Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

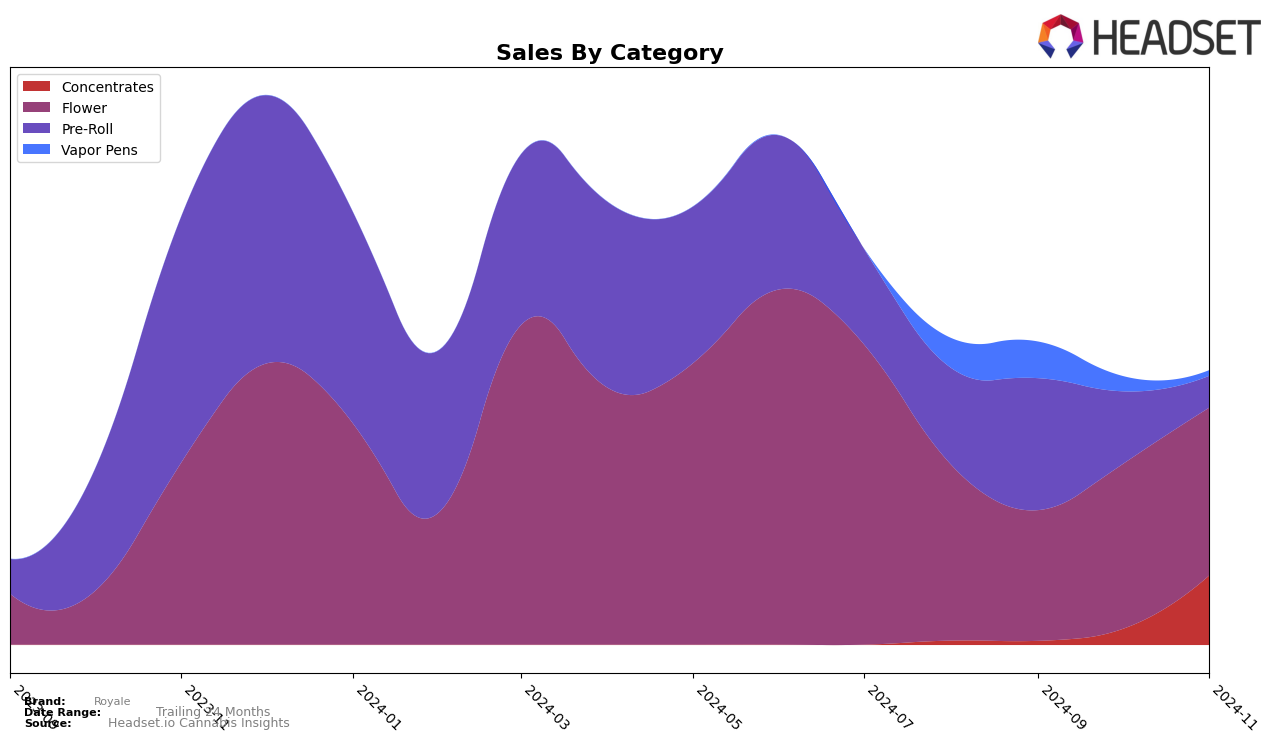

In Illinois, Royale's performance across various categories exhibits some notable trends. In the Flower category, Royale has seen fluctuations in its rankings, moving from 48th in August to 49th in November, indicating a slight decline in market presence. The Pre-Roll category shows a similar pattern, with Royale dropping from 49th in August to 54th in November. These rankings suggest that Royale is facing challenges in maintaining its position within the top 50 in these categories. The declining sales figures in both categories further highlight the need for strategic adjustments to regain momentum in this competitive market.

Meanwhile, in Missouri, Royale has experienced a more positive trajectory, particularly in the Concentrates category. The brand made a significant leap from being unranked to 42nd in October, and then further improved to 25th in November. This upward movement indicates a growing acceptance and possibly an expanding consumer base for Royale's Concentrates in Missouri. In the Flower category, Royale entered the rankings at 49th in October and improved slightly to 44th in November, showing a promising trend. However, the absence of rankings in the Vapor Pens category post-October might be a concern, suggesting a loss of visibility or market share in that segment.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Royale has shown a promising upward trajectory in recent months. Despite not being in the top 20 brands earlier, Royale made its entry in October 2024 at rank 49 and improved to rank 44 by November 2024. This positive movement suggests a growing consumer interest and potential increase in market share. In contrast, In The Flow experienced a significant decline, dropping from rank 21 in September to 52 in November, indicating a potential loss of consumer preference or market challenges. Meanwhile, Royal Cannabis (WA) maintained a relatively stable position, fluctuating between ranks 30 and 37, while Tyson 2.0 entered the rankings in November at 46 and slightly declined to 47. Cubano remained consistently in the lower ranks, hovering around 43 to 48. Royale's upward trend, amidst these shifts, highlights its potential to capture a larger market share if the momentum continues.

Notable Products

In November 2024, the top-performing product for Royale was Dirty Runtz (3.5g) in the Flower category, which climbed to the number one spot with notable sales of 2029 units. Ice Cream Runtz Live Crumble (1g) in the Concentrates category secured the second position, marking its first appearance in the rankings. Baker's Dozen (3.5g) dropped to third place from its previous top rank in October, while Baker's Dozen Pre-Roll (1g) fell to fourth, reflecting a slight decline in its sales trajectory over the months. Pineapple Burst Live Crumble (1g) emerged in the fifth position, indicating a growing interest in concentrates. Overall, the rankings reveal a dynamic shift in consumer preferences towards new entries and concentrate products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.