Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

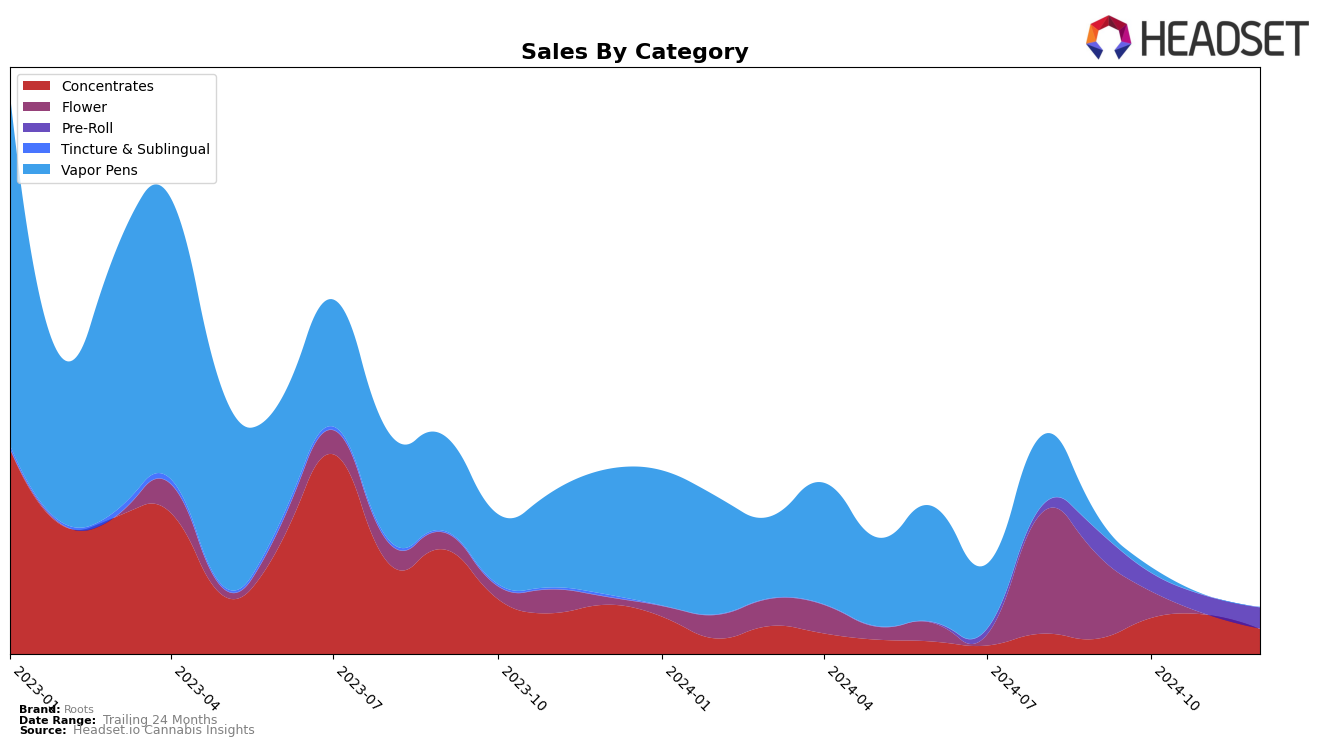

Roots has shown varied performance across different states and categories in recent months. In Colorado, the brand's presence in the Flower category was notable in September 2024, securing the 79th rank. However, the absence of rankings in the following months suggests that Roots did not maintain a strong position in the top 30, which might indicate either a decline in market competitiveness or a strategic shift in focus. This could be an area for potential improvement or reevaluation for the brand to regain visibility and traction in Colorado's Flower market.

Meanwhile, in Nevada, Roots demonstrated a more consistent presence in the Concentrates category, ranking 19th in October and gradually moving to the 25th position by December 2024. This downward trend might reflect increased competition or changes in consumer preferences. Additionally, the brand's entry into the Pre-Roll category in December, ranking 57th, indicates a new strategic venture, although it did not break into the top 30. The brand's performance in Nevada suggests a mixed but active engagement with the market, highlighting both opportunities for growth and challenges in maintaining a competitive edge.

Competitive Landscape

In the competitive landscape of the Nevada concentrates market, Roots has experienced notable fluctuations in its ranking and sales performance over the last few months of 2024. Despite a promising start in October, where Roots climbed to 19th place, it saw a decline to 21st in November and further to 25th in December. This downward trend coincides with a decrease in sales from October to December. In contrast, Dadirri maintained a consistent presence, holding steady at 23rd place in both November and December, with a slight increase in sales during this period. Meanwhile, Mammoth Labs showed a volatile pattern, dropping out of the top 20 in November but reappearing in December at 24th, suggesting a potential rebound. NLVO / North Las Vegas Organics and Gunslinger also faced challenges, with both brands failing to secure a spot in the top 20 in certain months. These dynamics indicate a highly competitive market where Roots must strategize to regain its footing and capitalize on potential growth opportunities.

Notable Products

In December 2024, the top-performing product from Roots was the Strawberry Banana Cured Resin Batter (1g) in the Concentrates category, which achieved the number 1 rank with sales of 204 units. The Super Sour Diesel Badder (1g), also in the Concentrates category, improved its standing to the 2nd position from the previous month's 3rd, despite a slight decrease in sales to 175 units. The Strawberry Lemonade Infused Pre-Roll (1g) made a notable entry at the 3rd position, marking its first appearance in the rankings. Jenny Kush Batter (1g) experienced a drop to the 4th position from 2nd in November, with sales decreasing to 151 units. The Superbloom - Cake N Cream Hash Infused Pre-Roll (1g) maintained a presence in the rankings at the 5th position, consistent with its debut in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.