Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

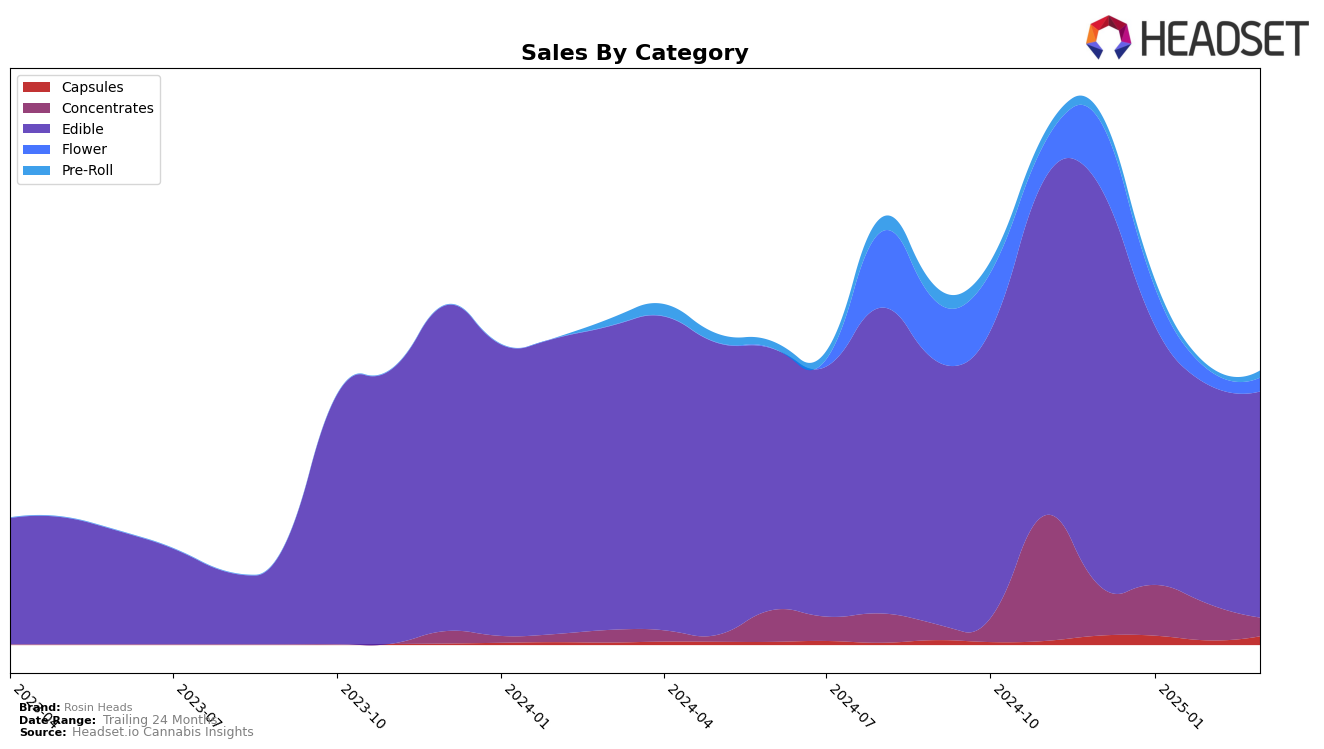

Rosin Heads has shown varied performance across different states and product categories. In British Columbia, the brand's presence in the concentrates category has been declining, with ranks slipping from 33rd in December 2024 to 38th by February 2025. Notably, Rosin Heads did not make it into the top 30 in March 2025, indicating a potential challenge in maintaining competitiveness in this market. This downward trend in rankings is mirrored by a decrease in sales, which nearly halved from December 2024 to February 2025. This could suggest a need for strategic adjustments to regain market share in British Columbia's concentrates sector.

In contrast, Rosin Heads has maintained a relatively stable position in the edibles category in Ontario. Despite a significant drop in sales from December 2024 to January 2025, the brand has consistently held the 14th rank from January through March 2025. This stability in rankings, despite fluctuating sales figures, suggests that Rosin Heads has a solid foothold in Ontario's edibles market. This consistent ranking could be indicative of loyal customer retention or effective marketing strategies that have sustained their position against competitors in the region.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ontario, Rosin Heads has maintained a stable position, consistently ranking 14th from January to March 2025, after a slight drop from 13th in December 2024. This stability is noteworthy given the fluctuations observed among its competitors. For instance, Olli has shown an upward trajectory, improving its rank from 14th in December 2024 to 11th by March 2025, which could indicate a growing consumer preference or effective marketing strategies. Meanwhile, 1964 Supply Co has experienced a gradual decline from 9th to 12th place over the same period, suggesting potential challenges in maintaining their market share. Despite the competitive pressure, Rosin Heads' consistent ranking suggests a loyal customer base, though the brand might need to innovate or enhance its offerings to climb higher in the rankings and boost sales, especially as competitors like Olli gain momentum.

Notable Products

In March 2025, the top-performing product from Rosin Heads was the Hash Rosin Drops Mints 50-Pack (250mg) in the Edible category, maintaining its number one rank for four consecutive months, with sales reaching 3977. The Hash Rosin Wafer Stix Milk Chocolate (10mg) continued to hold the second position, showing a significant sales increase from February to March. Notably, the Peanut Butter Cup Hash Rosin Caramel Milk Chocolate (10mg) improved its rank from fourth to third, indicating a positive shift in consumer preference. The Hash Rosin Drops Mint 20-Pack (100mg) slipped to fourth place, while the Hash Rosin Caramel Stix Milk Chocolate (10mg) remained steady at fifth since its entry in February. Overall, the rankings reflect a stable preference for Rosin Heads' mint and chocolate-flavored edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.