Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

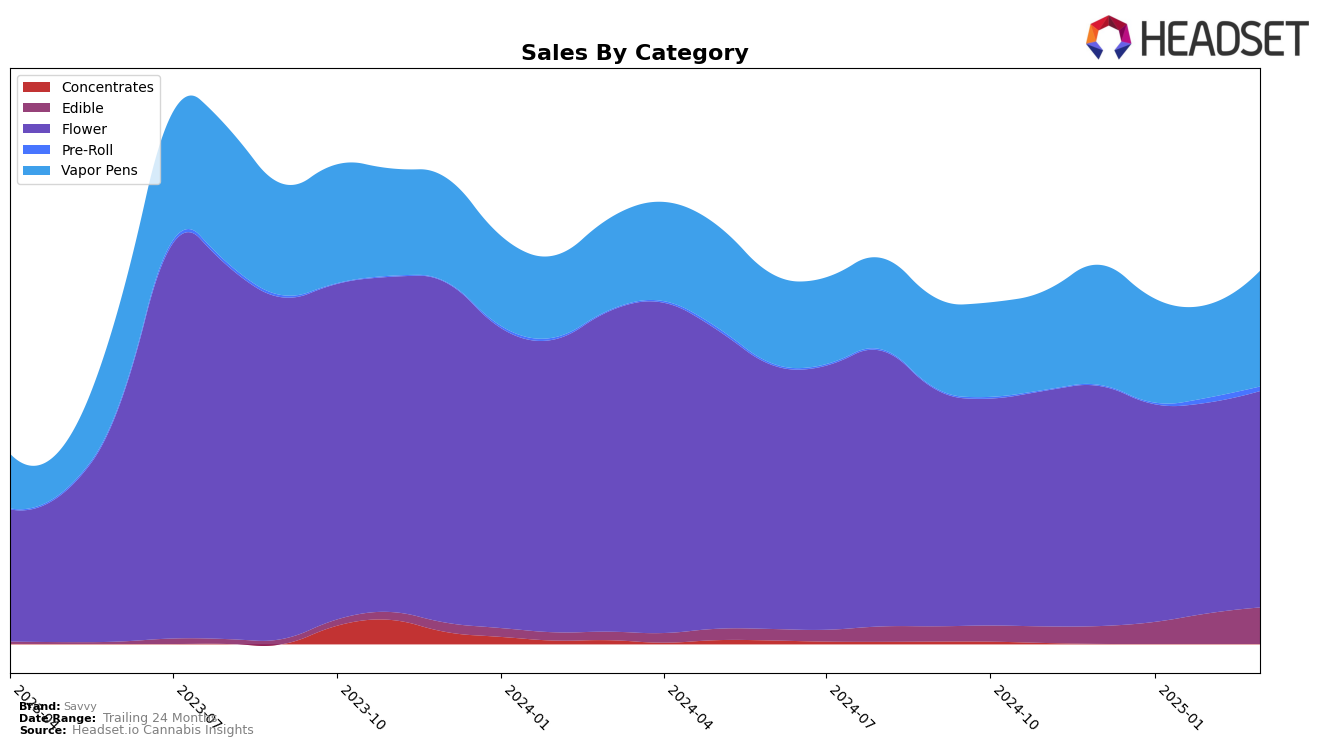

Savvy has shown a dynamic performance across various states and categories, with notable improvements in some regions while facing challenges in others. In Arizona, the brand made a significant leap in the Flower category, moving from the 18th position in February 2025 to the 9th position in March 2025. This upward trajectory is indicative of a robust growth in sales, which increased from $630,808 in February to $825,562 in March. Meanwhile, in Illinois, Savvy maintained a stable presence in the Flower category, consistently ranking around the 6th or 7th position over the months, showcasing a steady market hold. However, the brand's performance in the Vapor Pens category in Illinois saw a slight fluctuation, with rankings moving from 14th in January to 12th in March, suggesting a modest recovery in sales figures.

In Massachusetts, Savvy faced challenges in maintaining a top 30 position in the Flower category, with rankings absent in February 2025 and slipping to 44th in March. This suggests a potential decline in market competitiveness or consumer preference in that region. Conversely, the brand demonstrated a strong performance in New Jersey, especially in the Edible category, where it climbed to the 8th position by February and maintained it through March. This consistency in New Jersey's Edible market contrasts with the volatility observed in Ohio, where the Flower category rankings disappeared after January, indicating a withdrawal from the top 30 brands. Such movements highlight the varying regional dynamics Savvy faces, underlining the importance of targeted strategies to bolster its market presence.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Savvy has maintained a consistent presence, ranking 6th in December 2024 and January 2025, before slightly dropping to 7th in February and March 2025. This stability in rank suggests a steady market position amidst fluctuating performances by competitors. For instance, Daze Off consistently held a higher rank, ranging from 5th to 6th, indicating stronger sales performance. Meanwhile, Good Green showed notable volatility, jumping from 9th in January to 5th in February, before settling at 6th in March, which could suggest aggressive marketing strategies or product launches that temporarily boosted sales. Nature's Grace and Wellness maintained a stable 8th position, while &Shine experienced significant rank fluctuations, peaking at 8th in January but dropping out of the top 20 in February, before recovering to 9th in March. These dynamics highlight the competitive pressures Savvy faces, emphasizing the need for strategic initiatives to enhance its market share and potentially reclaim higher rankings.

Notable Products

In March 2025, the top-performing product for Savvy was the Guap - Berry Drip Macro Dose RSO Gummy (100mg), maintaining its number one rank from the previous month with sales reaching 35,738 units. The Guap - Blue Magic Macro Dose Gummy (100mg) held steady at the second position, showing consistent performance over the last three months. The Guap - Tangie Crush Macro Dose RSO Gummy (100mg) also retained its third rank, indicating a strong market presence. Notably, the Guap - Jungle Juice Macro Dosed Gummy (50mg) experienced a decline from its top position in December 2024 to fourth place in March 2025. Similarly, the Guap - Blue Magic Macro Dose Gummy (25mg) remained in fifth place, showing a slight decrease in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.