Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

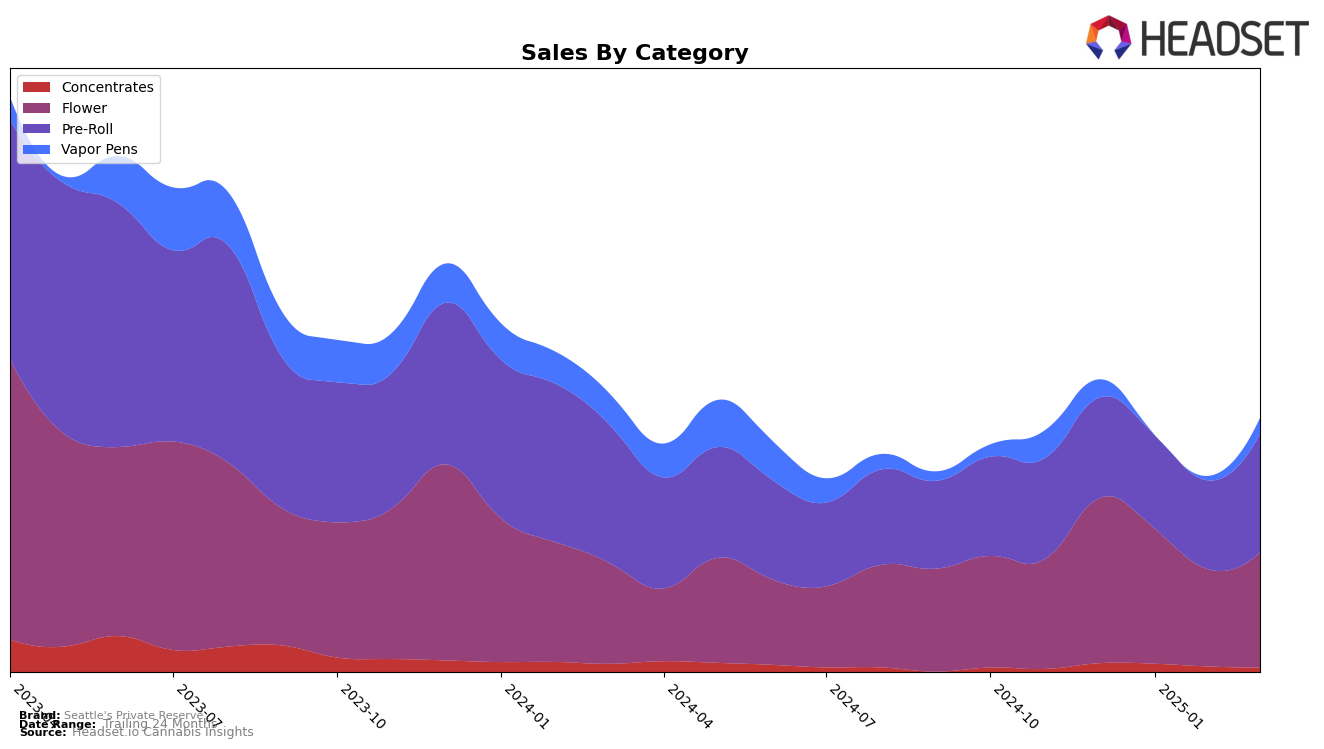

Seattle's Private Reserve has shown varied performance across different product categories in Washington. In the Concentrates category, the brand has struggled to break into the top 50, with its ranking fluctuating slightly from 61 in December 2024 to 66 in March 2025. This indicates a downward trend, with sales decreasing from $32,674 to $27,488 over the same period. In contrast, the Flower category saw a more dynamic movement, where the brand's ranking improved slightly in March 2025 after a dip in February. However, it remained outside the top 30, which suggests there is room for improvement in this category.

Pre-Rolls have been a relative stronghold for Seattle's Private Reserve, consistently ranking in the top 30 and even climbing to 24th place in March 2025. This upward trend is supported by an increase in sales from $126,194 in February to $160,232 in March. Meanwhile, Vapor Pens have been a challenging category, with the brand failing to rank in the top 100 in January 2025, although it did manage a slight recovery by March. The absence of a January ranking highlights a significant gap in the brand's market presence for Vapor Pens, indicating potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, Seattle's Private Reserve has shown a promising upward trend in rank from December 2024 to March 2025. Starting at the 30th position in December, the brand climbed to 24th by March, indicating a positive shift in market presence. This upward trajectory is noteworthy, especially when compared to competitors like Artizen Cannabis, which fluctuated between the 21st and 24th ranks during the same period, and Sky High Gardens (WA), which saw a decline from 19th to 26th. Meanwhile, Honey Tree Extracts experienced a similar rank improvement, moving from 28th to 22nd. Notably, Fetti made a significant leap from 47th to 25th, showcasing a rapid increase in market traction. Despite Seattle's Private Reserve's initial lower sales figures compared to some competitors, their consistent rank improvement suggests a strengthening brand presence and potential for increased sales momentum in the coming months.

Notable Products

In March 2025, Cake Frosting Pre-Roll 2-Pack (2g) emerged as the top-performing product for Seattle's Private Reserve, climbing from the third position in January to first place, with notable sales of 1733 units. Hood Candies Pre-Roll 2-Pack (2g) secured the second spot, showing a significant improvement from fourth place in February. Hippie Soap Pre-Roll 2-Pack (2g), which was the leader in February, dropped to third place this month. OG Cookies Pre-Roll 2-Pack (2g) entered the top five at fourth place, having not ranked in the previous months. The Shine Pre-Roll 2-Pack (2g) rounded out the top five, slipping from its third-place position in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.