category, the brand has sustained its second-place ranking throughout the same period, which demonstrates stability and consistent consumer demand despite a decrease in sales figures over the months.

In contrast, the brand's performance in the Concentrates category has been more volatile, with rankings fluctuating from 21st to 27th place over the observed months, reflecting a more competitive landscape or potential challenges in maintaining market share. Interestingly, the Topical category has seen Rise (MI) consistently ranked third, suggesting a steady but less dominant position compared to other categories. The absence of top 30 rankings in other states or provinces underscores the brand's concentrated market presence in Michigan, which could be both a limitation and an opportunity for future expansion.

Competitive Landscape

In the competitive landscape of the Michigan concentrates category, Rise (MI) has experienced fluctuating rankings and sales over the past few months. As of March 2025, Rise (MI) ranked 27th, a decline from its 21st position in December 2024, indicating a downward trend in its market position. Meanwhile, Pro Gro entered the top 30 in March 2025, ranking 25th, showcasing a competitive edge over Rise (MI) with slightly higher sales figures. Mischief also made a notable leap from being outside the top 50 to securing the 26th spot in March 2025, closely trailing Rise (MI) with comparable sales. Uplyfted Cannabis Co. saw a decline from 21st in January 2025 to 29th in March 2025, while Apex Cannabis Company (MI) made a significant jump to 28th place in March 2025, reflecting a resurgence in sales. These dynamics suggest that while Rise (MI) faces challenges in maintaining its rank, the competitive field remains dynamic, with brands like Pro Gro and Mischief gaining traction.

Notable Products

In March 2025, the top-performing product for Rise (MI) was the CBN/CBD/THC 1:1:1 PM Evening Tincture, maintaining its first-place rank consistently since December 2024. The CBD Transdermal Patch jumped to second place from fourth in February, with notable sales of 1,014 units in March. The CBD/THC/THCa 1:2:1 Advanced Strength Cream held steady in third place across the last three months, showing a slight increase in sales. The THC:THCa:CBG 1:1:1 Rise AM Tincture dropped from second to fourth place, indicating a decrease in sales momentum. A new entry, the RSO + Lemon Berry Live Resin Dart, debuted in fifth place, marking its first appearance in the top rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.