Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

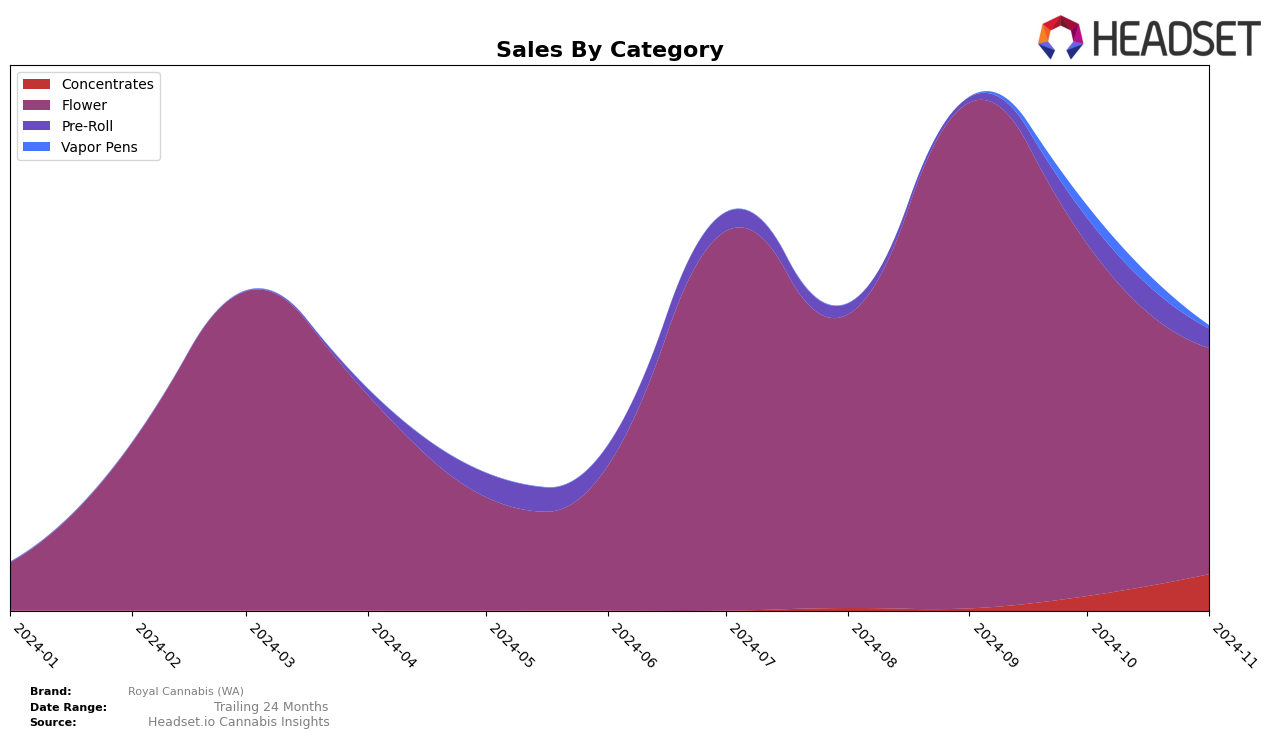

The performance of Royal Cannabis (WA) across various categories in Missouri has shown some notable trends over the past few months. In the Concentrates category, the brand made a significant leap from being unranked in the top 30 to securing the 29th position by November 2024. This upward trajectory indicates a growing acceptance and demand for their concentrates in the market. On the other hand, the Flower category has seen more fluctuation, with Royal Cannabis (WA) peaking at the 30th position in September before dropping to 37th by November. Despite this decline, the brand has maintained a presence in the top 40, suggesting a steady, albeit competitive, performance in this category.

In the Pre-Roll category, Royal Cannabis (WA) entered the rankings at 49th in October and improved slightly to 45th by November, highlighting a gradual increase in market penetration. However, the Vapor Pens category presents a more challenging scenario as the brand did not make it into the top 30 rankings, peaking at 72nd in October. This suggests that while there is some market presence, there is considerable room for growth and improvement. The overall sales figures reflect these dynamics, with noticeable sales growth in Concentrates and a more volatile performance in Flower and Pre-Rolls, underscoring the diverse market landscape in Missouri.

Competitive Landscape

In the Missouri flower category, Royal Cannabis (WA) has experienced notable fluctuations in its ranking over the past few months, reflecting a dynamic competitive landscape. Starting in August 2024, Royal Cannabis (WA) was ranked 39th, climbing to 30th in September, but then experiencing a decline to 33rd in October and 37th in November. This volatility contrasts with competitors such as Notorious, which showed a steady improvement, reaching a consistent 30th rank in October and November. Meanwhile, The Standard has shown a gradual upward trend, moving from 41st in August to 32nd by November. Additionally, Royale entered the rankings in October at 49th and improved slightly to 44th by November. These shifts suggest that while Royal Cannabis (WA) has seen some success, maintaining its competitive edge will require strategic adjustments to counter the consistent gains of brands like Notorious and The Standard.

Notable Products

In November 2024, Moonshot (3.5g) from Royal Cannabis (WA) emerged as the top-performing product, reclaiming its number one rank after falling to fourth place in October. This product achieved impressive sales of 3092 units, marking a significant increase from the previous month. Frozen Coke (3.5g) made a strong debut, securing the second rank, while Motorhead (3.5g) followed closely in third place. Pineapple Burst (3.5g) experienced a decline, dropping from second place in October to fourth in November. Loma Prieta Live Crumble (1g) entered the rankings at fifth, showcasing the growing popularity of concentrates in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.