Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

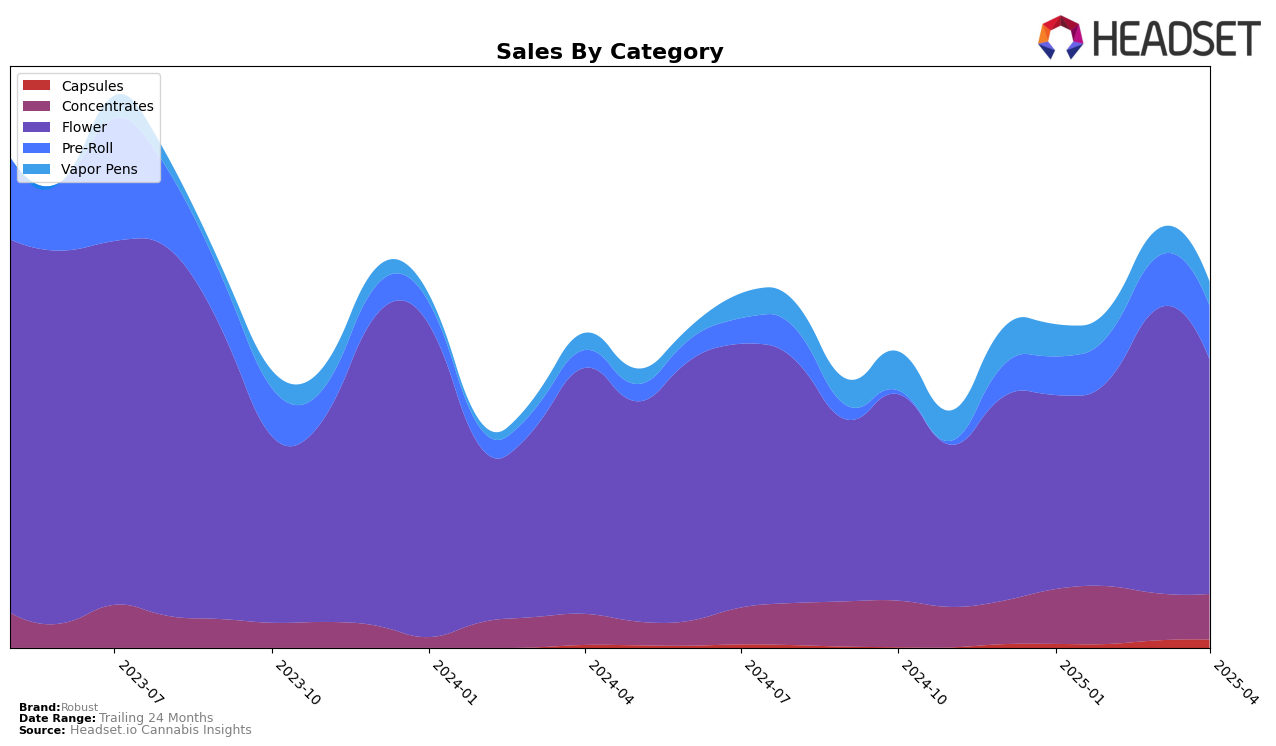

In Missouri, Robust has shown a diverse performance across various cannabis categories. Notably, in the Capsules category, Robust achieved a significant presence by securing the second position in both March and April 2025, indicating a strong foothold in this segment. Meanwhile, in the Concentrates category, Robust maintained a steady ranking, hovering around the 11th and 12th positions from January to April 2025. This consistency suggests a stable demand for their concentrate products. However, in the Vapor Pens category, Robust did not make it into the top 30, with rankings slipping from 46th in January to 53rd by April, highlighting an area that may require strategic attention for improvement.

In the Flower category, Robust experienced a notable upward trajectory, climbing from the 22nd position in January to the 15th in March before slightly dropping to 18th in April. This fluctuation indicates potential variability in consumer preferences or supply issues. The Pre-Roll category showed a more stable performance, with Robust maintaining a ranking in the low 20s, suggesting a consistent consumer base for these products. The absence of Robust in the top 30 for Vapor Pens throughout the first four months of 2025 stands out as a potential weakness, especially considering the brand’s stronger performance in other categories. This disparity across categories provides valuable insights into consumer behavior and market dynamics in Missouri, offering opportunities for Robust to refine their product offerings and marketing strategies.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Robust has shown a dynamic shift in its market position from January to April 2025. Initially ranked 22nd in January, Robust made a significant leap to 15th place by March, driven by a notable increase in sales during that period. However, by April, the brand experienced a slight decline, dropping to 18th place. This fluctuation indicates a competitive pressure from brands like C4 / Carroll County Cannabis Co., which maintained a relatively stable ranking, and Pinchy's, which also saw a drop in April. Meanwhile, Nuthera Labs showed an upward trend, improving its rank from 22nd in February to 16th in April, suggesting a potential threat to Robust's market share. These insights highlight the volatile nature of the Missouri Flower market and the need for Robust to strategize effectively to maintain and improve its competitive position.

Notable Products

In April 2025, the top-performing product for Robust was Napa Valley Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, climbing to the number 1 rank with notable sales of 3428 units. Brunch Punch (3.5g) from the Flower category dropped to the 2nd position, despite leading in March, with a slight decrease in sales. Robust FECO Syringe (1g) in the Concentrates category secured the 3rd position, marking its first appearance in the top ranks for April. California Raisins #4 (3.5g) maintained its presence in the top 5, moving up to 4th place from 5th in March. Whipz (3.5g) continued to hold the 5th spot, showing consistent performance in the Flower category across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.