Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

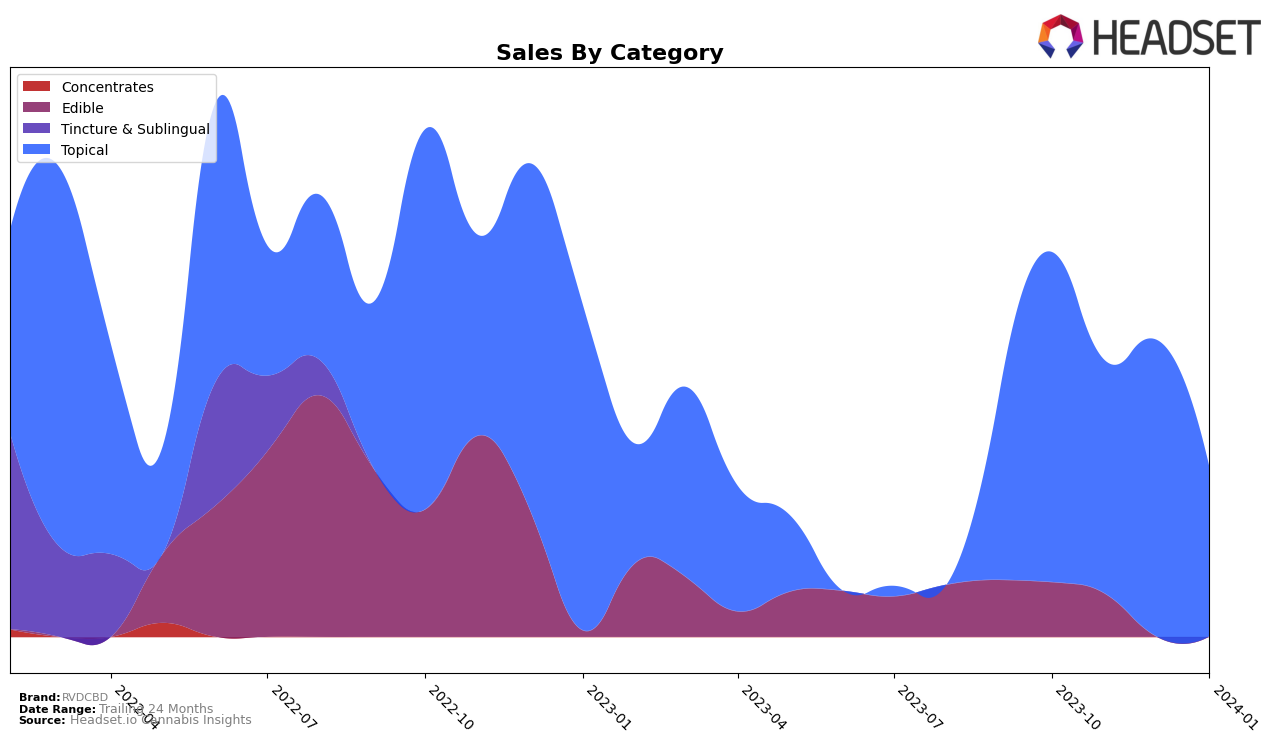

In the competitive cannabis market of Nevada, RVDCBD has shown a varied performance across different product categories. Notably, in the Edibles category, RVDCBD experienced a slight decline, moving from rank 50 in October 2023 to rank 51 in November 2023, before disappearing from the top 20 rankings altogether in the following months. This trajectory suggests a need for strategic adjustments to bolster its presence and sales in the Edible segment. On the other hand, the brand maintained a more stable and noteworthy position within the Topicals category, consistently ranking within the top 15 from October 2023 through January 2024. This stability, especially in a niche category like Topicals, indicates a strong consumer base and potential for continued growth, despite a slight rank slip from 12th to 14th over the observed period.

Examining sales figures provides further insight into RVDCBD's market dynamics within Nevada. For instance, in the Topicals category, the brand saw its highest sales in October 2023 at $5999, followed by a decrease in November and December, before experiencing a more significant drop in January 2024 to $3070. This decline in sales, despite relatively stable rankings, could suggest market saturation, increased competition, or seasonal fluctuations affecting consumer demand. The disappearance from the Edibles ranking after November 2023, coupled with the downward sales trend in Topicals, underscores the challenges RVDCBD faces in maintaining its market share. Strategic initiatives focusing on product differentiation, marketing, or consumer engagement may be necessary to reverse these trends and capitalize on its established presence in the Topicals category.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Nevada, RVDCBD has seen fluctuating ranks over the recent months, indicating a dynamic and challenging market environment. Starting at the 12th position in October 2023, it slightly dipped to the 13th in December before settling at the 14th position by January 2024. This trajectory suggests a competitive pressure from both established and emerging brands. Notably, Cannabella has maintained a stronger presence, consistently ranking above RVDCBD throughout the observed period, despite a slight decline in its own rank. Flex-All also demonstrated resilience, staying ahead of RVDCBD for most of the period, but eventually fell just below RVDCBD by January 2024. Meanwhile, Remedy showed an inconsistent pattern, disappearing from the rankings in December, which might indicate volatility or strategic shifts within the market. The entry of Cross Country Wellness into the rankings in December, rising to the 16th position by January, underscores the competitive nature of the market and the continuous challenge for RVDCBD to maintain or improve its market position amidst these dynamic shifts.

Notable Products

In January 2024, RVDCBD's top-performing product was the CBD Muscle & Joint Cream (1500mg CBD) within the Topical category, maintaining its number one rank from the previous months with sales figures reaching 68 units. The CBD Neon Rings Gummies 30-Pack (750mg) from the Edible category saw a significant improvement, climbing to the second rank in January from being unranked in October and third in November. The CBD Peach Rings 30-Pack (750mg), also in the Edible category, held a consistent second place in the earlier months but did not make it to the top rankings in January. Similarly, the CBD Sour Bears Gummies 30-Pack (750mg) experienced a fluctuation in its ranking, moving from third to second and then not ranking in January. These shifts highlight dynamic consumer preferences within RVDCBD's product range, with the CBD Muscle & Joint Cream demonstrating sustained popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.