Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

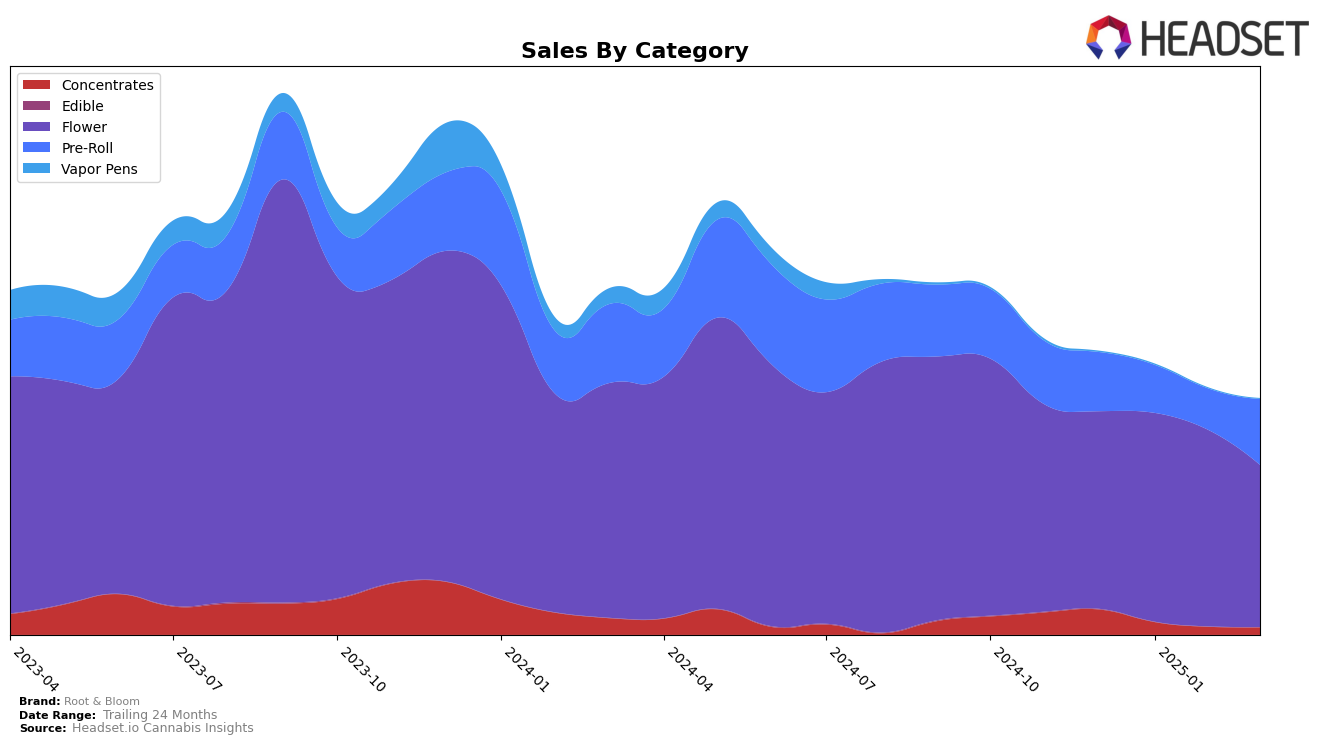

In the state of Massachusetts, Root & Bloom has shown varied performance across different cannabis categories. In the Concentrates category, the brand has experienced a decline in ranking, starting from 20th in December 2024 and dropping to 38th by March 2025, which indicates a significant decrease in market presence. This downward trend is mirrored by their sales figures in this category, which have shown a consistent decline over the months. Conversely, in the Flower category, Root & Bloom managed to maintain a relatively stable position, with a slight fluctuation from 24th to 27th place by March 2025. The sales volume in this category, although slightly decreasing, suggests a more resilient performance compared to Concentrates. The Pre-Roll category presents an interesting dynamic where the brand did not make it into the top 30 brands, indicating room for improvement in this segment.

Root & Bloom's performance in the Pre-Roll category in Massachusetts reflects a competitive challenge, as they remained outside the top 30 brands for the entire period. Despite being ranked 41st in March 2025, there was a noticeable increase in sales from February to March, suggesting potential growth opportunities if the upward trend continues. The Flower category remains a stronghold for Root & Bloom, with a consistent ranking around the 20th position, indicating a solid foothold in this segment. The fluctuations in their rankings across categories highlight the competitive landscape of the Massachusetts cannabis market and suggest that while Root & Bloom is facing challenges in certain areas, there are still avenues for growth and stabilization, particularly in the Flower category.

Competitive Landscape

In the Massachusetts flower category, Root & Bloom has experienced notable fluctuations in its competitive positioning from December 2024 to March 2025. Starting at rank 24 in December, Root & Bloom improved to rank 20 by February, before dropping to rank 27 in March. This pattern suggests a dynamic market environment where Root & Bloom faces stiff competition. Notably, Strane consistently outperformed Root & Bloom, despite a downward trend from rank 12 in December to rank 25 in March, indicating a potential opportunity for Root & Bloom to capture market share if Strane's decline continues. Meanwhile, Local Roots showed a steady improvement, moving from rank 35 in December to rank 26 in March, suggesting a rising competitor that Root & Bloom should monitor closely. The competitive landscape is further complicated by brands like Resinate and Bountiful Farms, which, while not consistently in the top 20, show potential for disruption with fluctuating sales and ranks. Overall, Root & Bloom's ability to maintain and improve its ranking will depend on strategic adjustments in response to these competitive dynamics.

Notable Products

In March 2025, the top-performing product for Root & Bloom was Wedding Cake Pre-Roll (1g) in the Pre-Roll category, maintaining its position as the number one ranked product from February. Lemonhead Delight Pre-Roll (1g) showed a significant improvement, climbing to the second position from third in February, with sales reaching 2,954 units. Cherry Pie OG (3.5g) in the Flower category remained steady at the third spot, reflecting consistent demand. Cherry Pie OG Pre-Roll (1g) debuted at fourth place, indicating a strong market entry. Lemon OG Haze Pre-Roll (1g) also entered the top five for the first time, securing the fifth position, suggesting growing consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.