Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

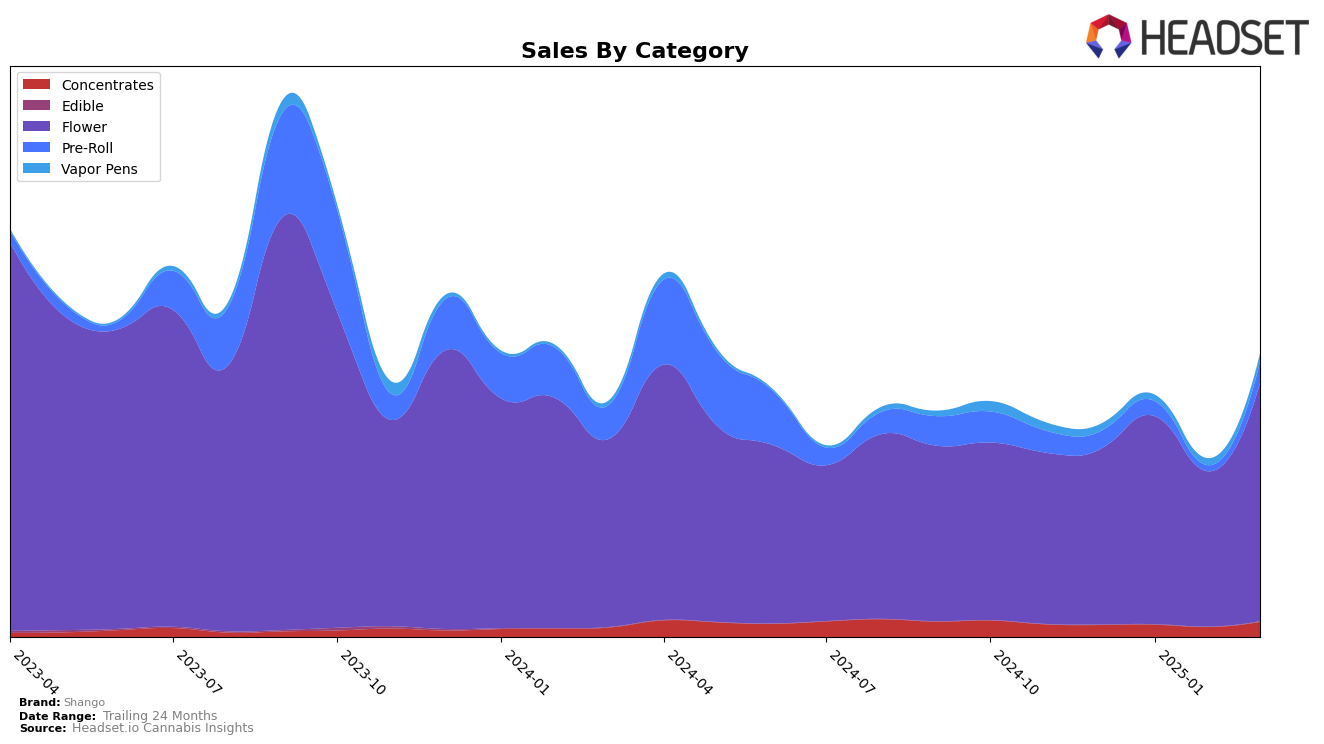

In Arizona, Shango has shown a notable performance across different cannabis categories. In the Flower category, Shango maintained a strong presence, consistently ranking third from January to March 2025, with a significant sales boost in March. This consistent performance highlights Shango's stronghold in the Flower market within Arizona. However, in the Pre-Roll category, Shango's ranking fluctuated, starting at 25th in December 2024, dropping out of the top 30 in February 2025, and then recovering to 18th by March 2025. This indicates some volatility in their Pre-Roll offerings, despite the eventual recovery. Meanwhile, in Concentrates, Shango improved its ranking from 18th in December to 13th by March, suggesting a positive trend and potential growth in this segment.

In Nevada and Oregon, Shango's performance presents a mixed picture. In Nevada, Shango was not in the top 30 for Vapor Pens in January 2025, but it managed to re-enter the rankings in February and March, indicating some recovery in this category despite the earlier setback. In Oregon, Shango's presence in the Flower category was not noted until February 2025, where it ranked 89th, eventually improving to 60th by March. This suggests a potential upward trajectory, although the brand still faces challenges in gaining a stronger foothold in the Oregon market. These movements across states and categories highlight Shango's varying market performances, with both opportunities for growth and areas needing strategic focus.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Shango has maintained a strong presence, consistently ranking third from January to March 2025, after climbing from fifth place in December 2024. This upward trend in rank is indicative of Shango's growing market influence, despite facing stiff competition from leading brands. Find. has dominated the top spot consistently, while Mohave Cannabis Co. holds a steady second place. Shango's sales trajectory shows a significant increase from December 2024 to March 2025, suggesting effective market strategies and consumer loyalty. Meanwhile, Cheech & Chong's and High Grade have experienced fluctuations in their rankings, with High Grade notably dropping out of the top 20 in February before rebounding in March. This competitive dynamic highlights Shango's resilience and potential for further growth in the Arizona Flower market.

Notable Products

In March 2025, Frosted Donuts (3.5g) emerged as the top-performing product for Shango, climbing from the fifth position in February to first place, with notable sales of 3150 units. Glitter Bomb (3.5g) secured the second spot, marking its debut in the rankings. Baked Alaska (3.5g) followed closely in third place, also making its first appearance. Lemon Cherry Gelato (3.5g) achieved fourth place, while Devil Driver (3.5g) experienced a drop from second place in February to fifth in March, despite strong sales in previous months. These shifts highlight a dynamic market where new entries are gaining traction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.