Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

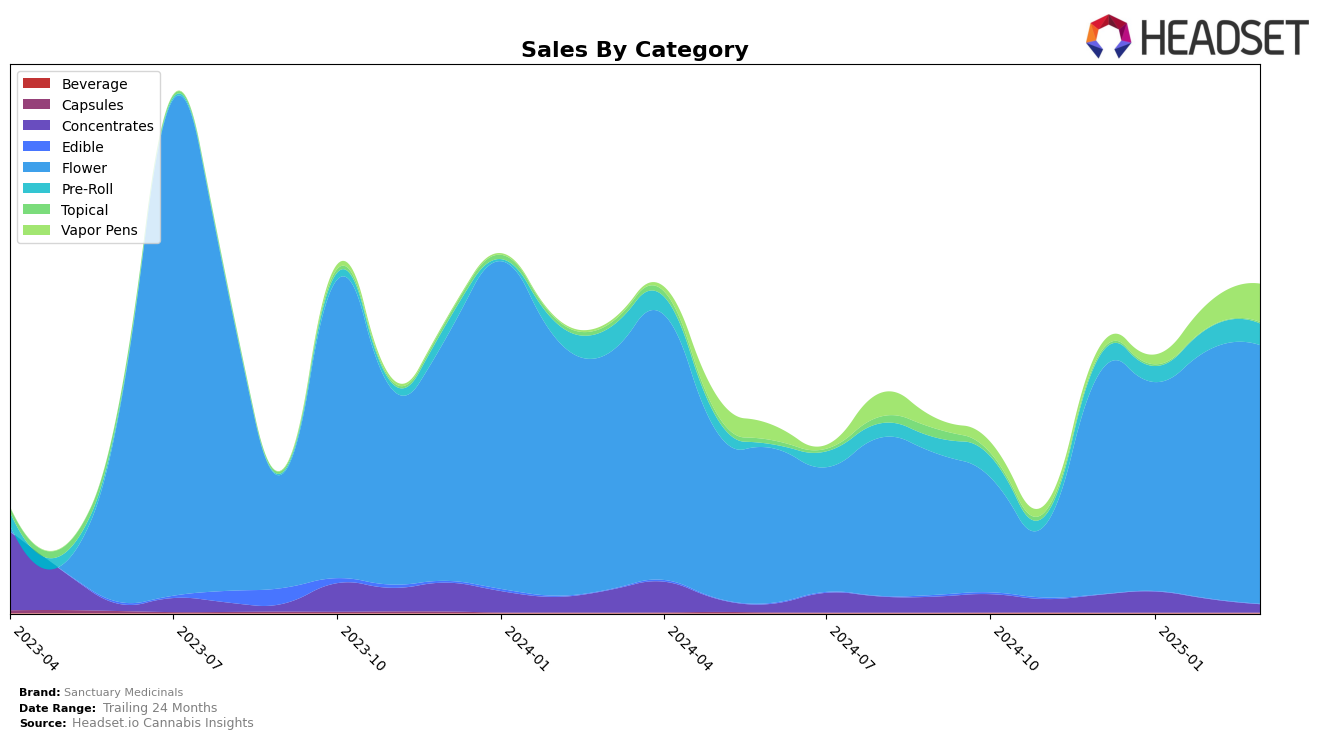

Sanctuary Medicinals has shown varied performance across different product categories in Massachusetts. In the Concentrates category, the brand struggled to break into the top 30 rankings, hovering around the 38th to 43rd positions from December 2024 to February 2025, before dropping out of the top 30 by March 2025. This indicates a challenge in gaining traction within this segment, despite a notable increase in sales from December to January. On the other hand, the Flower category paints a more optimistic picture, with Sanctuary Medicinals consistently ranking within the 38th to 47th range, showing a peak in March 2025. This suggests a steady demand and potential growth opportunity in the Flower segment.

In the Vapor Pens category, Sanctuary Medicinals did not feature in the top rankings until February 2025, when it entered at 81st place and improved to 69th by March 2025. This upward trend, along with a significant sales increase from February to March, indicates a positive momentum that could be indicative of growing consumer interest or effective marketing strategies. However, the absence of rankings in prior months highlights the competitive nature of this category and suggests that while there is progress, there is still significant room for improvement. The brand's performance across these categories reflects both challenges and opportunities in the Massachusetts cannabis market.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Sanctuary Medicinals has shown a dynamic shift in its market position over the months from December 2024 to March 2025. Starting at rank 46 in December, Sanctuary Medicinals experienced a slight dip to 47 in January, before making a notable climb to 38 in February, and then settling at 45 in March. This fluctuation in rank reflects a competitive market where brands like Khalifa Kush and Garcia Hand Picked have maintained relatively stable positions, albeit with some minor rank adjustments. Meanwhile, Sparq Cannabis Company saw a decline from 25 in December to 43 in March, indicating a potential opportunity for Sanctuary Medicinals to capture more market share. Despite these rank changes, Sanctuary Medicinals' sales have shown a positive trend, particularly with a significant increase from February to March, suggesting effective strategies in product offerings or marketing that could be leveraged further to improve their competitive standing.

Notable Products

In March 2025, the top-performing product for Sanctuary Medicinals was Garlic Breath (3.5g) in the Flower category, maintaining its number one rank from February with sales of 1813 units. Oishii (3.5g), also in the Flower category, climbed to the second position, showing a slight increase from its third-place rank in January. Gastro Pop (3.5g) entered the rankings for the first time in March, securing the third spot within the Flower category. Garlic Breath Pre-Roll (0.5g) and Gastro Pop Pre-Roll (0.5g) were ranked fourth and fifth respectively, marking their debut in the rankings this month. Overall, March saw new entrants and consistent performers in the top five, indicating a dynamic shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.