Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

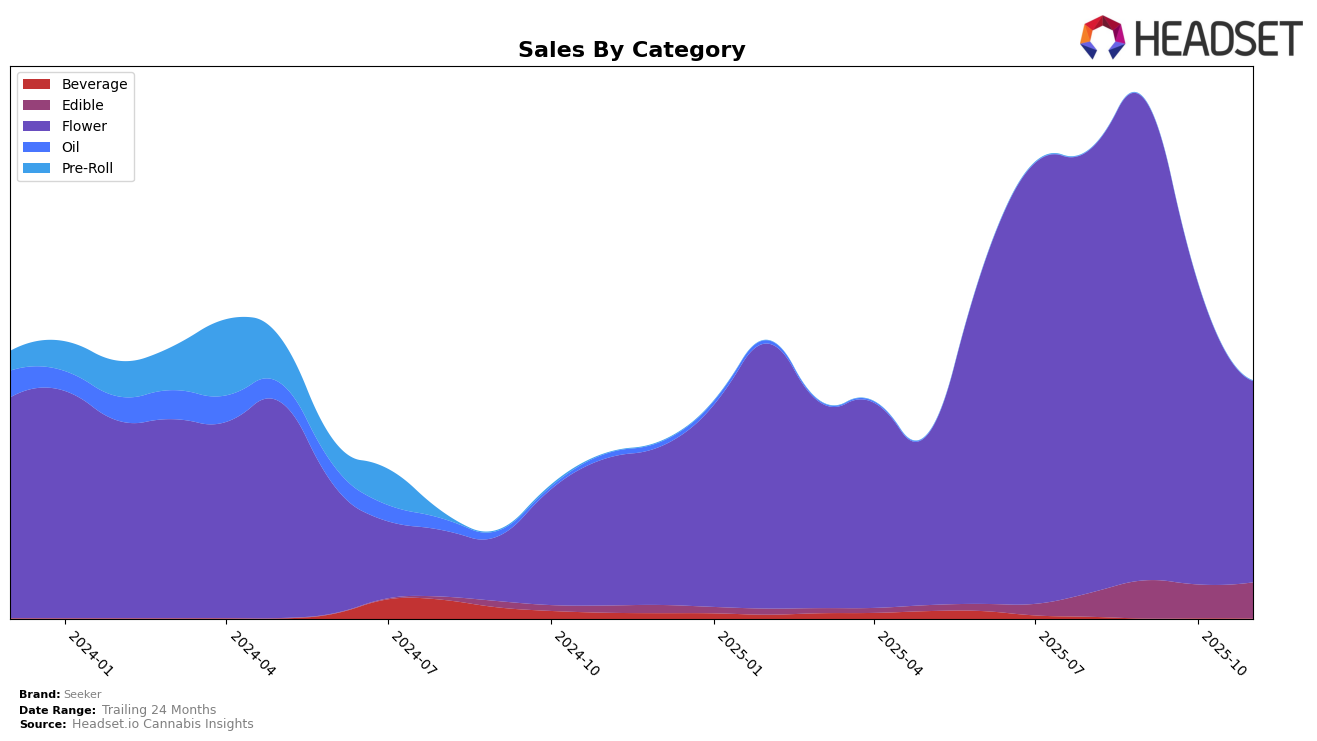

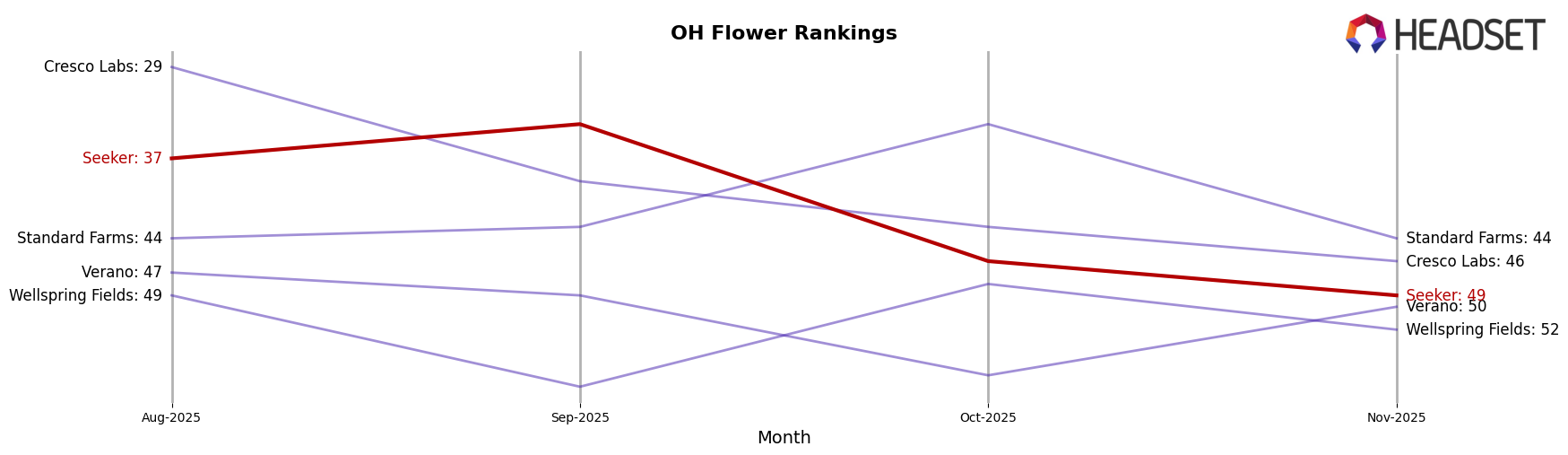

In the realm of cannabis brands, Seeker has shown varied performance across different states and categories. Notably, in Ohio, Seeker's presence in the Flower category has been on a downward trajectory, with rankings slipping from 37th in August 2025 to 49th by November 2025. This decline in rank is mirrored by a decrease in sales, indicating potential challenges in maintaining a competitive edge in this market segment. The absence from the top 30 brands in recent months suggests an area of concern for Seeker, as they struggle to capture consumer interest in Ohio's Flower category.

Conversely, Seeker's performance in the Edible category in Ontario tells a different story. Here, Seeker has maintained a relatively stable presence, with rankings hovering around the mid-20s from August to November 2025. The brand's consistent placement within the top 30 indicates a solid foothold in this sector, with a slight increase in sales from September to November 2025. This stability in Ontario's Edible category suggests that Seeker has successfully carved out a niche, offering potential growth opportunities if they can leverage their current market position effectively.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Seeker has experienced notable fluctuations in its ranking and sales performance from August to November 2025. Seeker's rank dropped from 34th in September to 49th by November, indicating a downward trend in market position. This decline in rank is mirrored by a decrease in sales, from a high of $311,788 in September to $120,605 in November. In contrast, Standard Farms saw a significant boost in October, jumping to 34th place, which suggests a temporary surge in consumer preference or effective marketing strategies. Meanwhile, Cresco Labs and Verano maintained lower rankings, with Cresco Labs consistently declining in sales, which might indicate a broader market challenge. Seeker's performance, particularly the sharp drop in both rank and sales, highlights the competitive pressures in the Ohio Flower market and underscores the need for strategic adjustments to regain its footing.

Notable Products

In November 2025, Seeker's top-performing product was Peach Soft Chew 100mg in the Edible category, maintaining its leading position from September. Triple Berry Soft Chew 10mg, another Edible, held the second rank, swapping places with Peach Soft Chew from the previous month. Pineapple Express 2.83g in the Flower category consistently ranked third over the past four months, showing stable performance. Notably, Jamaican Lamb's Bread 2.83g entered the rankings in November, securing the fifth position with sales of 581 units. Blueberry Cotton Candy 2.83g, also in the Flower category, dropped to fourth place, a decline from its consistent fourth or fifth rank in prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.