Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

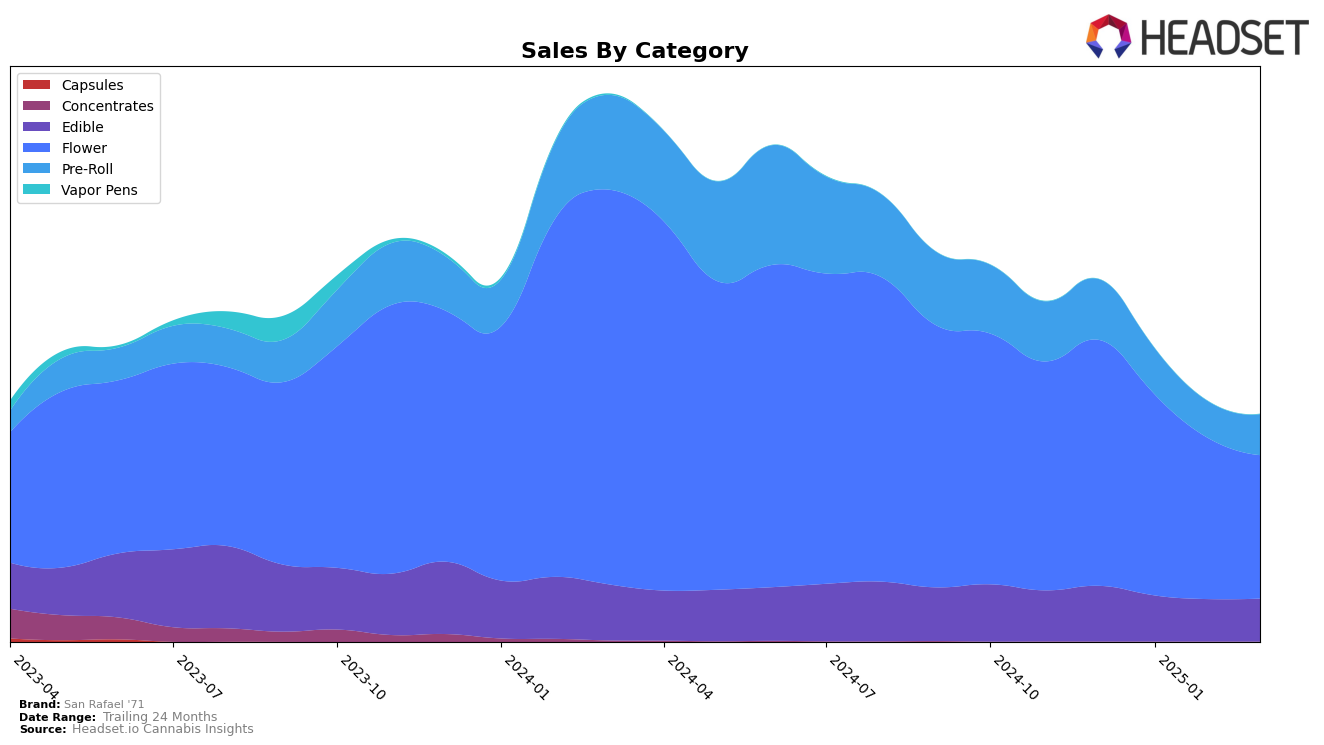

San Rafael '71 has shown varied performance across different categories and provinces, with notable movements in rankings over recent months. In Alberta, the brand's edible category maintained a stable position just outside the top 10, ranking 10th in December 2024 and slightly dropping to 12th by March 2025. However, their flower category experienced a more significant decline, moving from 20th to 24th in the same period. In contrast, the pre-roll category in Alberta saw fluctuations, briefly improving in February 2025 before settling at 69th in March, indicating a challenging competitive environment. Meanwhile, in British Columbia, the brand's edible products remained relatively stable, maintaining a ranking around 18th to 19th, while the flower and pre-roll categories faced more volatility, with flower rankings dropping to 57th in March 2025.

In Ontario, San Rafael '71's edibles held a consistent position, ranking 18th from January to March 2025, suggesting a steady consumer base in this category. However, the flower category faced more challenges, as evidenced by a decline from 36th in December 2024 to 54th by March 2025, hinting at increased competition or shifting consumer preferences. The brand's presence in Saskatchewan was limited to the flower category, where it was ranked 50th in December 2024, but did not maintain a top 30 position in subsequent months, signaling potential areas for improvement or market expansion. This varied performance across provinces and categories underscores the dynamic nature of the cannabis market and highlights the importance of strategic positioning for San Rafael '71.

Competitive Landscape

In the competitive landscape of the flower category in Alberta, San Rafael '71 has experienced notable fluctuations in its rank and sales performance from December 2024 to March 2025. Initially holding the 20th position in December 2024 and January 2025, San Rafael '71 improved to 18th in February 2025, before slipping to 24th in March 2025. This decline in rank coincides with a downward trend in sales, from a high in December to a lower figure in March. In contrast, 1964 Supply Co and Simply Bare have shown varying performances, with 1964 Supply Co improving its rank slightly from 23rd to 21st before dropping again, while Simply Bare's rank fluctuated but remained consistently close to San Rafael '71. Meanwhile, Carmel saw a significant leap from 39th in January to 19th in February, surpassing San Rafael '71, indicating a competitive pressure that may have contributed to San Rafael '71's challenges. These dynamics suggest that while San Rafael '71 remains a significant player, it faces stiff competition and must strategize to regain its footing in the Alberta flower market.

Notable Products

In March 2025, the top-performing product for San Rafael '71 was the Sour Blueberry Live Resin Gummies 4-Pack (10mg) in the Edible category, maintaining its first-place rank consistently since December 2024 with sales of 8,227 units. The Moon Berry Pre-Roll 3-Pack (1.5g) in the Pre-Roll category saw a notable rise, moving from third place in the previous months to second place in March, with a significant increase in sales. The Tangerine Dream Cured Resin Gummies 4-Pack (10mg) dropped from second to third place, reflecting a decline in sales performance over the months. Blaspberry Gummies 4-Pack (10mg) held steady at fourth place, showing consistent sales figures. A new entry, Cosmic Cream (3.5g) in the Flower category, debuted at fifth place, adding diversity to the top ranks.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.