Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

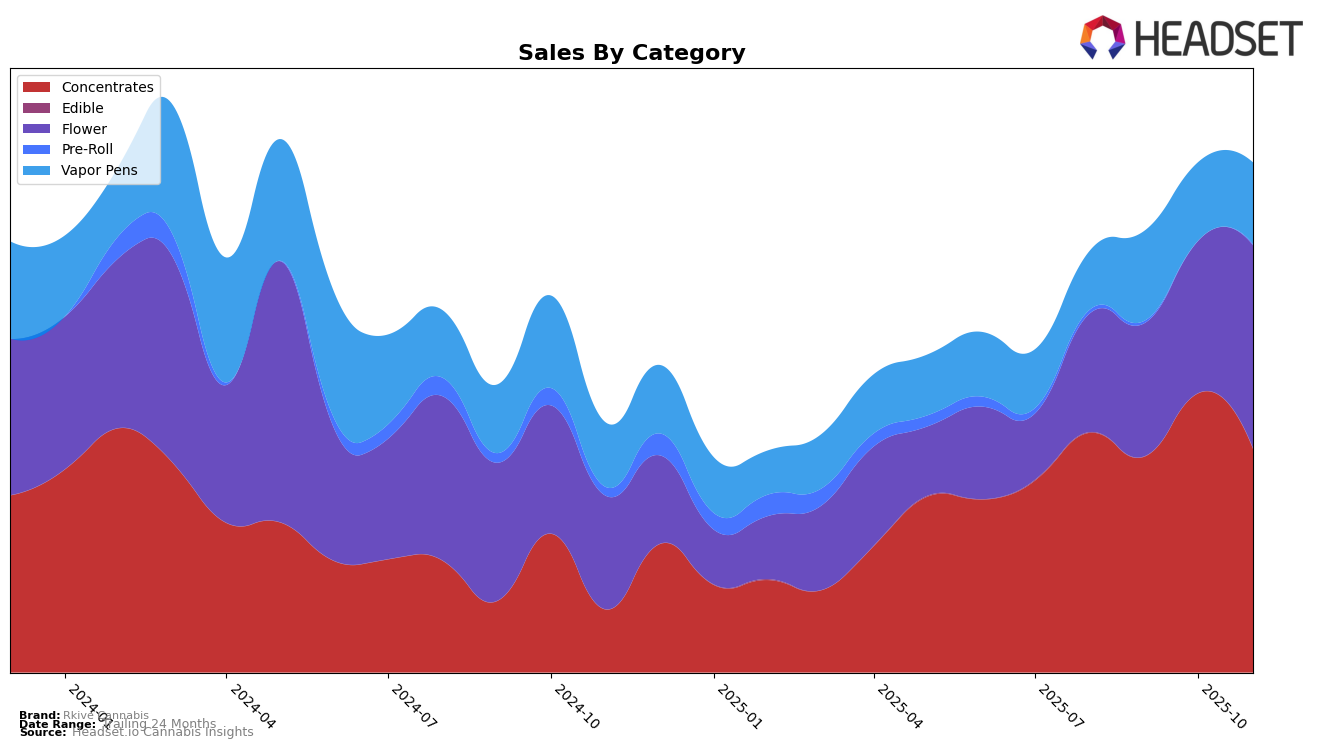

Rkive Cannabis has shown varied performance across different categories in Michigan. In the Concentrates category, the brand maintained a strong presence, consistently ranking in the top five over the past few months, peaking at the second position in October 2025. Despite a slight drop to fourth place in November, this indicates a solid foothold in the market. The Flower category saw a notable upward trajectory, with Rkive Cannabis climbing from 95th place in August to 50th in November. This significant improvement suggests an increasing consumer preference for their flower products, which could be attributed to enhanced product offerings or effective market strategies.

In the Vapor Pens category, Rkive Cannabis experienced fluctuations, with rankings shifting from the 56th position in August to 41st in November. Although the brand did not break into the top 30, the upward trend from October to November indicates potential growth. This performance could be seen as a positive sign, suggesting that with strategic adjustments, Rkive Cannabis might further improve its standing in this competitive segment. The absence of top 30 rankings in some categories highlights areas for potential growth and focus for the brand as it seeks to expand its market presence in Michigan.

Competitive Landscape

In the Michigan concentrates category, Rkive Cannabis has experienced notable fluctuations in its ranking over the past few months, which can be attributed to the dynamic competitive landscape. In August 2025, Rkive Cannabis held the third position, maintaining this rank in September before climbing to second place in October. However, by November, it had dropped to fourth place. This shift is particularly significant given the performance of competitors like Cannalicious Labs, which consistently held the second and third positions, and Society C, which made a remarkable leap from 18th in September to second in November. Despite these changes, Rkive Cannabis achieved its highest sales in October, suggesting a strong market presence, though it faces stiff competition from brands like 710 Labs and Wojo Co, which have also shown resilience and growth in sales. These dynamics highlight the importance for Rkive Cannabis to strategize effectively to regain and maintain a higher rank amidst such competitive pressures.

Notable Products

In November 2025, LA Push Pop (3.5g) emerged as the top-performing product for Rkive Cannabis, climbing from the third position in October to first, with impressive sales of 9719 units. Candy Fumez (3.5g) also showed strong performance, advancing from fifth to second place, reflecting a significant increase in popularity. Sudz (3.5g) secured the third rank, marking its return to the top three after being absent in October. New entries in the rankings include Banana Peelz Rosin Disposable (0.5g) at fourth and Banana Peelz Cold Cure Hash Rosin (1g) at fifth, both debuting in November. These shifts indicate a dynamic change in consumer preferences, with a notable rise in the popularity of flower products and the introduction of new vapor pens and concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.